Car Insurance For Provisional License Holders

Car Insurance For Provisional License Holders

Why Do Provisional Drivers Need Insurance?

If you are a provisional driver, you are required by law to have car insurance. The UK government requires all drivers to have insurance to cover the cost of any damages that may occur in an accident. Even if you are a learner driver, you must still be covered by insurance.

Having insurance is a must for all drivers, especially provisional drivers. It helps protect you from any financial losses that may arise from an accident. Without insurance, you could be liable for any damage caused to another party. In addition, it can also help cover repair costs for your vehicle in the event of an accident.

What Are The Benefits Of Car Insurance For Provisional Drivers?

Car insurance for provisional drivers comes with several benefits. Firstly, it provides financial protection if you were to cause an accident while driving. It can also help cover any medical costs if you were to be injured in an accident. Additionally, it can help cover the cost of any repairs that need to be made to your car after an accident.

In addition, car insurance for provisional drivers can also help you save money in the long run. The cost of insurance for provisional drivers is usually lower than for experienced drivers. This means that you can save money on your insurance premiums in the long run.

How To Get The Best Car Insurance For Provisional Drivers

When looking for car insurance for provisional drivers, it is important to shop around. Different insurance companies offer different rates and coverage levels, so it is important to compare different providers to find the best deal. Additionally, it is also important to consider the excess you will be required to pay in the event of a claim.

It is also important to read the policy documents carefully before signing up for any insurance policy. This will help ensure that you are aware of the cover you are getting and any exclusions that may apply. Additionally, it is also important to read the terms and conditions of the policy carefully to ensure that you are aware of the coverage limits.

Tips For Finding The Best Car Insurance For Provisional Drivers

When looking for car insurance for provisional drivers, it is important to compare different providers to find the best deal. It is also important to read the policy documents carefully before signing up for any insurance policy. Additionally, it is important to consider the excess you will be required to pay in the event of a claim.

It is also important to consider the level of coverage you need. If you are looking for comprehensive cover, it is important to ensure that you are covered for all eventualities. Additionally, it is important to ensure that the policy you choose covers all the necessary add-ons such as breakdown cover and personal accident cover.

Finally, it is important to remember that car insurance for provisional drivers is a legal requirement. This means that you must have insurance to be able to drive legally. If you are caught driving without insurance, you could face serious penalties, including fines and even a driving ban.

