Auto Insurance For High Risk Drivers In Maryland

Saturday, October 21, 2023

Edit

Auto Insurance for High Risk Drivers in Maryland

What is a High Risk Driver?

Drivers in Maryland are classified according to their driving record and risk factor. High-risk drivers are those who have been involved in accidents, have multiple tickets, or have had their license suspended or revoked. They are deemed higher risk to insure and will, therefore, pay more for their auto insurance policy. The State of Maryland also has its own regulations and requirements that insurance companies must follow when it comes to insuring high-risk drivers.

What are the Requirements for High Risk Drivers in Maryland?

The Maryland Insurance Administration (MIA) requires that all drivers in the state carry minimum auto insurance coverage. The minimum coverage for high risk drivers is the same as all other drivers in the state. This includes bodily injury liability, property damage liability, uninsured motorist coverage, and personal injury protection. High risk drivers are also required to maintain a Maryland Automobile Insurance Fund (MAIF) policy. This coverage is available to all drivers in the state, regardless of their risk factor.

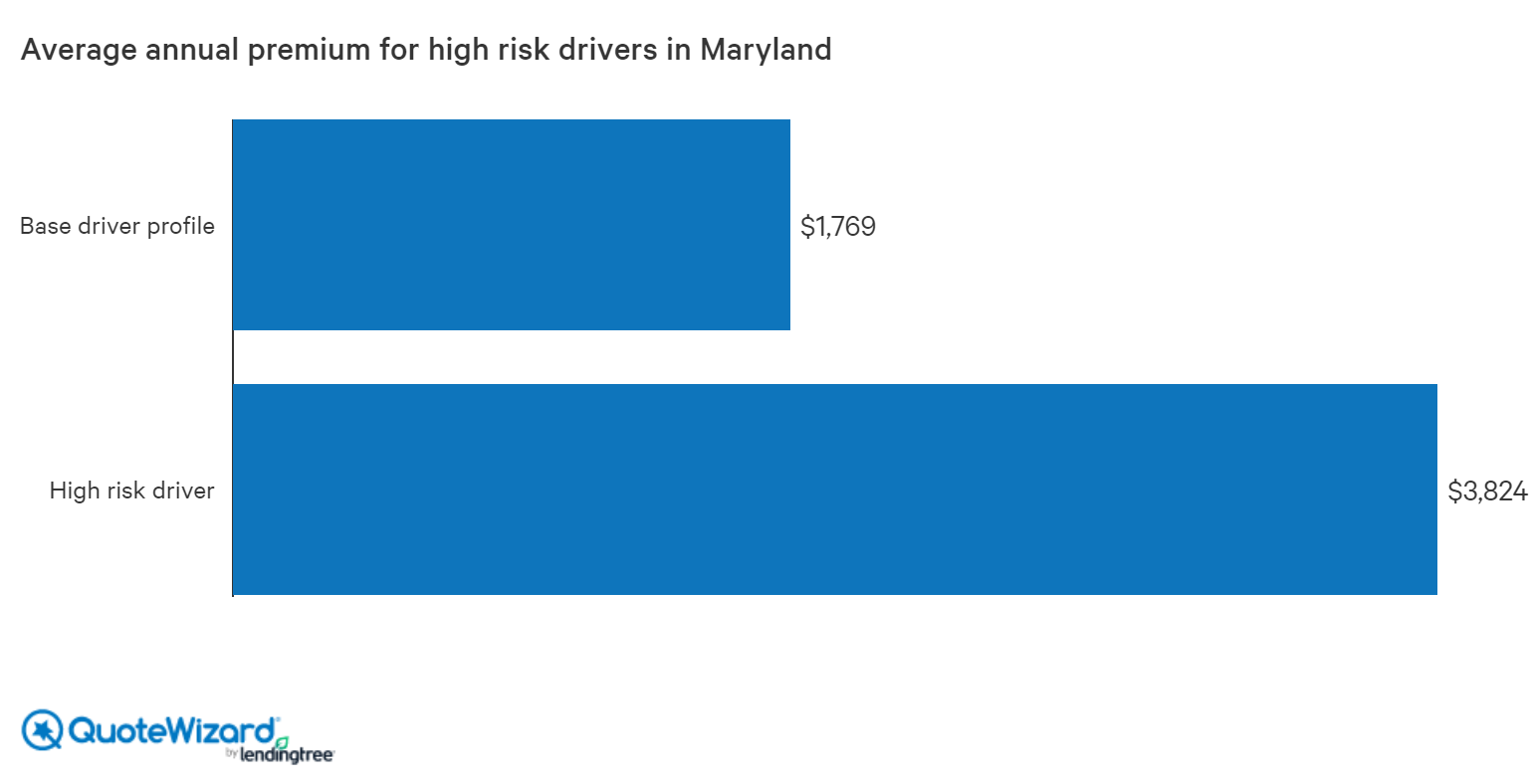

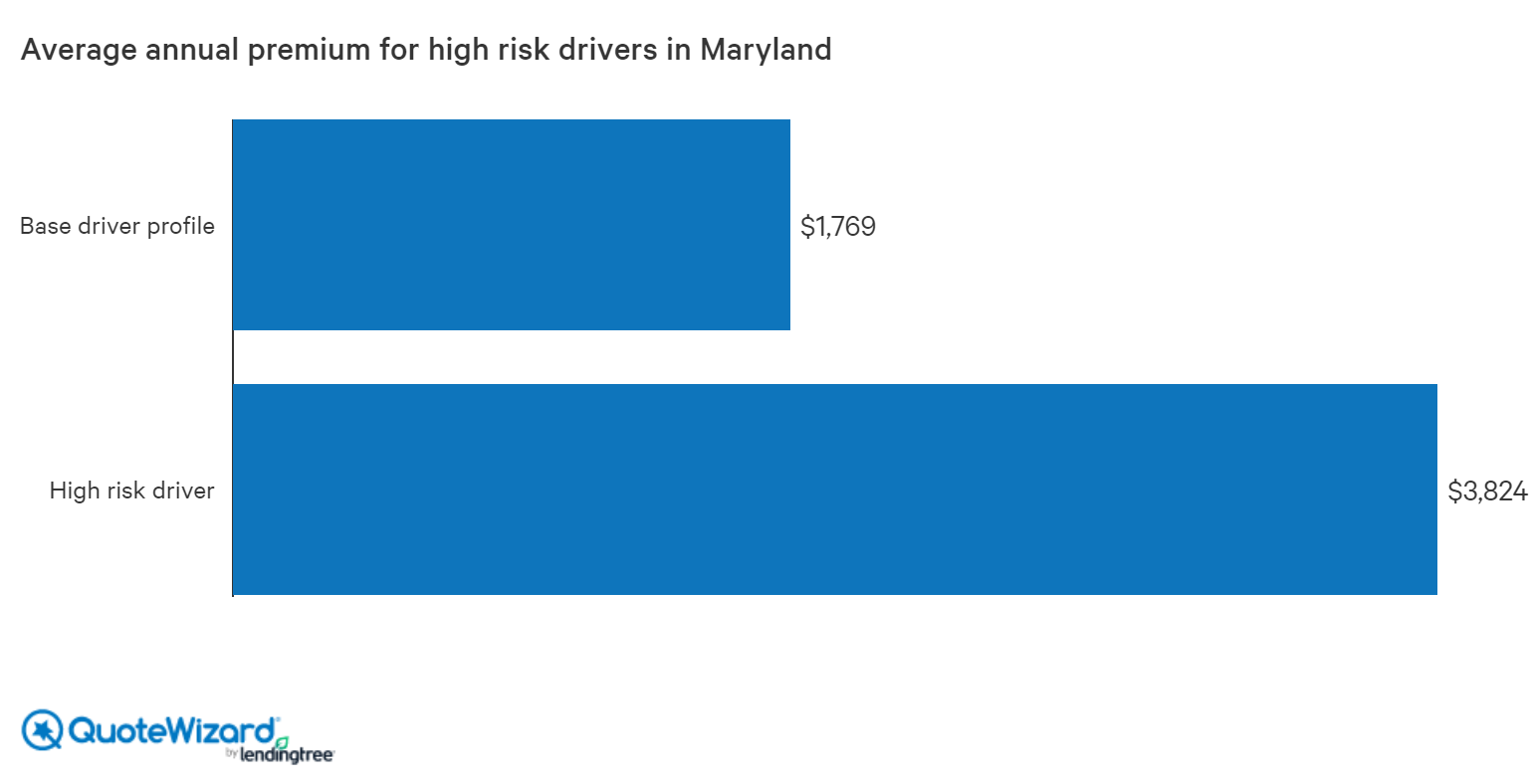

What are the Costs of Auto Insurance for High Risk Drivers in Maryland?

The cost of auto insurance for high-risk drivers in Maryland will vary, depending on the insurance company and the driver's record. Generally, high-risk drivers can expect to pay higher premiums than other drivers, due to their increased risk factor. Insurance companies also factor in the driver's age, type of vehicle, and driving history, among other things, to determine the cost of the policy.

