Average Car Insurance Cost Oklahoma Per Month

Friday, September 8, 2023

Edit

Average Car Insurance Cost in Oklahoma Per Month

Overview of Car Insurance in Oklahoma

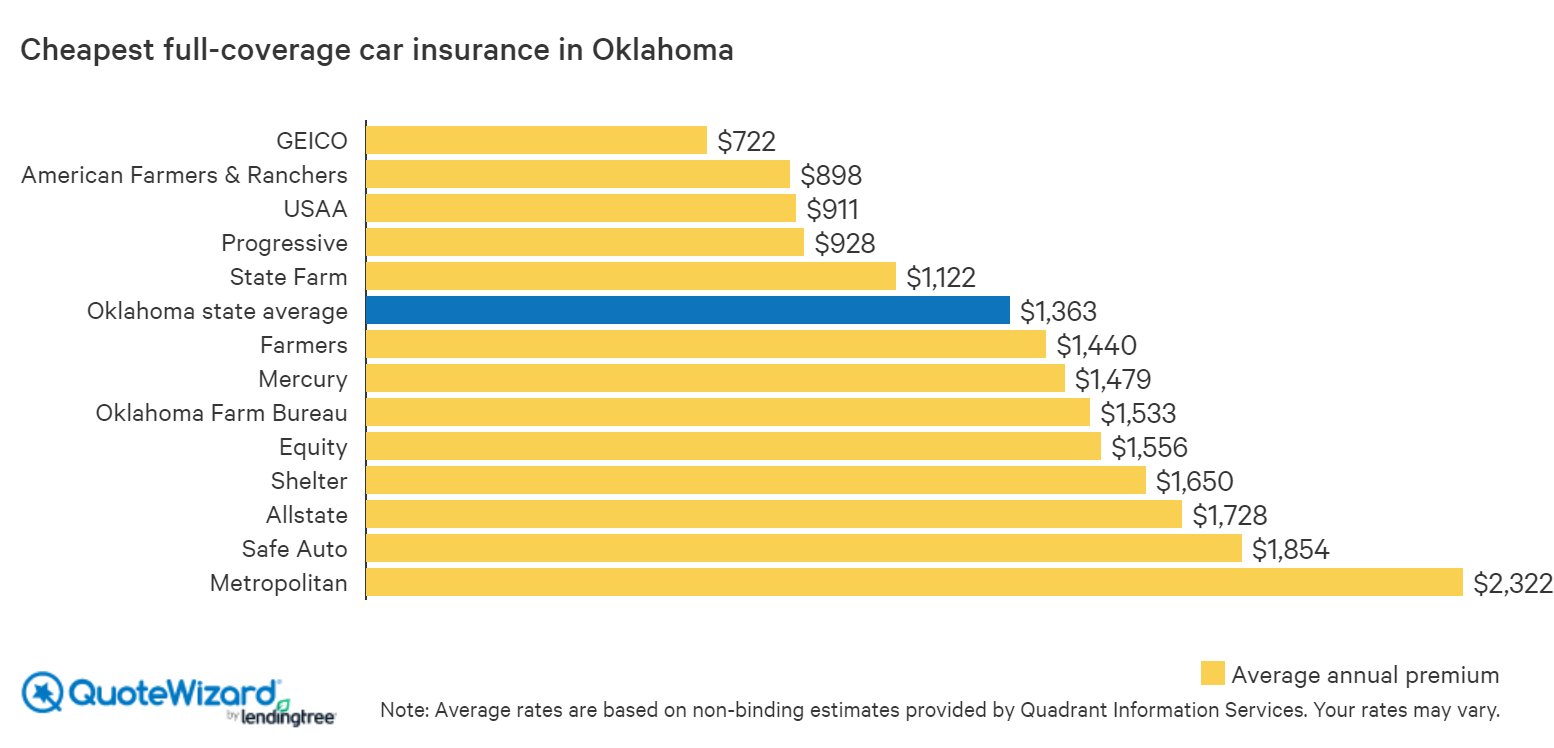

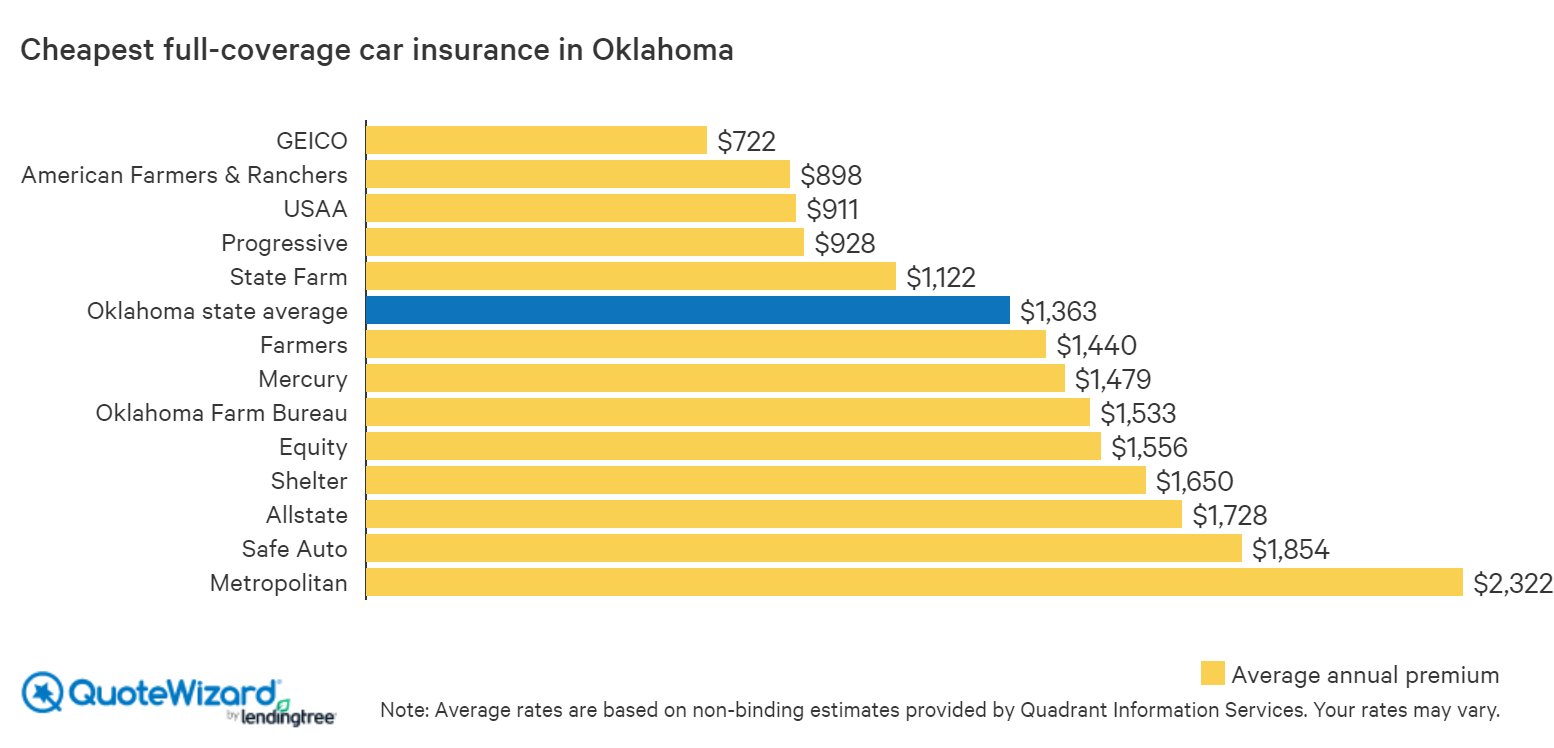

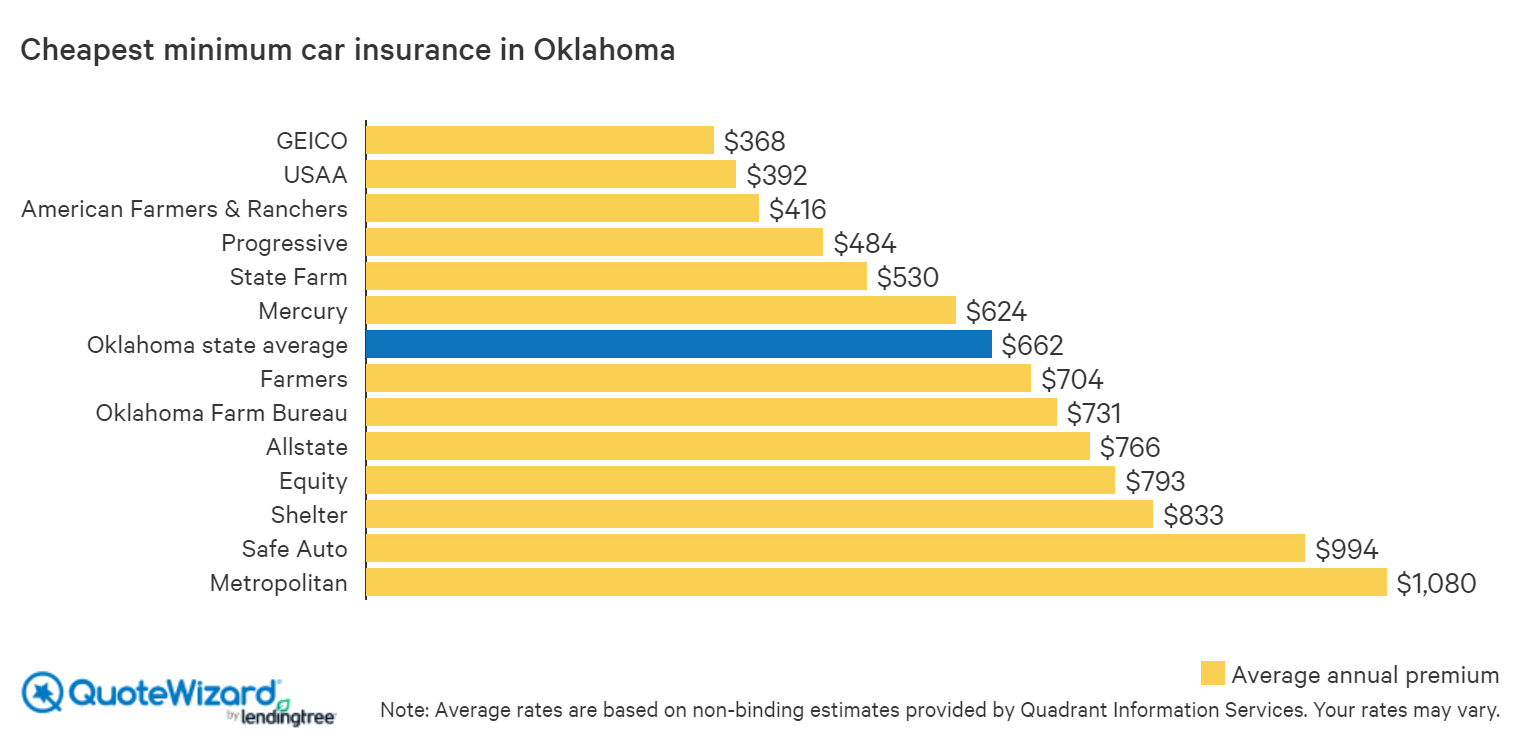

Oklahoma is located in the mid-south of the United States and is bordered by Texas, Kansas, Missouri, Arkansas and New Mexico. It's a state rich in history and culture, and has a thriving economy. It's also home to some of the most affordable car insurance in the nation. The average cost of car insurance in Oklahoma is $862 per year, or about $72 per month. That's about 10 percent less than the national average.

Oklahoma's car insurance laws are similar to those of most states. Drivers in the state are required to carry liability insurance, which covers them if they cause an accident that results in injury or property damage to another person. Liability coverage also covers medical costs if someone else is injured in an accident. Drivers also need to carry uninsured motorist coverage, which pays for medical costs if the driver is injured in an accident caused by an uninsured driver.

Factors that Affect Car Insurance Costs in Oklahoma

Car insurance premiums vary from state to state and even city to city. In Oklahoma, the cost of car insurance is influenced by several factors, including the type of coverage purchased, the age and driving history of the driver, and the make and model of the vehicle. Drivers in Oklahoma pay more for car insurance if they have a bad driving record, or if they drive a car that is considered high-risk. The cost of car insurance also rises with age, as older drivers tend to be more expensive to insure.

