Rental Car Insurance Discover Card

Discover Card's Rental Car Insurance: A Comprehensive Guide

What is Rental Car Insurance?

Rental car insurance is a type of insurance that covers the cost of damages to a rental vehicle. It is typically offered by rental car companies at the time of rental. Most rental companies offer two types of insurance: collision damage waiver (CDW) and liability insurance. CDW covers the costs of repairs to the rental vehicle if it is damaged in an accident, while liability insurance covers any injury or damage to another person or property caused by the rental vehicle. Rental car insurance can be a great way to protect yourself from the financial burden of unexpected expenses in the event of an accident.

What Does Discover Card Cover?

Discover Card offers rental car insurance that covers up to $50,000 in damages caused to the rental vehicle. This coverage includes damage to the vehicle, as well as towing, storage, and other related expenses. Discover Card's rental car insurance also provides liability coverage of up to $1 million for bodily injury and property damage caused by the rental vehicle. This coverage includes legal fees and court costs, as well as medical bills incurred by the injured party. Additionally, Discover Card also offers roadside assistance, including towing and flat tire service, as well as trip interruption coverage if the rental vehicle is stolen or damaged.

Eligibility Requirements

In order to be eligible for Discover Card's rental car insurance, the rental car must be rented in the United States and paid for with your Discover Card. The rental period must not exceed 15 consecutive days. Additionally, the rental car must be a four-door vehicle with a maximum of 12 passengers. You must also be at least 25 years old and the primary driver of the rental car.

How to File a Claim

If you need to file a claim for damages to the rental vehicle, you must contact the rental car company directly. You should also contact Discover Card's customer service department to report the incident and begin the claims process. You will need to provide documentation of the incident, such as a police report or other proof of damages. After filing the claim, Discover Card will investigate the incident and provide you with a determination of coverage. If the claim is approved, Discover Card will pay for the repairs to the rental vehicle.

How to Avoid Filing Claims

The best way to avoid filing a claim is to practice safe driving habits. Be sure to follow the laws of the road and obey all traffic laws. Additionally, it is important to inspect the rental vehicle before taking it out on the road. You should also be aware of your surroundings and be cautious when driving in unfamiliar areas. Lastly, always be sure to read and understand the terms and conditions of the rental agreement before signing it.

Conclusion

Discover Card's rental car insurance is a great way to protect yourself from unexpected expenses in the event of an accident. However, it is important to understand the eligibility requirements and how to file a claim should the need arise. By practicing safe driving habits and inspecting the rental vehicle before taking it out on the road, you can reduce the chances of needing to file a claim. With Discover Card's rental car insurance, you can rest assured that you are covered in the event of an accident.

Do Discover Credit Cards Come With Rental Car Insurance?

Rental Insurance: Discover Card Auto Rental Insurance

New Card Discover.com/Activate Review and Tips | ClassActionWallet

discover-card-benefits - CardTrak.com

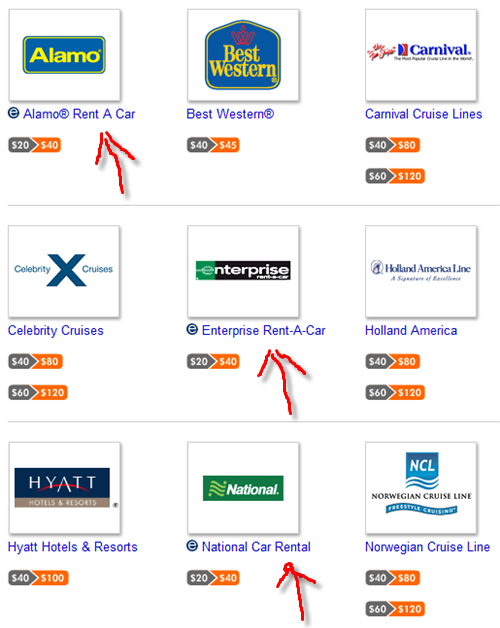

Credit Card Car Rental Rewards