Cheap Auto Insurance For Sr 22

Wednesday, September 6, 2023

Edit

Cheap Auto Insurance For SR 22

What is SR 22 Auto Insurance?

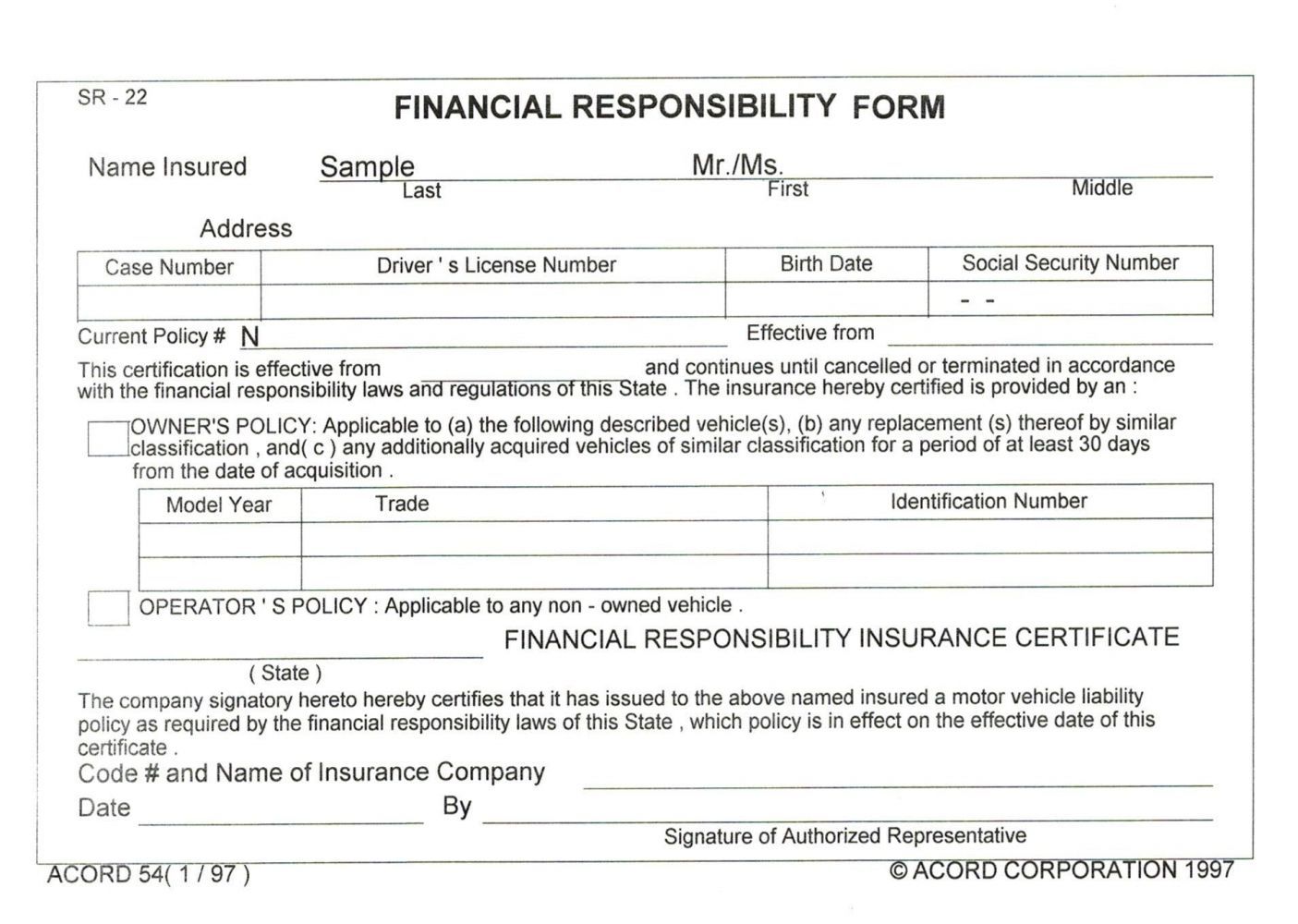

SR 22 auto insurance is a form of financial responsibility required by most U.S. states for certain drivers. This form serves as a guarantee that an individual has the minimum liability coverage required by the state. SR 22 auto insurance is also known as a Certificate of Financial Responsibility (CFR). Individuals who have been convicted of certain driving-related offenses, such as a DUI/DWI, are typically required to file an SR 22 form with the state in order to get their driver's license reinstated.

How Does SR 22 Auto Insurance Work?

When an individual is required to file an SR 22 form with their state, they must purchase a minimum amount of liability coverage. This coverage must remain active and in force for a minimum of three years. The SR 22 form serves as proof that the individual has the required coverage.

If the individual cancels their policy or the policy lapses for any reason, the insurance company is required to notify the state. The state will then suspend the individual's driver's license until the policy is reinstated and valid. Furthermore, if the individual does not maintain the policy for the full three years, they will have to start the process over again.

Finding Cheap SR 22 Auto Insurance

Finding cheap SR 22 auto insurance can be difficult, as insurance companies are often hesitant to insure high-risk drivers. However, there are a few steps you can take to make sure you get the best rate possible.

The first step is to get multiple quotes from different insurance companies. Not all companies offer SR22 insurance and the rates can vary significantly. Comparing rates from multiple companies will help you find the best rate possible.

It's also a good idea to shop around for discounts. Many insurers offer discounts for students, retirees, and good drivers. Be sure to ask about any discounts that may be available and make sure you mention any special circumstances that may qualify you for a discount.

Pros and Cons of SR 22 Auto Insurance

There are both pros and cons to SR 22 auto insurance. On the one hand, it provides a way for individuals with a history of poor driving to get the coverage they need to drive legally. On the other hand, it can be difficult to find coverage and the rates can be expensive.

The biggest pro of SR 22 auto insurance is that it provides a way for individuals with a history of poor driving to get the coverage they need to drive legally. Without this coverage, they would not be able to drive.

The biggest con of SR 22 auto insurance is that it can be difficult to find coverage and the rates can be expensive. Insurance companies are often hesitant to insure high-risk drivers, so it can be difficult to find an affordable policy. Furthermore, the rates for SR 22 coverage are typically higher than for other types of insurance.

Tips for Finding Cheap SR 22 Auto Insurance

When looking for cheap SR 22 auto insurance, it's important to be aware of a few tips that can help you get the best rate possible.

First, make sure you shop around for multiple quotes. Not all insurance companies offer SR 22 insurance and the rates can vary significantly. Comparing rates from multiple companies will help you find the best rate possible.

It's also a good idea to check into discounts. Many insurers offer discounts for students, retirees, and good drivers. Be sure to ask about any discounts that may be available and make sure you mention any special circumstances that may qualify you for a discount.

Finally, don't forget to check your driving record. Improving your driving record can help you get lower rates. If you have any points on your license, make sure you take the steps to have them removed.

Finding cheap SR 22 auto insurance can be time-consuming, but it doesn't have to be difficult. Following these tips can help you get the coverage you need at a price you can afford.

Best Cheap SR22 Insurance | CheapInsurance.com

Cheap SR22 & SR22A Georgia Insurance

SR-22 Fairfield OH: Get Insured Fast! Call us Today

SR22 Insurance, What It Is and When You Need It - 2017 Motor Insurance

SR22 Insurance - Affordable DUI Insurance Quotes - YouTube