Another factor that affects the cost of car insurance in Oklahoma is the type of coverage purchased. Liability coverage is usually the most affordable option, but comprehensive coverage, which covers damage to the driver's own car, is more expensive. Drivers in Oklahoma also pay more for car insurance if they have multiple vehicles or if they choose to add additional coverage, such as rental car reimbursement or roadside assistance.

Average Car Insurance Cost in Oklahoma Per Month

The average cost of car insurance in Oklahoma is $862 per year, or about $72 per month. This is about 10 percent lower than the national average of $927 per year, or $77 per month. However, this can vary depending on the type of coverage purchased and the driver's age and driving history.

Young drivers, or those under the age of 25, tend to pay the most for car insurance. They also tend to pay more for comprehensive coverage, which covers damage to the driver's own car, than they do for liability coverage, which covers damage to other people's property.

Older drivers, or those over the age of 25, generally pay less for car insurance than younger drivers. They may also be eligible for discounts if they have a good driving record or are enrolled in a defensive driving course.

Tips to Lower Car Insurance Costs in Oklahoma

There are several ways to lower the cost of car insurance in Oklahoma, including:

1. Shop Around: Shopping around for car insurance is one of the best ways to save money on premiums. Different companies offer different rates, and it pays to compare quotes to find the best deal.

2. Increase Deductibles: Increasing the deductible on car insurance is another way to lower premiums. Increasing the deductible means that the driver is responsible for a larger portion of the costs in the event of an accident, and this can result in lower premiums.

3. Take a Defensive Driving Course: Taking a defensive driving course can help drivers save money on their car insurance premiums. Most insurance companies offer discounts to drivers who complete a defensive driving course.

4. Drive Safely: The best way to save money on car insurance is to drive safely and responsibly. Drivers who avoid accidents and traffic violations can save money on their car insurance premiums.

Conclusion

The average cost of car insurance in Oklahoma is about 10 percent lower than the national average. However, the cost of car insurance can vary depending on the type of coverage purchased, the age and driving history of the driver, and the make and model of the vehicle. Drivers in Oklahoma can save money on their car insurance premiums by shopping around, increasing their deductibles, taking a defensive driving course, and driving safely and responsibly.

Buy Cheap Car Insurance in Oklahoma | QuoteWizard

Buy Cheap Car Insurance in Oklahoma | QuoteWizard

The Best Average Cost Of Car Insurance 2022 - Dakwah Islami

How Much is Car Insurance per Month? Average Cost

Car Insurance Cost | Berita Tekini