Average Car Insurance Cost California Per Month

Tuesday, September 5, 2023

Edit

Average Car Insurance Cost Per Month in California

Overview of California's Insurance Market

California is the biggest state in the US and has the largest auto insurance market. The state's insurance marketplace is competitive, with hundreds of insurance providers offering coverage. Auto insurance rates vary significantly depending on the type of vehicle, your driving record, and other factors. Understanding the average car insurance cost for California drivers can help you make an informed decision when shopping for a policy.

Factors that Affect Car Insurance Cost

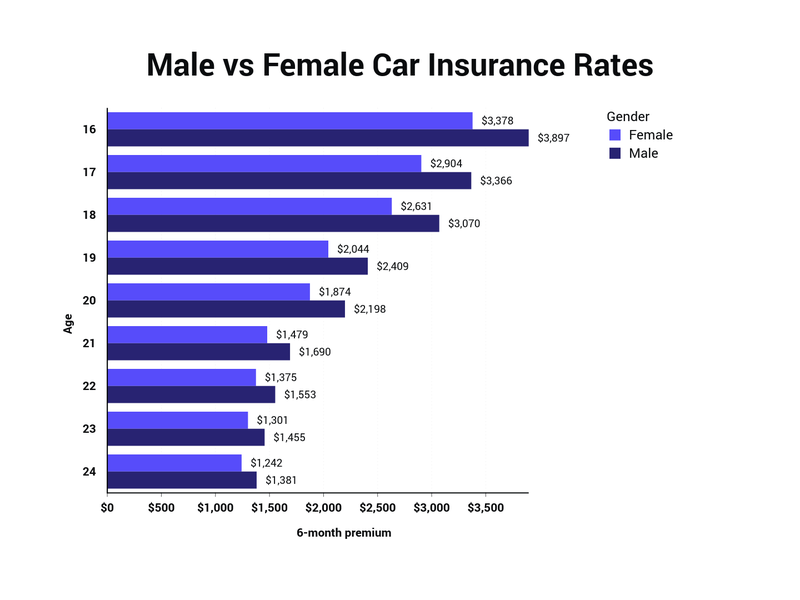

Car insurance rates in California depend on a number of different factors. Your age, gender, and driving record all play a role in determining your insurance rate. Your vehicle's make and model, as well as the type of coverage you select, also have an impact on the cost of your policy. Insurance providers also consider the area where you live and park your car, as well as your credit score and any prior claims you may have made.

Average Cost of Car Insurance in California

According to the California Department of Insurance (CDI), the average cost of car insurance in California is approximately $1,560 per year, or about $130 per month. This is slightly higher than the national average of $1,430 per year. Rates can vary significantly, however, depending on the type of coverage you select and the factors mentioned above.

