Car Insurance For 20 Year Old

Car Insurance for 20 Year Olds

Why is Car Insurance Expensive for 20 Year Olds?

It is no secret that car insurance for 20 year olds is expensive. As a driver in this age group, you are considered a high risk driver due to your lack of driving experience. Because of this, you are more likely to be involved in an accident, which causes insurance companies to view you as a liability. As a result, you are charged higher premiums than older drivers. Additionally, insurance companies may also factor in your lifestyle and activities such as speeding, drinking and driving, or reckless driving. All of these can contribute to your high insurance premiums.

What Factors Affect Car Insurance for 20 Year Olds?

When it comes to car insurance for 20 year olds, there are several factors that can influence the rate you pay. The most important factor is your driving record. Insurance companies consider your experience behind the wheel and any traffic violations you may have had in the past. The type of car you drive is also an important factor. If you are driving an older vehicle, you may be able to get a lower rate, as the car will cost less to repair. Your credit score is another factor that can affect your rate, as insurance companies may use it to determine how responsible you are.

How to Get Cheap Car Insurance for 20 Year Olds?

There are several ways you can get cheap car insurance for 20 year olds. One of the best ways is to shop around and compare rates from multiple companies. You can do this online or by speaking to an insurance agent. Additionally, you can look for discounts such as a good student discount, a multi-line discount, or a safe driver discount. These can help you get a lower rate. You can also opt for a higher deductible, which will also help to lower your premium.

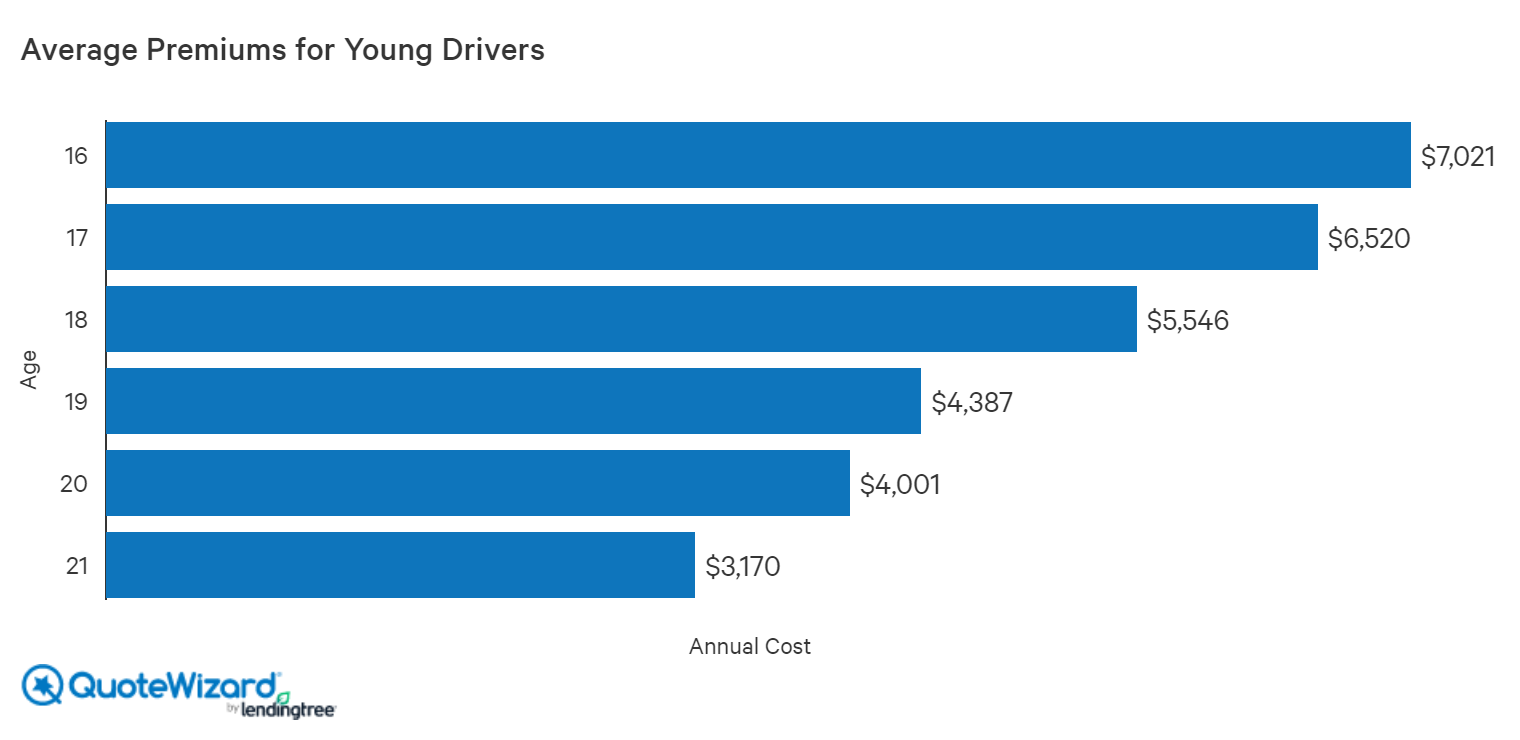

What is the Average Cost of Car Insurance for 20 Year Olds?

The average cost of car insurance for 20 year olds can vary depending on a variety of factors, such as your driving record, the type of car you drive, and your credit score. On average, a 20 year old can expect to pay around $1,500 to $2,000 per year for car insurance. However, this can vary greatly depending on your individual circumstances.

How Can I Save Money on Car Insurance for 20 Year Olds?

There are several ways you can save money on car insurance for 20 year olds. Shopping around and comparing rates from multiple companies is the best way to get the best rate. Additionally, you can look for discounts such as a good student discount, a multi-line discount, or a safe driver discount. You can also opt for a higher deductible, which will also help to lower your premium. Finally, you can make sure to keep your driving record clean, as this will help to keep your rates low.

Average Full Coverage Car Insurance For 20 Year Old

+11 Car Insurance Cost For 20 Year Old References - SPB

Cheapest Car Insurance for 20 Year Olds - YouTube

Car Insurance for a 20-year-old | QuoteWizard

Best Life Insurance Rates for a 20 Year Old (and a bunch of ways to pay