Sgic Car Insurance Cancel Policy

Sgic Car Insurance Cancel Policy

Overview

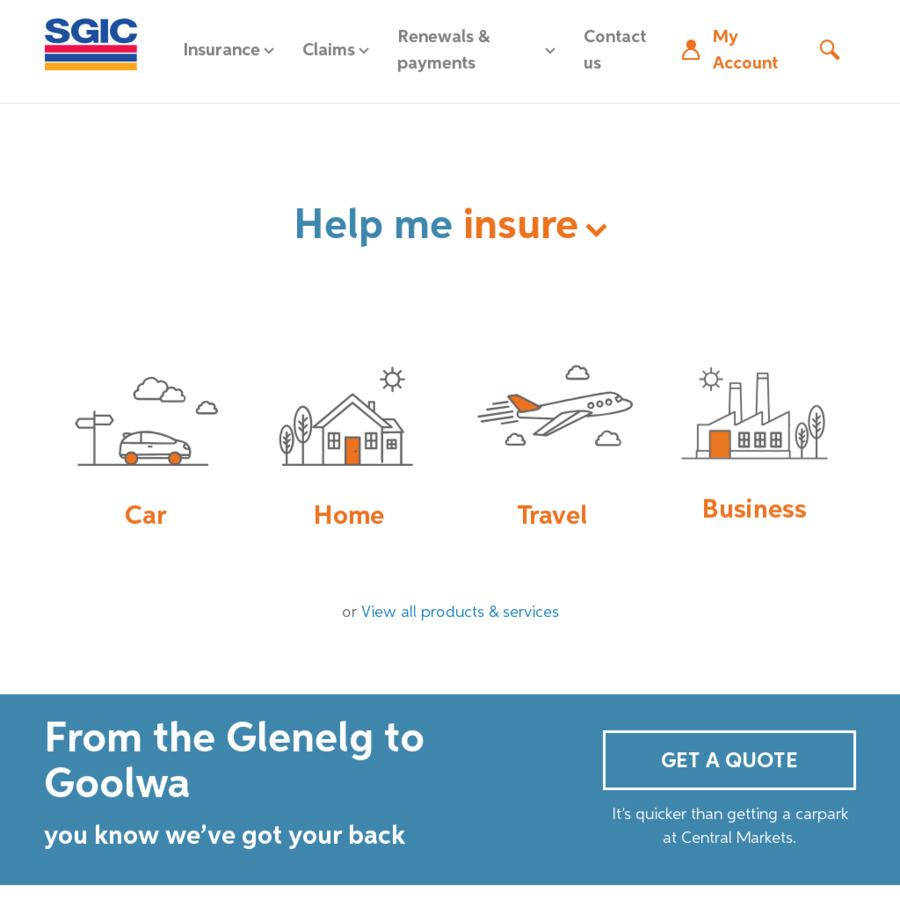

SGIC Car Insurance has been providing customers with quality, affordable car insurance in Australia for more than 80 years. The company is one of the leading providers of car insurance in the country, with a range of products to meet the needs of different customers. SGIC has a range of policies that customers can choose from, and one of these is a cancel policy. This policy allows customers to cancel their policy at any time and receive a full or partial refund of the premium they paid.

Cancellation Process

The cancellation process for SGIC car insurance is straightforward and simple. Customers can cancel their policy by calling the customer service department, or by logging into their online account. Once the policy is cancelled, SGIC will refund the customer for any premiums paid up front. Depending on the type of policy and when it is cancelled, the customer may receive a full or partial refund. Customers should note that the refund amount may be reduced if the policy was cancelled after the cooling-off period.

Cooling-Off Period

SGIC Car Insurance has a 14-day cooling-off period for customers who wish to cancel their policy. This means that customers have 14 days from the date they purchased their policy to cancel it and receive a full refund of the premiums they paid. After the cooling-off period, customers will only receive a partial refund if they cancel their policy.

Cancellation Fees

SGIC Car Insurance may charge a cancellation fee if customers cancel their policy after the cooling-off period. The fee is usually a percentage of the total premiums paid and is calculated on a sliding scale depending on how long the policy has been in effect. The fee is intended to cover the costs associated with cancelling the policy, such as administrative costs and any claims that may have been made.

Additional Information

SGIC Car Insurance customers should also be aware that if they cancel their policy after the cooling-off period, they may still be liable for any claims that are made against the policy. This means that even if the policy has been cancelled, the customer may still be required to pay for any damages or medical expenses that occur as a result of an accident. Customers should also be aware that if they are cancelling their policy for any reason other than a move to another provider, they may be subject to a cancellation fee.

Conclusion

SGIC Car Insurance has a straightforward cancel policy that allows customers to cancel their policy at any time and receive a full or partial refund of their premiums. Customers should be aware that there is a 14-day cooling-off period in which they can receive a full refund, and that after this period they may be subject to a cancellation fee. Customers should also be aware that they may still be liable for any claims that are made against the policy even after it has been cancelled.

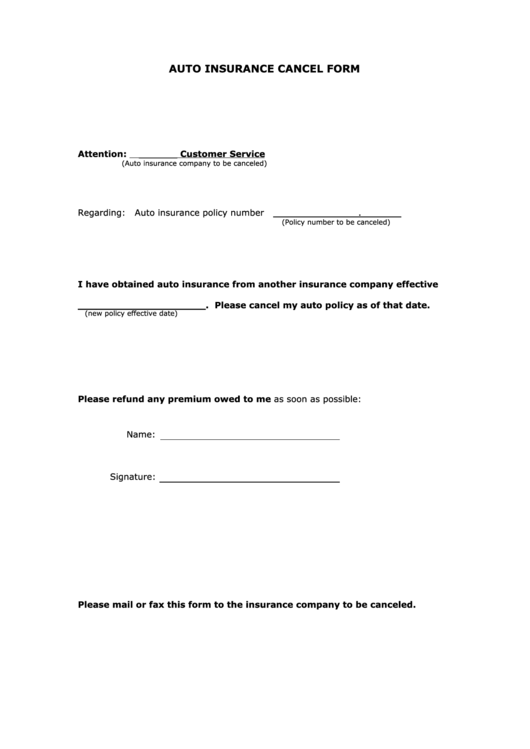

Fillable Auto Insurance Cancel Form printable pdf download

SGIC Car Insurance claim not providing rental car - OzBargain Forums

Quotemehappy.com