Cheap Car Insurance Low Deposit

Friday, September 8, 2023

Edit

Cheap Car Insurance Low Deposit

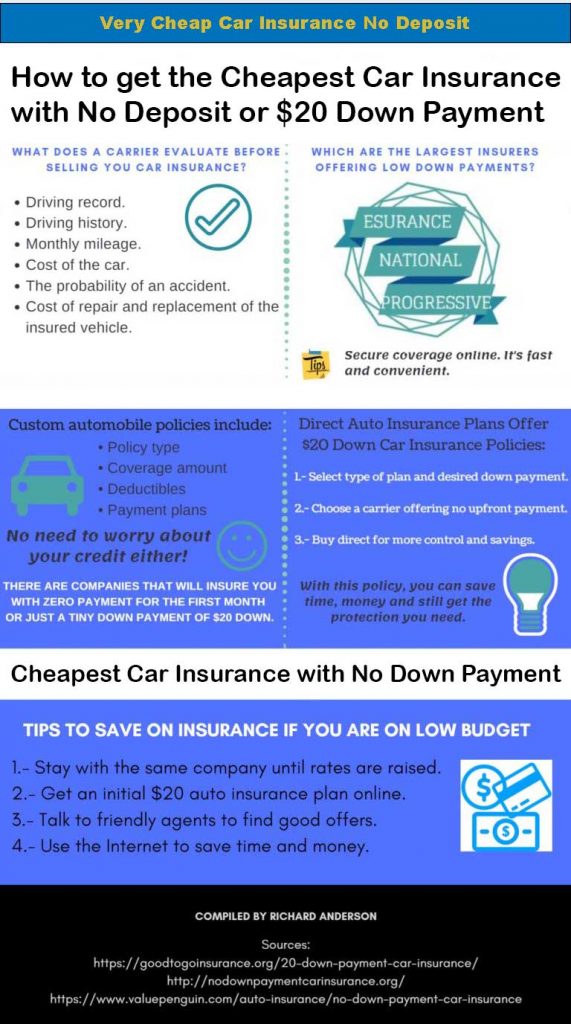

What Is Cheap Car Insurance Low Deposit?

Cheap car insurance low deposit is a type of car insurance policy that requires a lower amount of money upfront to cover the cost of insurance. This type of policy is ideal for people who don’t have a lot of extra cash lying around, as it allows them to pay a lower amount upfront and spread out the payments over the duration of the policy. For example, a policy might require only a $500 deposit to start and the remainder of the premium to be paid in monthly installments. This can make it much easier for people to afford their car insurance and protect themselves from the financial repercussions of an accident.

What Are The Benefits of Cheap Car Insurance Low Deposit?

Cheap car insurance low deposit is a great option for people who are on a budget and don’t have the funds to pay the full premium upfront. By paying a smaller deposit upfront, they can spread out the cost of their insurance over the duration of their policy and make it much more manageable. Another benefit is that it helps to reduce the risk of non-payment, as the insurance company can be assured that the policy holder will pay the remainder of their premiums on time.

Are There Any Downsides to Cheap Car Insurance Low Deposit?

The main downside to cheap car insurance low deposit is that it can be more expensive in the long run. The insurance company will charge a higher rate of interest to compensate for the smaller initial deposit, which can add up over time. Additionally, the insurance company will often require a higher credit score in order to be eligible for this type of policy, which can be an obstacle for some people.

Who Is Eligible For Cheap Car Insurance Low Deposit?

The eligibility requirements for cheap car insurance low deposit vary from company to company. Generally, the insurance company will look at your credit score and driving history to determine whether you are eligible for this type of policy. In some cases, the insurance company might also require that you have a certain level of coverage on your existing policy in order to qualify.

How Can I Find Cheap Car Insurance Low Deposit?

The best way to find cheap car insurance low deposit is to shop around and compare quotes from different providers. You can do this online or by speaking to an insurance broker. When comparing quotes, make sure to look at the coverage levels, deductibles, and monthly payments to make sure you’re getting the best deal.

Final Thoughts

Cheap car insurance low deposit is a great option for people who are on a budget and don’t have the funds to pay the full premium upfront. It can help to make car insurance more affordable and spread out the cost of the policy over the duration of the policy. However, it can be more expensive in the long run and the insurance company will often require a higher credit score in order to be eligible. Shopping around and comparing quotes from different providers is the best way to find the best deal.

Very Cheap Car Insurance No Deposit or $20 Down | Trusted for 25+ Years

low deposit auto insurance policy with affordable rate | Affordable car

Cheap No Deposit Car Insurance Policy, Low Deposit, Zero Deposit, No

You Need To Know All About No Deposit Car Insurance | Car insurance

Very Cheap Car Insurance with No Deposit | Save $100s Online!