Lonpac Car Insurance Malaysia Review

Lonpac Car Insurance Malaysia Review

Introduction

Lonpac Insurance Berhad (Lonpac) is one of the oldest and largest general insurance companies in Malaysia. It is a wholly-owned subsidiary of Lonpac Group, one of the largest insurance groups in the country. The company has been in the business of providing insurance protection to individuals, businesses and corporations since its inception in 1957. It offers a wide range of products from general insurance to life assurance, health insurance and motor insurance. In this article, we will be taking a look at Lonpac’s car insurance offerings in Malaysia.

Lonpac Car Insurance Overview

Lonpac Car Insurance offers a range of car insurance products to suit the needs of different customers. It provides coverage for third-party liability, personal accident, theft, fire, legal liability and other related perils. The company also provides cover for accessories and additional riders such as windscreen cover, medical expenses, no-claim bonus protection and more. Customers can choose from a wide range of deductibles and premium rates depending on their individual needs.

Benefits of Lonpac Car Insurance

Lonpac Car Insurance offers a number of benefits to its customers. The company offers a 24-hour customer service helpline for its customers, which can be accessed at any time. There is also a range of discounts available to customers, including no-claim bonus protection, windscreen cover and medical expenses. The company also offers a range of add-on covers such as personal accident cover, breakdown assistance and rental car cover, as well as a loyalty program that rewards customers with points that can be redeemed for cash or other benefits.

Types of Lonpac Car Insurance

Lonpac Car Insurance offers a range of car insurance products to suit the needs of different customers. These include comprehensive cover, third party cover and third party, fire and theft cover. Depending on the type of cover chosen, customers can benefit from a range of additional features and benefits such as windscreen cover, medical expenses, no-claim bonus protection and more. Customers can also choose from a range of deductibles and premium rates depending on their individual needs.

How to Make a Claim with Lonpac Car Insurance

Making a claim with Lonpac Car Insurance is simple and straightforward. Customers can contact the company’s 24-hour customer service helpline to lodge their claim. The company will then assess the claim and decide whether to accept or reject it. If the claim is approved, the customer will be reimbursed for the amount of the claim, minus any excesses and deductibles. The company also offers a range of additional services such as legal assistance and repair assistance to help customers with their claims.

Conclusion

Lonpac Car Insurance is one of the leading car insurance providers in Malaysia. It offers a wide range of products and services, including comprehensive cover, third party cover and third party, fire and theft cover. The company also offers a range of additional features and benefits such as windscreen cover, medical expenses, no-claim bonus protection and more. Customers can also make claims quickly and easily by contacting the company’s 24-hour customer service helpline.

Insurance Panel Workshops in Malaysia - Bjak Blog

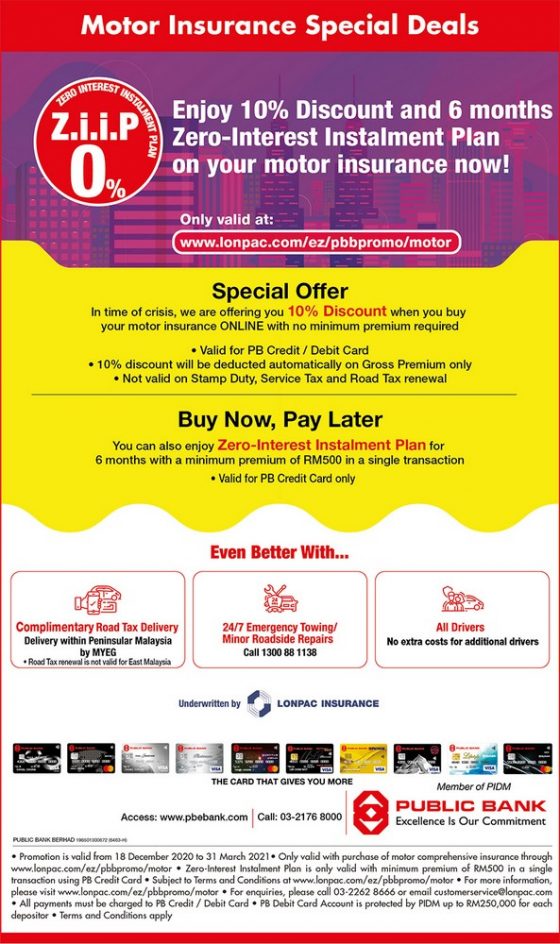

Now till 31 Mar 2021: Lonpac Motor Insurance Special Deal with Public

Business Partners - T.L. GIAM ADJUSTERS SDN. BHD.

Www Lonpac Insurance Malaysia - foxceedr

MYEG Motor Insurance | ACPG Management Sdn Bhd