Gap Insurance Providers In Texas

Gap Insurance Providers in Texas

What is Gap Insurance?

Gap insurance, also known as Guaranteed Auto Protection Insurance, is an insurance policy designed to cover the difference between the amount you owe on your car loan and the current market value of your car. This difference is known as the "gap" and is often the result of depreciation. Gap insurance can be used to protect your finances in the event of an accident or theft of your vehicle.

How Does Gap Insurance Work?

Gap insurance is designed to protect you if you owe more on your car loan than the market value of the vehicle. For example, if you purchase a car for $20,000 and the value of the car depreciates quickly, you could find yourself owing more than the car is worth. This is where gap insurance comes in. If your car is totaled or stolen, gap insurance will cover the difference between the amount you owe and the value of your car.

Benefits of Gap Insurance

Gap insurance can be a great benefit to car owners. The biggest benefit is the financial protection it provides. If you are in an accident or your car is stolen, gap insurance will cover the difference between what you owe and the current market value of the car. This can help you avoid costly repairs or having to pay for a new car out of pocket.

Finding Gap Insurance in Texas

If you are looking for gap insurance in Texas, there are several options available to you. Most major insurance companies offer gap insurance policies, so you can contact your current insurance provider to see if they offer this type of coverage. Additionally, there are many online providers that offer gap insurance policies as well. It is important to compare policies and quotes to make sure you are getting the best coverage for the best price.

Gap Insurance Cost in Texas

The cost of gap insurance in Texas will vary depending on the type of coverage you are looking for and the amount of coverage you need. Generally, the average cost of gap insurance in Texas is between $300 and $500 per year. However, prices can vary depending on the type of coverage and the amount of coverage you need. It is important to shop around for the best coverage and the best price.

Conclusion

Gap insurance is an important type of coverage that can help protect your finances in the event of an accident or theft. If you are looking for gap insurance in Texas, there are several options available to you. Most major insurance companies offer gap insurance policies, as well as many online providers. It is important to compare policies and quotes to make sure you are getting the best coverage for the best price.

