What Is Full Coverage On Auto Insurance

What Is Full Coverage On Auto Insurance?

What Is Auto Insurance?

Auto insurance is a type of insurance policy that protects you from financial loss if you’re ever involved in an accident. It covers damages to your vehicle, as well as any medical expenses that you or your passengers may incur. It also covers any damage caused by an uninsured driver or a hit-and-run driver. Auto insurance is an important part of responsible car ownership, and it’s a legal requirement in most states.

What Does Full Coverage Auto Insurance Cover?

Full coverage auto insurance typically includes liability, collision, comprehensive, and uninsured/underinsured motorist coverage. Liability is the coverage you need to protect yourself in case you cause an accident and someone else is injured or their property is damaged. Collision covers damage to your car caused by a collision with another vehicle or an object. Comprehensive covers any non-collision damage to your car, such as from theft, vandalism, weather, or a falling object. Uninsured/underinsured motorist coverage protects you if you’re in an accident with an uninsured or underinsured driver.

How Much Does Full Coverage Cost?

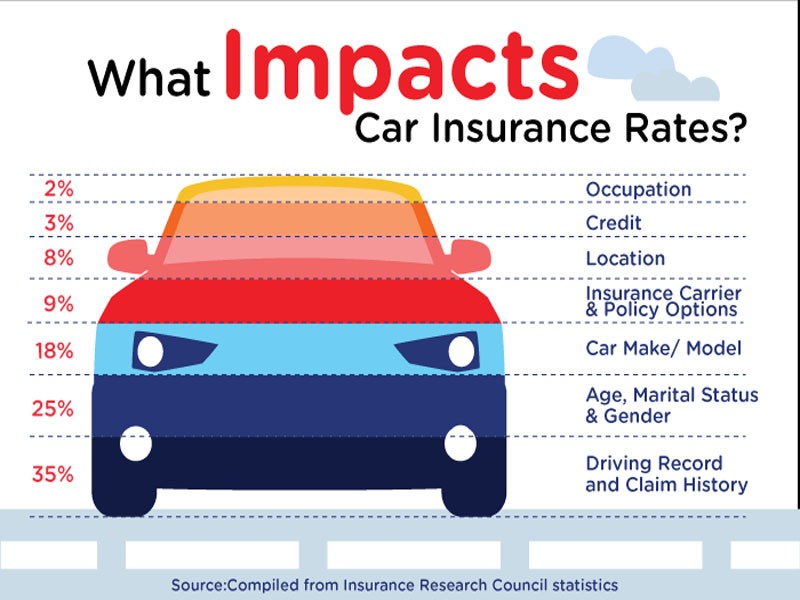

The cost of full coverage auto insurance varies depending on your car and your driving history. Generally, full coverage is more expensive than basic liability coverage, but it can also provide more comprehensive protection in the event of an accident. Some insurers offer discounts for bundling auto and home insurance, or for having multiple cars on the same policy. It’s important to shop around and compare prices to get the best deal on full coverage.

When Is Full Coverage Necessary?

Full coverage is typically necessary if you’re financing or leasing a car. Most lenders require full coverage to protect their investment. It’s also a good idea to carry full coverage if you have an expensive or newer vehicle. Without full coverage, you could be left holding the bag if your car is totaled in an accident or stolen. Finally, full coverage may be required by your state.

Tips For Saving Money On Full Coverage Auto Insurance

There are several ways to save money on full coverage auto insurance. The first is to shop around and compare prices. Different insurers have different rates, so it pays to shop around. You can also look for discounts, such as for bundling multiple policies or having a good driving record. If you have an older car, you may want to drop comprehensive coverage as it may not be worth the cost. Finally, you can raise your deductible to lower your premiums.

Conclusion

Full coverage auto insurance is an important part of responsible car ownership and can provide valuable protection in the event of an accident. It covers liability, collision, comprehensive, and uninsured/underinsured motorist coverage. The cost of full coverage varies depending on your car and driving history, but you can save money by shopping around and looking for discounts. Ultimately, full coverage may be necessary if you’re financing or leasing a car, have an expensive vehicle, or are required by your state.

+11 What Is Considered Full Coverage Auto Insurance In Florida 2022 - SPB

Full coverage car insurance in california by Promax Insurance Agency

What is Full Coverage Car Insurance? - eTrustedAdvisor

“Full Coverage” Car Insurance Explained - YouTube

How To Understand Car Insurance Coverage - haute2design