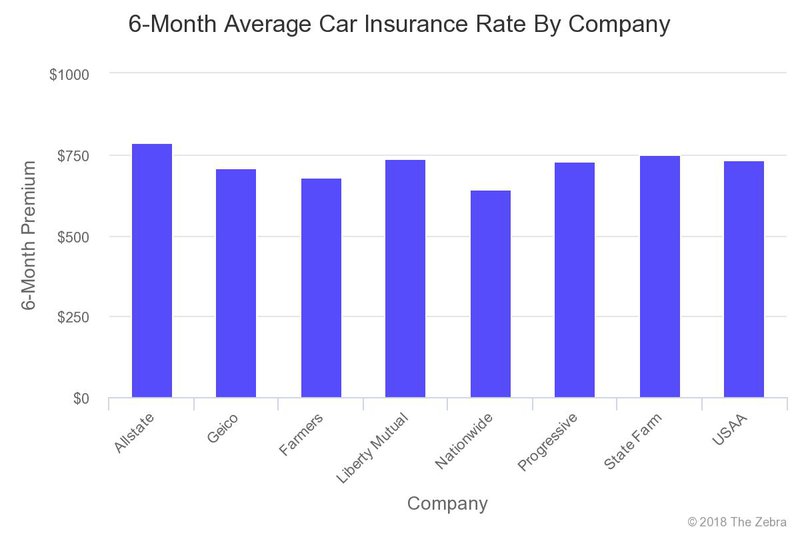

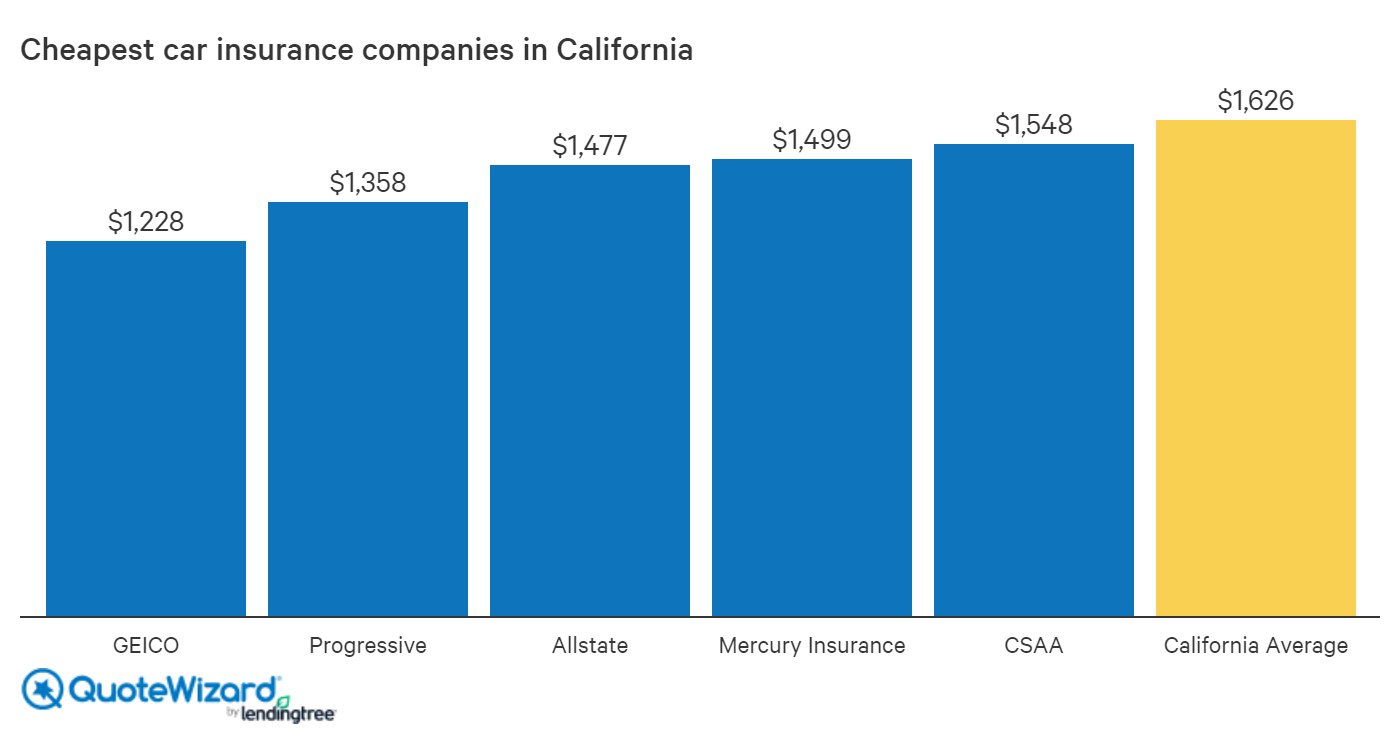

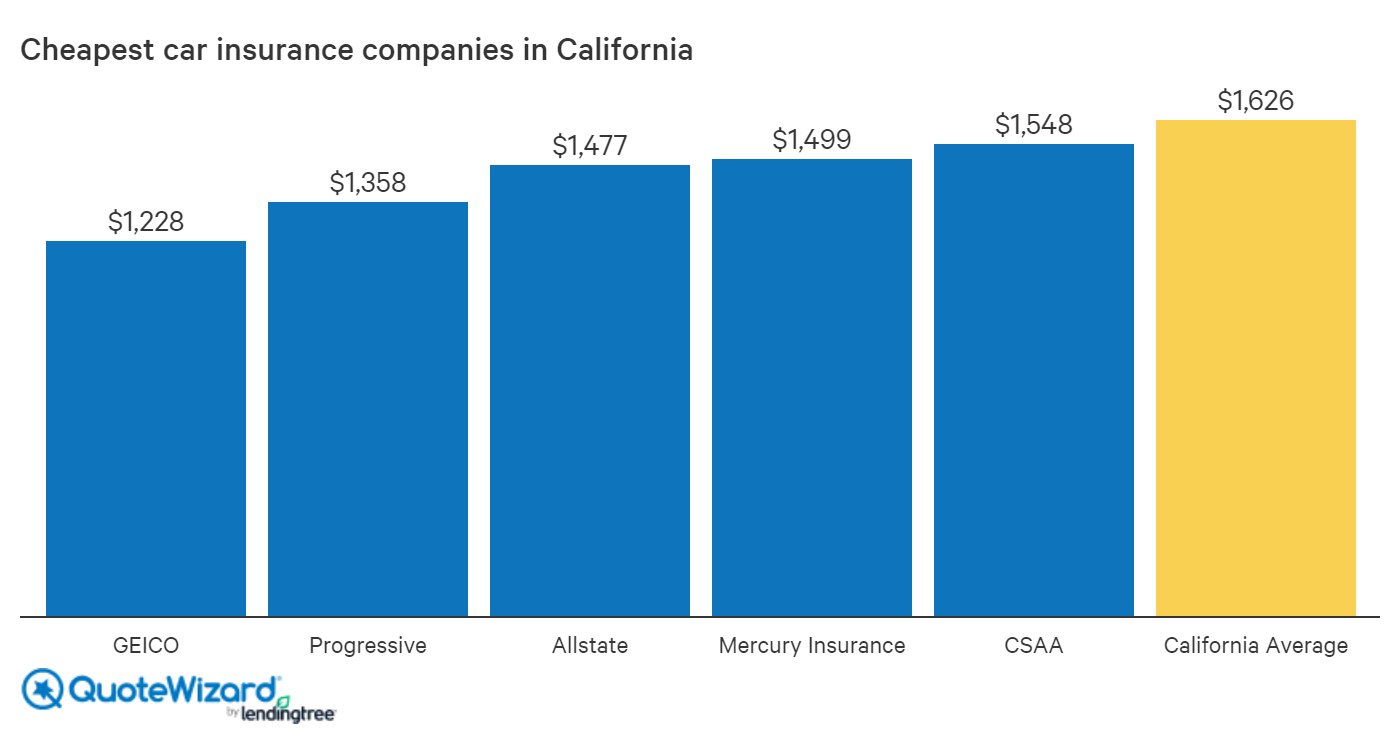

Comparing Car Insurance Quotes

When shopping for car insurance, it’s important to compare multiple quotes from different providers. Different insurers have different rates, so it’s important to look around and find the best price. You can compare quotes online or you can contact insurers directly to get more information. Keep in mind that the cheapest price isn’t always the best option. You should also consider the quality of coverage, customer service, and other factors when choosing an insurance provider.

Discounts for California Drivers

Many insurers offer discounts to California drivers. For example, many insurers offer discounts for safe drivers, good students, and drivers who have completed an approved driver safety course. You may also be able to get a discount if you have multiple vehicles insured with the same company. Be sure to ask your insurer if they offer any discounts that may be applicable to you.

Getting the Right Coverage

The type of coverage you select will also affect the cost of your policy. In California, drivers must purchase at least liability coverage and uninsured motorist coverage. Liability coverage protects you in case you cause an accident, while uninsured motorist coverage protects you if you’re hit by an uninsured driver. You may also want to consider additional coverage such as comprehensive and collision coverage, which cover damage to your vehicle.

When shopping for car insurance, it’s important to compare quotes and understand the average car insurance cost in California. Taking the time to research and compare policies can help you find the best coverage for the best price.

Finding Cheap Car Insurance in California | QuoteWizard

Average Car Insurance California - What Car Insurance Companies Don't

How Much Does Car Insurance Cost in California? (2019 Average

Calif. Males Subject to Higher Auto Insurance Premiums Than Females

How Much Does Car Insurance Cost? | The Zebra