Car Insurance Full Coverage Vs Liability Only

Car Insurance: Full Coverage Vs Liability Only

What is Full Coverage Car Insurance?

Full coverage car insurance is an insurance policy that covers a wide range of risks. It is designed to protect you, your car, and other people in the event of an accident or other damage to your vehicle. Full coverage car insurance typically includes liability, collision, comprehensive, medical payments, and uninsured/underinsured motorist protection. Liability coverage pays for damages you cause to other people and property. Collision coverage pays for damages to your car. Comprehensive coverage pays for losses due to theft, vandalism, and other non-accident-related damage. Medical payments coverage pays for medical bills resulting from an accident. Uninsured/underinsured motorist protection pays for damages caused by drivers without insurance or not enough insurance.

What is Liability Only Car Insurance?

Liability only car insurance is a basic car insurance policy that covers only the minimum requirements for the state in which you live. Liability coverage pays for damages you cause to other people and property. It does not provide any coverage for damage done to your own car and does not pay for any medical bills you may incur due to an accident. Liability only car insurance is usually the cheapest type of car insurance available, but it is not always the best option for everyone. It is important to understand the difference between full coverage and liability only car insurance to make sure you are getting the right type of coverage for your needs.

The Pros and Cons of Full Coverage Vs Liability Only Car Insurance

The biggest advantage of full coverage car insurance is that it provides comprehensive protection for your car, yourself, and other people in the event of an accident. It is also the most expensive type of car insurance, so it is important to weigh the cost of full coverage against the potential benefit. Full coverage car insurance also typically includes additional benefits such as rental car coverage and emergency roadside assistance. The downside of full coverage car insurance is that it can be expensive and may not be necessary for all drivers.

The main advantage of liability only car insurance is that it is the least expensive type of car insurance available. It is also the most basic type of car insurance, so you can be sure you are only paying for the coverage you need. The downside of liability only car insurance is that it does not provide any protection for your own car or medical bills. It also does not provide any additional benefits such as rental car coverage or emergency roadside assistance.

Which One is Right for You?

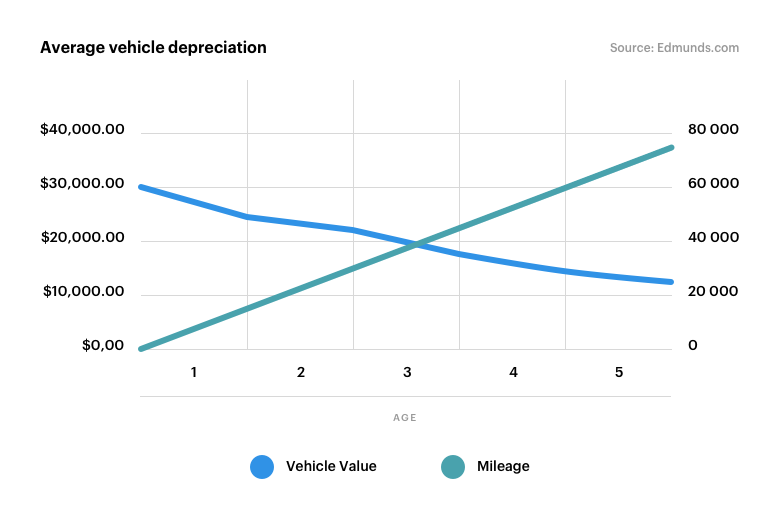

Choosing between full coverage and liability only car insurance ultimately depends on your individual circumstances. If you are a young driver or have an older car, liability only car insurance may be the best option for you. However, if you have a new car or a car that is more expensive to repair, full coverage car insurance may be the better option. It is important to compare the cost of full coverage and liability only car insurance to make sure you are getting the best deal for your money. Additionally, it is important to understand the coverage each type of car insurance provides to make sure you are getting the right amount of protection for your needs.

Conclusion

Choosing between full coverage and liability only car insurance is an important decision. It is important to understand the difference between the two types of car insurance and to compare the cost to make sure you are getting the right type of coverage for your needs. Full coverage car insurance typically provides comprehensive protection and additional benefits, while liability only car insurance is cheaper but only covers the minimum requirements. Ultimately, the right type of car insurance for you will depend on your individual circumstances.

Page for individual images - QuoteInspector.com

Full Coverage vs. Liability: Which Is Better? - Call Jacob Emrani

Liability vs Full Coverage: What You Need To Know - Cover

Car Insurance Liability Vs. Full Coverage - YouTube

What Is Comprehensive Insurance Coverage? | Allstate