Can You Get Insurance On A Rebuilt Title

Can You Get Insurance On A Rebuilt Title?

If you're looking to purchase a vehicle that has a rebuilt title, you may be wondering whether or not you can get insurance on it. The answer is yes, you can get insurance on a rebuilt vehicle, however, it is important to understand that you may have to pay more for the insurance than you would for a vehicle with a clean title.

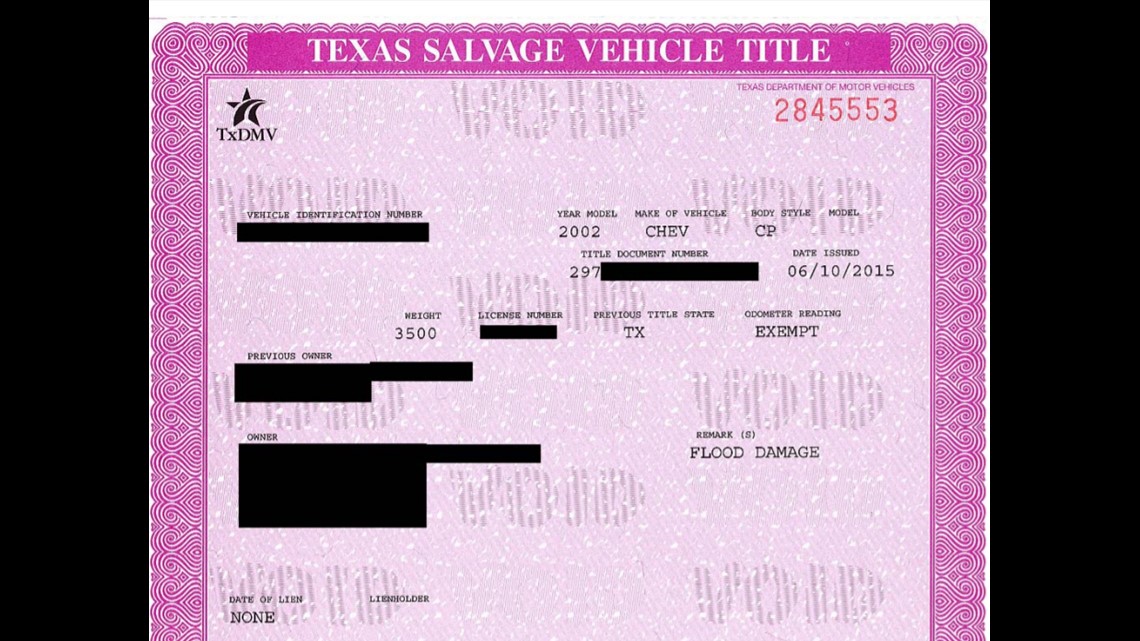

What is a Rebuilt Title?

A rebuilt title is a designation given to a vehicle that has been damaged, either in a major accident or flood, and was then repaired and given a salvaged title. The vehicle can then be inspected and given a rebuilt title, which means it is ready to be sold to a new owner. However, because the vehicle has been damaged, it is not considered a standard vehicle, and insurance companies may be more hesitant to offer coverage.

What Does Insurance Cover?

When you purchase insurance on a rebuilt title vehicle, it is important to understand what type of coverage you will be receiving. Generally speaking, you can expect to receive coverage for the following items: liability, collision, comprehensive, and uninsured/underinsured motorist. Liability coverage will help to protect you if you are found at fault in an accident, while collision and comprehensive will help to cover any damages that may occur to your vehicle, regardless of fault. Uninsured/underinsured motorist coverage is important as it will help to protect you if you are in an accident with someone who does not have insurance or does not have enough insurance to cover your damages.

How Much Does Insurance Cost?

The cost of insurance on a rebuilt title vehicle will vary depending on the company and the type of coverage you choose. Generally speaking, you can expect to pay more for the insurance than you would for a vehicle with a clean title. This is due to the fact that the vehicle has a salvaged title and is considered to be a higher risk. Additionally, some insurance companies may require additional inspections or documents in order to provide coverage on a rebuilt title vehicle. Be sure to shop around and get quotes from several different companies in order to find the best coverage for the best price.

What Other Factors Are Considered?

In addition to the type of coverage you choose and the cost of the insurance, there are a few other factors that insurance companies may consider when determining the cost of insurance on a rebuilt title vehicle. These can include the age of the vehicle, the make and model, the safety features, and the driver's record. The age of the vehicle is important as some insurance companies may consider older vehicles to be a higher risk. Additionally, the make and model of the vehicle, as well as any safety features, can also be taken into consideration. Finally, the driver's record, such as any previous traffic violations or accidents, will also be taken into account when determining the cost of insurance.

Conclusion

In conclusion, you can get insurance on a rebuilt title vehicle, but it is important to understand that you may have to pay more for the insurance than you would for a vehicle with a clean title. Additionally, there are a few factors that insurance companies may take into consideration when determining the cost of insurance, such as the age of the vehicle, the make and model, the safety features, and the driver's record. Be sure to shop around and get quotes from several different companies in order to find the best coverage for the best price.

Can You Get Full Coverage on a Rebuilt Title? Find Out Here!

Texas Rebuilt Motorcycle Titles - MotorCycle Review

Can You Get Insurance On A Rebuilt Title : What Is Rebuilt Title Car

Can You Get Insurance On A Salvage Title : Can You Still Get Insurance

How To Get A Salvage Title The Right Way | Li Linguas

/pros-and-cons-of-a-salvage-title-car-527266-v4-JL-a971907575294521a67e20f680017f86.png)