Can You Insure A Car On A Provisional Licence

Can You Insure A Car On A Provisional Licence?

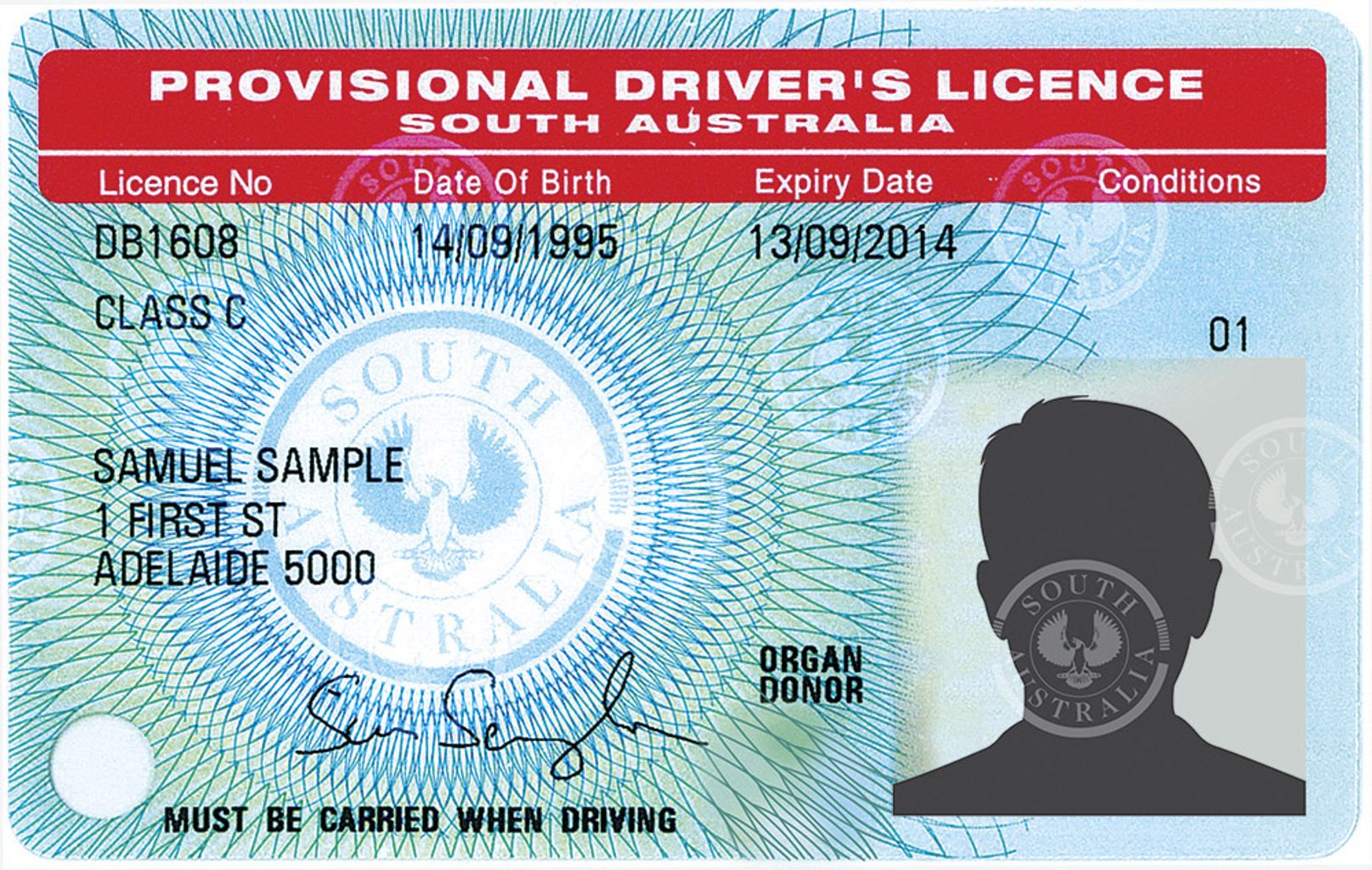

What Is A Provisional Licence?

A provisional licence is a document issued to new drivers by the DVLA (Driver and Vehicle Licensing Agency) that allows them to learn to drive a car on public roads. To obtain a provisional licence, applicants must be aged 17 or over and be a resident of Great Britain. The licence is valid for 10 years, and holders are required to pass a practical driving test before they can become fully qualified to drive.

What Are The Requirements For Provisional Licence Holders?

Provisional licence holders are subject to certain restrictions. They must display ‘L’ plates on the front and rear of their vehicle when driving and may only drive cars with a qualified supervisor aged 21 or over and with at least three years’ driving experience. They must also adhere to the speed limit and are not allowed to drive on motorways.

Can A Provisional Licence Holder Get Car Insurance?

Yes, it is possible for a provisional licence holder to get car insurance. However, the cost of the insurance is likely to be higher than for a fully qualified driver. This is due to the higher risk that insurers perceive when insuring a driver with less experience. It is important to shop around for the best deal and to compare quotes from different providers before deciding which policy to take out.

What Are The Restrictions On Insurance For Provisional Licence Holders?

Provisional licence holders may be subject to certain restrictions when taking out car insurance. For example, some insurers may only offer third party cover, which only covers damage to other people’s vehicles and property and not the policyholder’s own car. Other insurers may impose age limits on drivers or restrict the type of car that can be insured. It is important to check the details of the policy carefully before taking it out.

What Other Factors Should Be Considered When Getting Car Insurance On A Provisional Licence?

When applying for car insurance on a provisional licence, it is important to consider a number of other factors. For example, it is important to make sure that the policy includes a courtesy car, as this can be invaluable in the event of an accident or breakdown. It is also important to check the level of cover offered, as some policies may only provide third party cover or may exclude cover for certain types of damage. Finally, it is important to ensure that the policy includes legal cover, as this can be invaluable if the policyholder is ever taken to court over an accident.

Conclusion

In conclusion, it is possible for a provisional licence holder to get car insurance. However, the cost is likely to be higher than for a fully qualified driver, and there may be certain restrictions on the type of cover that is offered. It is important to shop around and compare quotes from different providers before deciding which policy to take out, and to consider the other factors that may affect the cost and level of cover offered.

Insurance Companies That Insure Provisional Drivers - noclutter.cloud

Getting your provisional license - Driving lessons in Eastbourne

£34 provisional driving licence when you apply online - Save the Student

DD Motoring: A decade of driving in Donegal – Donegal Daily

Number of driving licences revoked on medical grounds up 50 per cent