A Close Look at What ACA Navigators Do to Help People Get Covered

948K Texans fall into Medicaid ‘coverage gap’ | Local News

Gap Insurance Protects During Hard Times | Wichita Toyota Financing Options

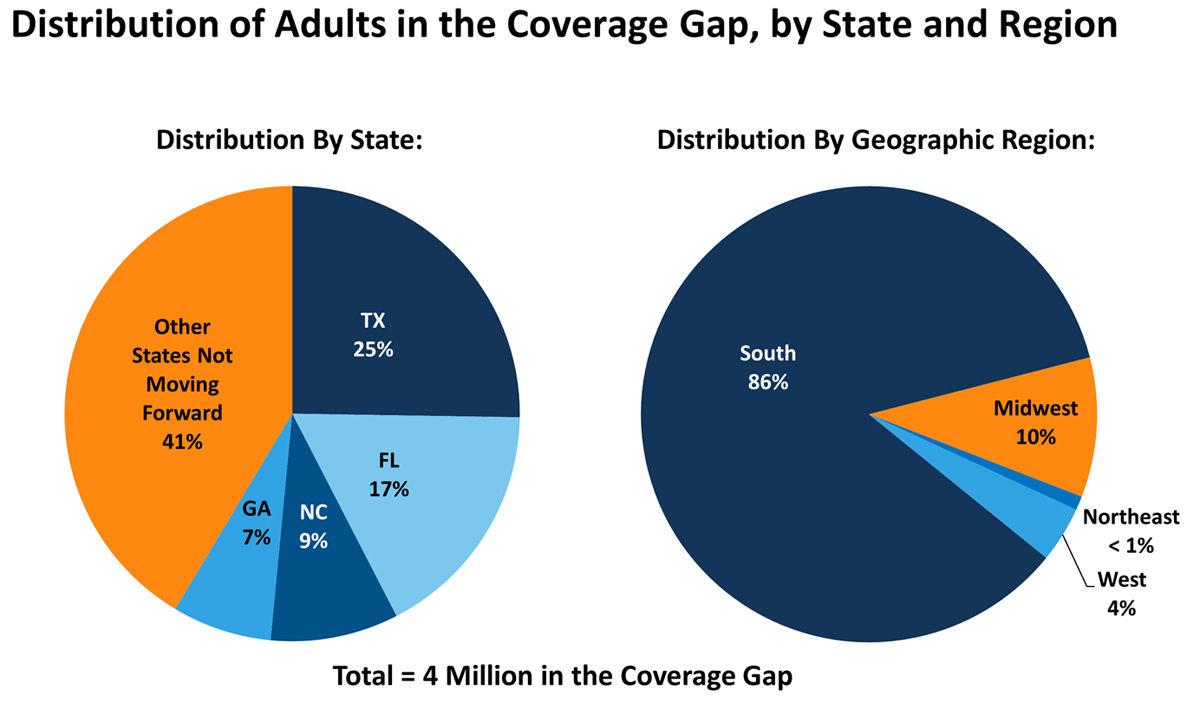

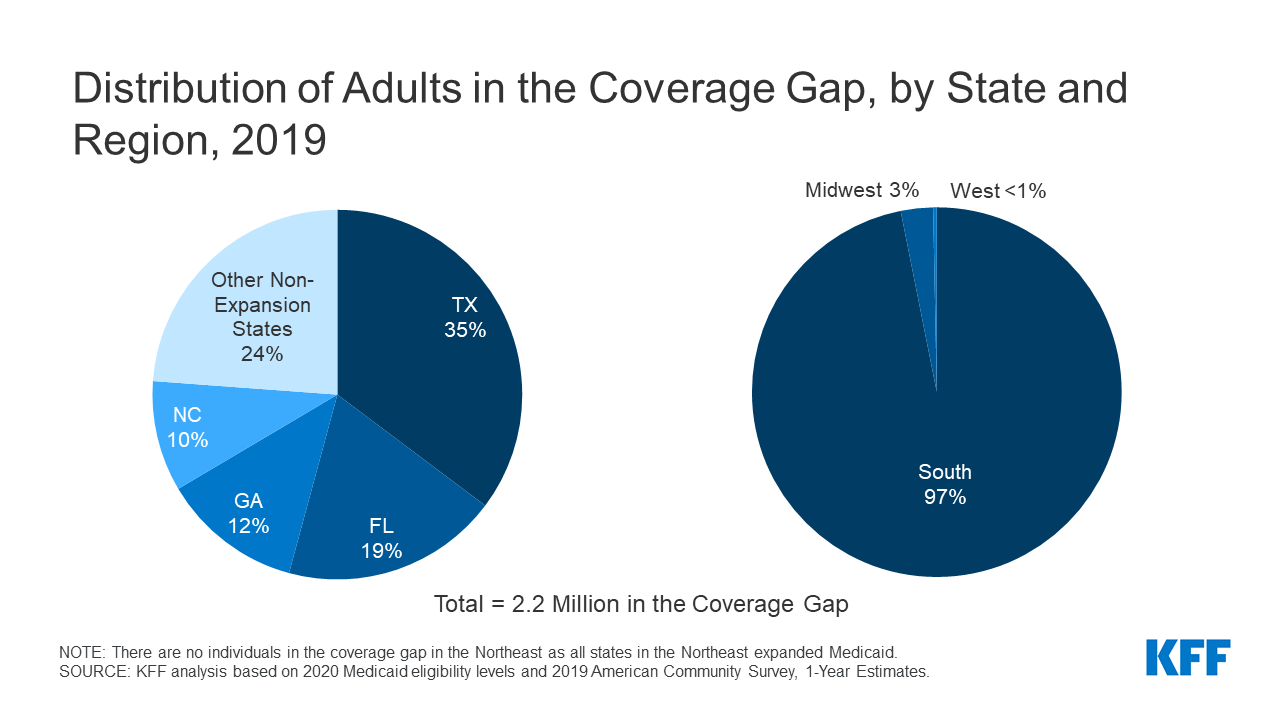

The Coverage Gap: Uninsured Poor Adults in States that Do Not Expand

GAP Insurance on Vimeo