Is Florida A No Fault State For Car Insurance

Is Florida A No Fault State For Car Insurance?

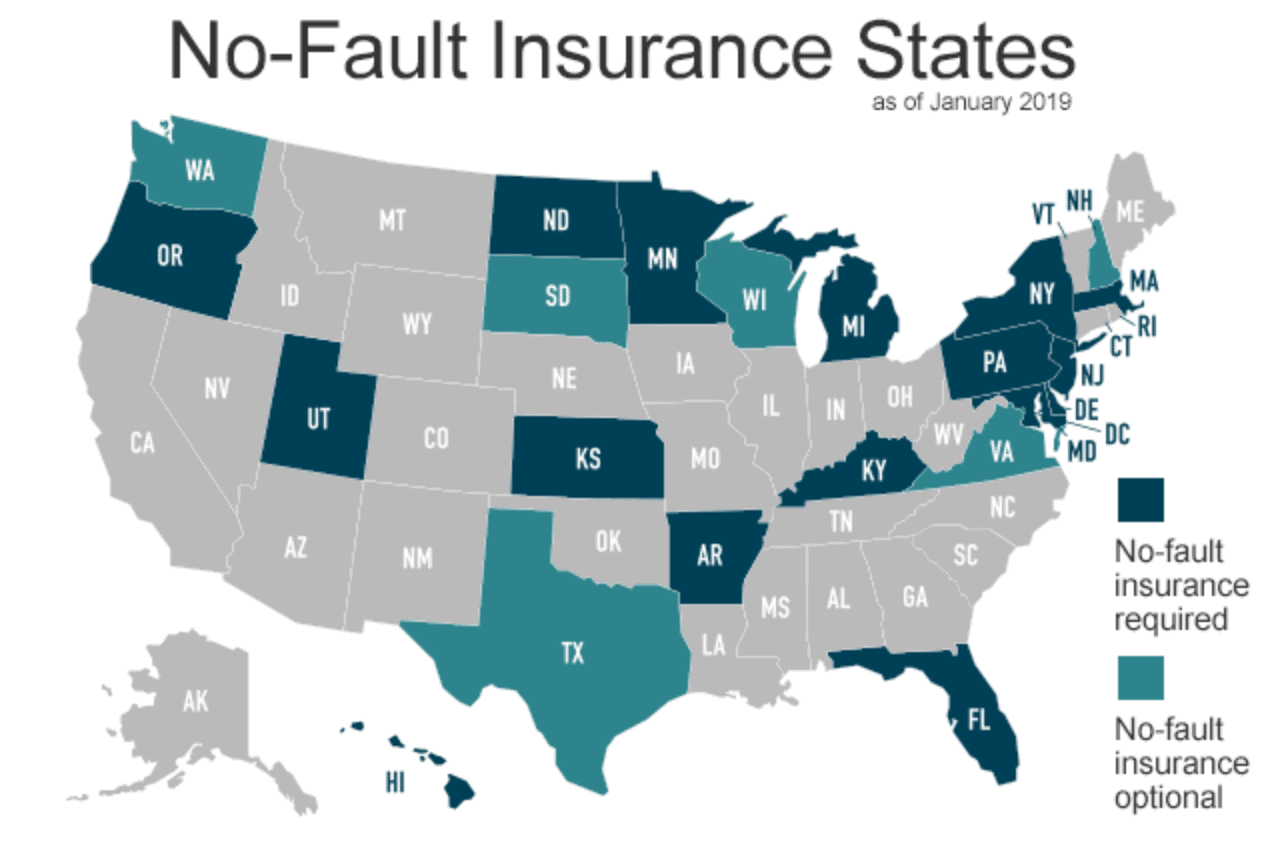

If you are a Florida resident and are looking for car insurance, you may be asking yourself, “Is Florida a no-fault state?” The answer is yes, Florida is a no-fault state when it comes to auto insurance. That means that when a car accident occurs, each driver’s insurance company pays for their own insured’s damages regardless of who was at fault. There are certain limits and exceptions to this rule, however, so it is important to understand all the details of no-fault insurance in Florida before you purchase a policy.

What Is No-Fault Insurance?

No-fault insurance, also known as Personal Injury Protection (PIP) insurance, is a type of car insurance that pays for the medical and other related expenses of the insured driver, regardless of who is at fault in an accident. It is required by law in many states, including Florida, and is designed to reduce the amount of time and money spent on lawsuits following an accident. In addition to medical expenses, PIP insurance can also cover lost wages, funeral expenses, and other related costs.

What Are the Benefits of No-Fault Insurance in Florida?

No-fault insurance in Florida has several benefits. For one, it simplifies the claims process after an accident. Rather than trying to determine who was at fault, each driver’s insurance company pays for their own insured’s expenses. This process is usually much faster than the process of determining fault, which can take months or even years. Additionally, no-fault insurance can also help to reduce the cost of car insurance premiums. Since no-fault insurance eliminates the need for lengthy and expensive lawsuits, insurance companies can offer lower premiums for no-fault coverage.

Are There Any Restrictions on No-Fault Insurance in Florida?

Yes, there are some restrictions on no-fault insurance in Florida. For one, PIP coverage does not cover property damage, which means that if your car is damaged in an accident, your insurance company will not pay for the repairs. Additionally, PIP coverage does not cover any injuries that are a result of an intentional act. Lastly, PIP coverage only covers a certain amount of medical expenses, so if the damages exceed the coverage limit, you may still be responsible for paying the remaining costs.

Conclusion

No-fault insurance is a type of auto insurance that is required in Florida. It pays for the medical and other related expenses of the insured driver, regardless of who is at fault in an accident. No-fault insurance has several benefits, such as simplifying the claims process and reducing car insurance premiums. There are also some restrictions on no-fault insurance, including that it does not cover property damage or injuries caused by an intentional act. Understanding these details can help you make an informed decision when purchasing car insurance in Florida.

What No Fault Car Insurance Is?

Florida No-Fault Auto Insurance Under Annual Review | Terrell • Hogan

Out of State Visitors Hurt in Car Accidents in Florida (Settlements)

Shops, Cars and The o'jays on Pinterest

PPT - No-Fault Auto Insurance Fraud in Florida Trends, Challenges