What Does Property Damage Liability Cover

What Does Property Damage Liability Cover?

Understanding Property Damage Liability

Property damage liability is a type of insurance coverage that is required by law in many states. It is also known as PDL and provides protection to a driver from financial losses from damages caused by their vehicle to another person’s property. Generally, this coverage is found in auto insurance policies, but it can also be a part of a homeowners or renter’s policy. It can be purchased as a stand-alone policy in some cases. This coverage pays for the repair or replacement of the other person’s property, such as a fence, guardrail, another vehicle, or a structure.

What Does Property Damage Liability Cover?

Property damage liability coverage encompasses damages to both real and personal property. Real property is defined as any land, buildings, or other structures that are permanently attached to the land. This can include fences, guardrails, and other structures. Personal property generally refers to items that are not attached to the land, such as a vehicle or a boat. This coverage also may include liability for damages caused by a driver’s negligence, such as hitting a parked car.

Limits of Property Damage Liability Coverage

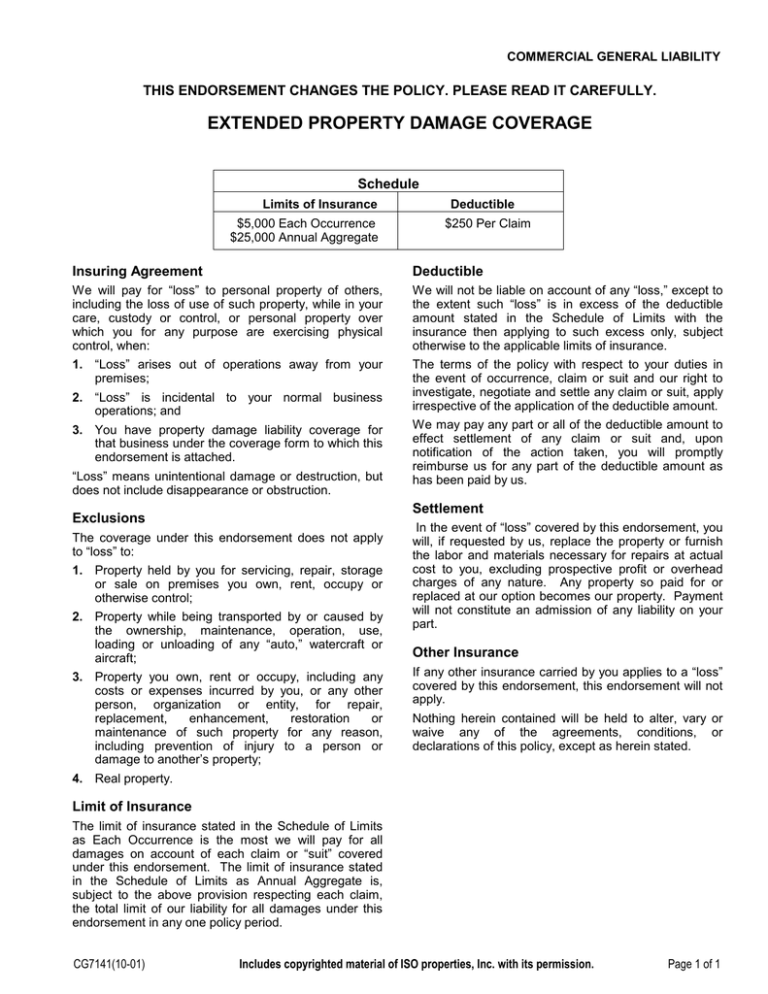

Property damage liability coverage will have limits. This means that the insurance company will pay up to a certain amount for damages caused by a driver’s vehicle. The limits vary and can be set in the policy. Generally, these limits will be set in terms of a total amount and per incident. So, for example, a policy may have a limit of $100,000 per incident and $300,000 total. This means that the insurance company will cover up to $100,000 in damages for a single incident, and up to $300,000 in damages for multiple incidents.

Additional Coverage

In addition to property damage liability coverage, some policies will also include coverage for damage caused to the insured’s own vehicle. This coverage is known as collision coverage and it will pay for the repair or replacement of the insured’s vehicle. This coverage can be purchased as part of a comprehensive auto insurance policy, or as a stand-alone policy. Collision coverage will also have limits, so it is important to understand these limits before purchasing coverage.

Conclusion

Property damage liability is a type of insurance coverage that is required in many states. It provides protection from financial losses from damages caused by a driver’s vehicle to another person’s property. This coverage will have limits, so it is important to understand these before purchasing a policy. In addition to property damage liability coverage, some policies will also include coverage for damage caused to the insured’s own vehicle. This coverage is known as collision coverage and it can be purchased as part of a comprehensive auto insurance policy, or as a stand-alone policy.

What Does Property Damage Liability Cover? | Houston, TX

What Exactly Does Property Damage Liability Cover? » Wassup Mate

PPT - Chapter PowerPoint Presentation, free download - ID:336147

extended property damage coverage

Auto Liability Insurance - What It Is and How to Buy