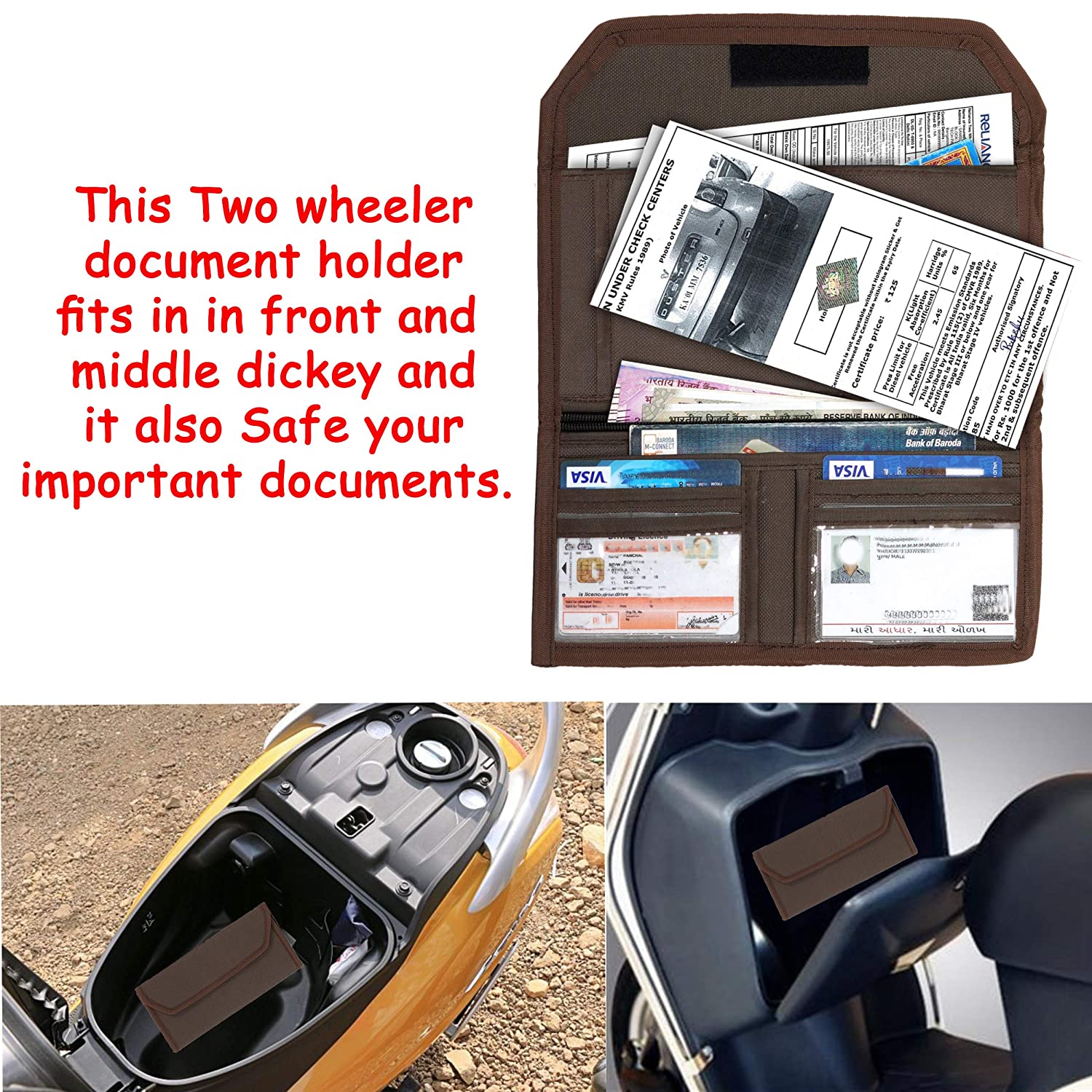

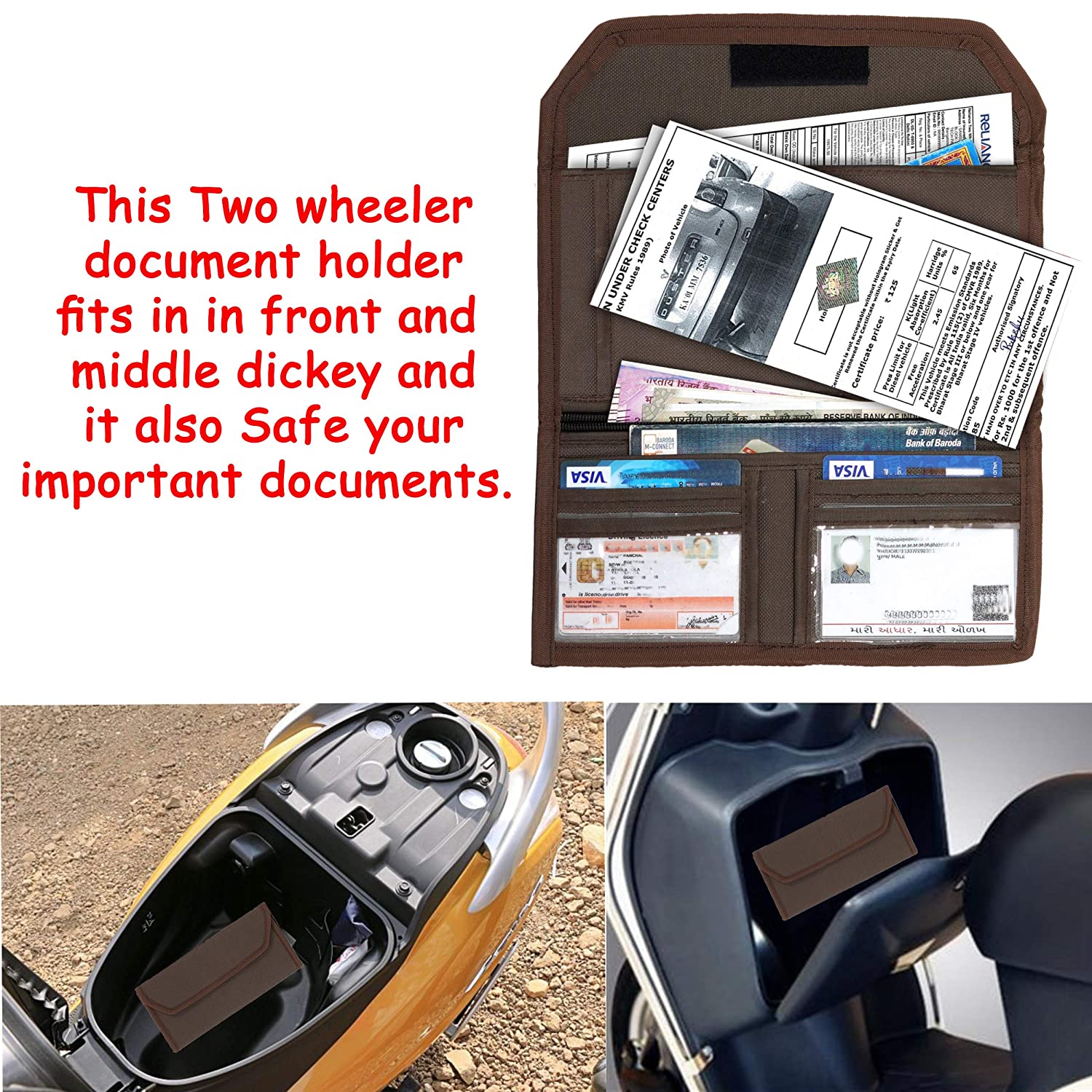

Car Insurance And Registration Holder : Set Of 3 Auto Car Registration

Car Insurance And Registration Holder : Set Of 3 Auto Car Registration

Car Insurance And Registration Holder : Set Of 3 Auto Car Registration

Car Registration and Insurance Card Holder with Magnetic Closure

Registration and Insurance Card Holder – Canopus USA