Where Can High Risk Drivers Find Auto Insurance in Maryland?

High risk drivers in Maryland can find auto insurance through their local insurance agent, or through an online comparison website. It is important for high risk drivers to shop around and compare rates from multiple companies, to ensure that they are getting the best rate for their auto insurance policy. Additionally, some insurance companies may offer discounts or other incentives to high risk drivers who meet certain criteria.

How to Get the Best Rate on Auto Insurance for High Risk Drivers in Maryland?

High risk drivers in Maryland can get the best rate on auto insurance by shopping around and comparing rates from multiple companies. Additionally, they should talk to their local insurance agent to see if they offer any discounts or incentives. Drivers should also look for ways to reduce their risk factor, such as taking a defensive driving course or taking steps to improve their credit score. Finally, drivers should make sure that they are not overestimating the coverage that they need, as this can lead to higher premiums.

Conclusion

High risk drivers in Maryland must carry minimum auto insurance coverage, and should shop around to get the best rate. Drivers should also look for ways to reduce their risk factor, such as taking a defensive driving course or improving their credit score. Finally, drivers should make sure that they are not overestimating the coverage that they need, as this can lead to higher premiums.

Find Cheap Auto Insurance in Maryland (2020) | QuoteWizard

Average Monthly Car Insurance Maryland - blog.pricespin.net

Cheap Car Insurance in Maryland 2019

Cheap High Risk Car Insurance - Can I find affordable car insurance if

Cheap Car Insurance in Maryland 2019