Long Term Care Insurance Aarp

Long Term Care Insurance Aarp: What You Need to Know

What is Long Term Care Insurance?

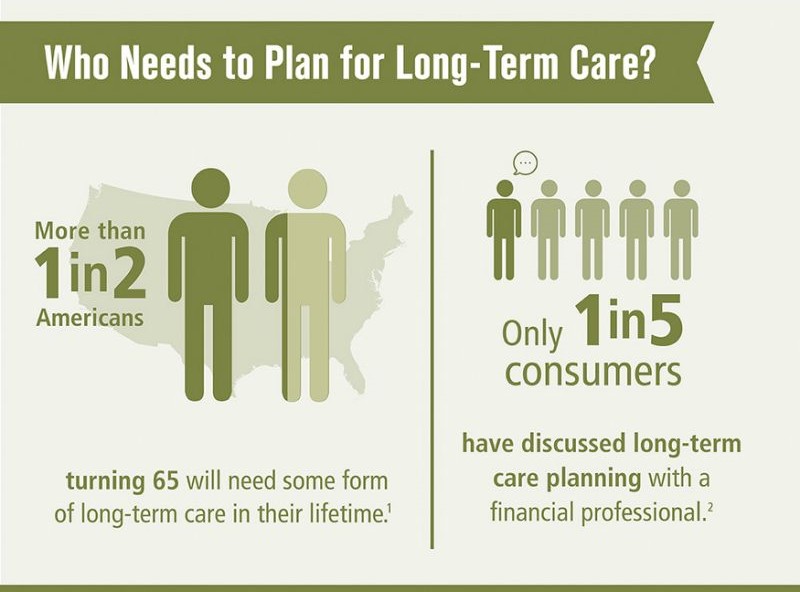

Long term care insurance is a type of insurance policy that helps cover the cost of long-term care services, such as in-home care, nursing home care, and assisted living. It is designed to help individuals pay for care and support when they can no longer perform activities of daily living, such as bathing, dressing, and eating, on their own. Long term care insurance policies are designed to provide financial assistance for those who would otherwise be unable to afford the cost of long-term care services.

What Does AARP Offer in Long Term Care Insurance?

AARP, formerly known as the American Association of Retired Persons, is a non-profit organization that provides a variety of services and benefits to its members. AARP offers long term care insurance through its partnership with one of the leading long term care insurance providers in the United States, Genworth Financial. AARP's long term care insurance policies are designed to provide financial assistance for those who need help paying for long-term care services. The policies provide coverage for a variety of long-term care services, such as in-home care, nursing home care, and assisted living. AARP's long term care insurance policies also offer benefits such as waived premiums, inflation protection, and a death benefit.

Who Qualifies for AARP's Long Term Care Insurance?

AARP's long term care insurance policies are available to individuals who are age 50 or older. The policies are also available to couples who are both age 50 or older. In order to qualify for AARP's long term care insurance, applicants must pass a health screening and meet the underwriting requirements of the insurance provider.

How Much Does AARP's Long Term Care Insurance Cost?

The cost of AARP's long term care insurance will vary depending on the type of policy you choose and the coverage you select. Generally, the cost of AARP's long term care insurance policies is comparable to the cost of other long term care insurance policies. However, AARP's long term care insurance policies may offer additional benefits and discounts that can help reduce the cost of the policy.

What Are the Benefits of AARP's Long Term Care Insurance?

AARP's long term care insurance policies offer a variety of benefits that can help individuals and families cover the cost of long-term care services. AARP's long term care insurance policies provide coverage for a variety of long-term care services, such as in-home care, nursing home care, and assisted living. AARP's long term care insurance policies also offer benefits such as waived premiums, inflation protection, and a death benefit. In addition, AARP's long term care insurance policies may offer discounts on long-term care services, as well as additional benefits such as an accelerated death benefit and a return of premium benefit.

How Do I Get Started with AARP's Long Term Care Insurance?

If you are interested in AARP's long term care insurance, the best way to get started is to visit the AARP website and fill out an online application. The online application will provide you with the information you need to make an informed decision about your long term care insurance needs. Once you have completed the online application, a representative from AARP will be able to assist you with any additional questions you might have and help you select the best long term care insurance policy for your needs.

Aarp long term care insurance - insurance

AARP Long Term Care Insurance - Compare Rates & Policy Details Here

AARP Long Term Care Insurance – Insurance Buzz #Classic #Car #House #

Cost Of Long Term Care Insurance / AARP Long Term Care Insurance Cost

The facts about AARP long-term care insurance - MarketWatch