What Is Basic Own Damage Premium In Car Insurance

What Is Basic Own Damage Premium In Car Insurance?

What is Own Damage Premium?

Own Damage Premium is an integral part of a car insurance policy. It covers the damage caused to your own car in the event of an accident, theft or natural calamity. A comprehensive car insurance policy typically includes covers for third party liabilities, own damage and personal accident cover.

Own Damage Premium is the portion of the cost of the car insurance policy that is applicable for your car’s own damage coverage. It is calculated on the basis of the Insured Declared Value (IDV) of the car, the car model, the age of the car, the place of registration and the Insurer's experience with the particular car model.

What is IDV?

IDV or Insured Declared Value is the maximum amount that an insurance company will pay in the event of an accident or theft. It is the sum assured and the basis of the own damage premium calculation. It is the current market value of the car, adjusted for depreciation and other factors.

What are the Factors Affecting Own Damage Premium?

The Own Damage Premium is affected by a variety of factors including the car model, the age of the car, the place of registration and the Insurer's experience with the particular car model.

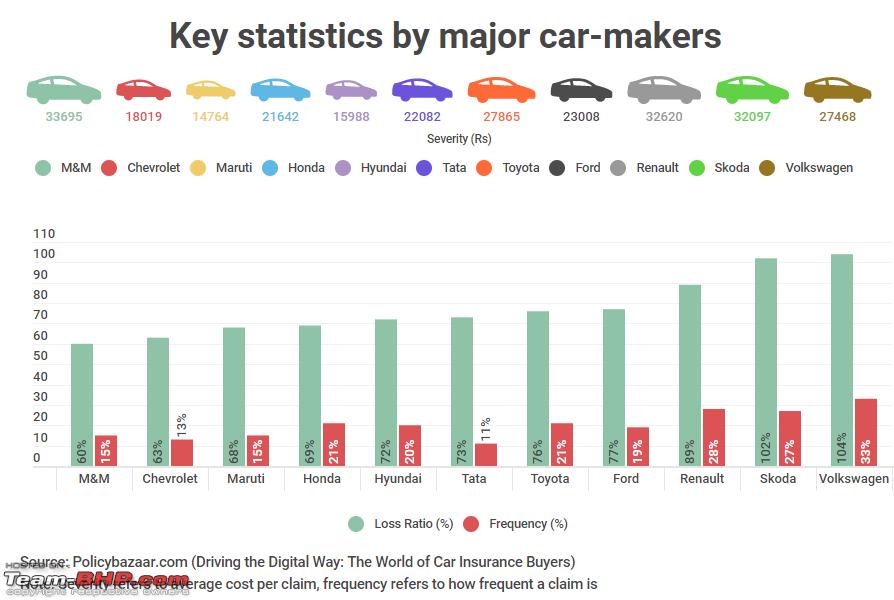

The car model affects the Own Damage Premium as certain car models are more prone to theft or damage due to their design. The age of the car also has an effect on the premium as older cars have a higher chance of breaking down or being involved in an accident. The place of registration is also important as certain areas are more prone to theft or accidents. Finally, the Insurer's experience with the particular car model is also taken into consideration, as the insurer may have had more claims for a particular model.

What is the Difference between Comprehensive and Third-Party Cover?

Comprehensive car insurance provides coverage for the damage caused to your own car in addition to the liability cover for third-party liabilities. The own damage cover includes coverage for damage caused due to accidents, natural calamities and theft. Third-party cover, on the other hand, only covers damage caused to a third-party in case of an accident.

The own damage premium is applicable only for the comprehensive cover, while the third-party cover does not include any own damage premium. The own damage premium is calculated on the basis of the Insured Declared Value (IDV) of the car, the car model, the age of the car, the place of registration and the Insurer's experience with the particular car model.

Conclusion

Own Damage Premium is an important part of the comprehensive car insurance policy and is calculated on the basis of the Insured Declared Value (IDV) of the car, the car model, the age of the car, the place of registration and the Insurer's experience with the particular car model. It is important to understand the different factors that affect the Own Damage Premium in order to get a better understanding of the terms and conditions of the policy.

Own damage motor insurance can now be bought separately | Mint

What Is Basic Premium In Car Insurance - Wedding Ideas You've Never

Does Car Insurance Cover Out Of State

Does Insurance Cover If You Damage Your Own Car

Car insurance set to become cheaper due to lower 'own damage' premiums