Average Car Insurance Cost Illinois

Tuesday, September 12, 2023

Edit

Average Car Insurance Cost in Illinois

How Much Does Car Insurance Cost in Illinois?

If you live in Illinois, you’re probably curious about how much car insurance costs in the Land of Lincoln. The cost of car insurance in Illinois can vary significantly, depending on the region, your age, the make and model of your car, and other factors. The average cost of car insurance in Illinois is $1,051 per year, according to the Insurance Information Institute. That’s slightly lower than the nationwide average of $1,470 per year.

What Factors Affect Car Insurance Rates in Illinois?

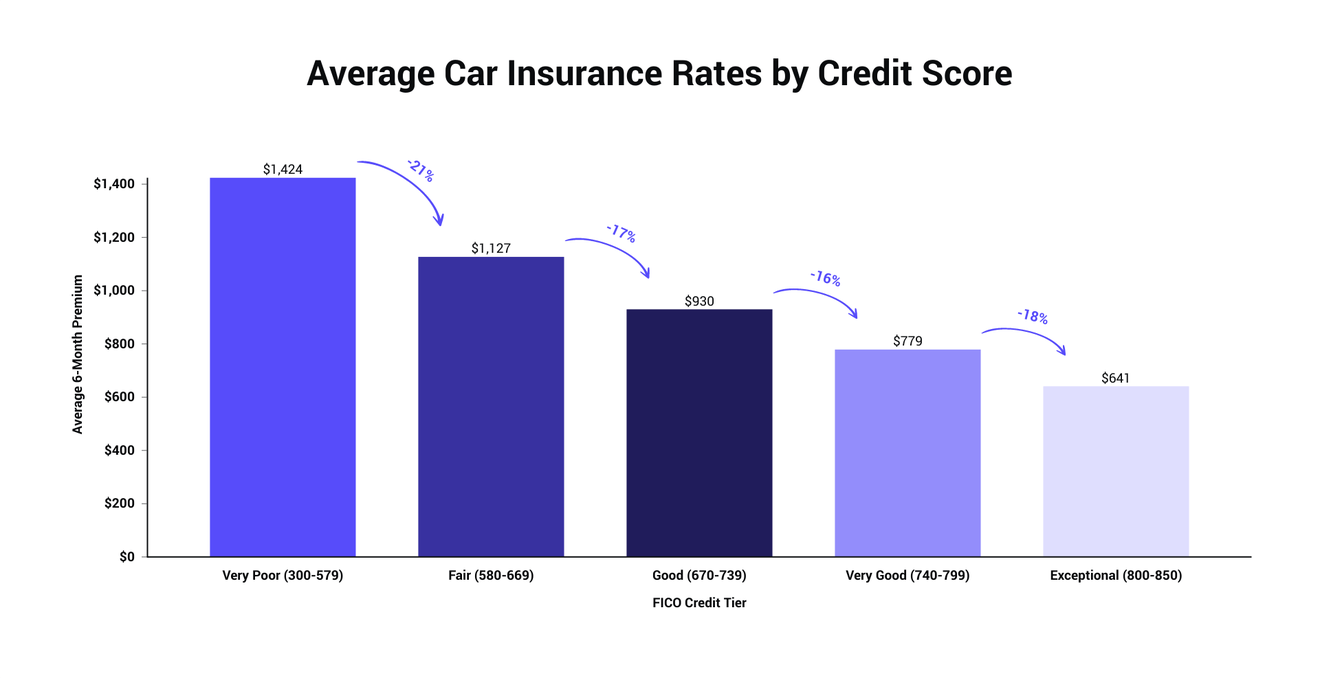

There are several factors that can affect your car insurance rates in Illinois. Your age is a big one; drivers under 25 are typically charged higher rates than more experienced drivers. The make and model of your car can also have an impact; a sports car will typically cost more to insure than a sedan. Your driving history is another factor that can influence your rates; if you have a history of speeding tickets or other violations, you’ll likely pay more for coverage. Other factors that can affect rates include your credit score, the location of your residence, and the type of coverage you select.

Insurance Requirements in Illinois

Illinois requires all drivers to carry a minimum level of car insurance coverage. The minimum required coverage is:

• Bodily Injury Liability: $25,000 per person/$50,000 per accident

• Property Damage Liability: $20,000 per accident

• Uninsured Motorist Bodily Injury: $25,000 per person/$50,000 per accident

• Uninsured Motorist Property Damage: $20,000 per accident

It’s important to note that the state minimums may not be enough coverage to protect you in the event of an accident. In Illinois, you’re also required to carry proof of insurance with you in your car at all times.

Saving Money on Auto Insurance in Illinois

Fortunately, there are several ways to save money on car insurance in Illinois. Shopping around for the best rates is a great place to start; different companies set different rates, so it pays to shop around and compare. You may also be able to get a discount if you bundle your car insurance with other policies, such as home or renters insurance. Taking a defensive driving course can also help you save money; many insurance companies offer discounts for drivers who complete these courses. Finally, make sure you keep your driving record clean; this will help you avoid costly tickets and violations that can cause your rates to skyrocket.

Get the Best Car Insurance in Illinois

If you’re looking for the best car insurance in Illinois, it pays to shop around and compare quotes. Talk to an independent insurance agent to get personalized advice and compare rates from multiple companies. An independent agent can help you find the coverage you need at a price you can afford.

When it comes to car insurance in Illinois, the cost can vary significantly. But by shopping around and taking advantage of discounts, you can find the coverage you need at a price that fits your budget.

How Much Does SR22 Cost in Illinois

Car Insurance in Illinois: Laws, Costs & Coverages | Independent Agents

The Average Cost of Car Insurance in Westmont, IL, is $1,336

The Average Rate of Car Insurance in Bolingbrook, IL, is $1,155

How Much Does Car Insurance Cost on Average? | The Zebra