Auto Insurance Collision Vs Liability

Auto Insurance: Collision Vs Liability Coverage

What is Auto Insurance?

Auto insurance is a type of insurance policy designed to provide financial protection for drivers in the event of an accident or other type of incident. It’s important to understand the different types of auto insurance coverage and what they cover. Auto insurance typically consists of liability, collision, and comprehensive coverage. Liability coverage pays for the other driver’s medical bills and property damage if you cause an accident. Collision coverage pays for damage to your car if you are in an accident. Comprehensive coverage pays for damages caused by events other than an accident, such as theft or fire.

What is the Difference Between Collision and Liability Coverage?

The main difference between collision and liability coverage is that collision coverage pays for damages to your vehicle, while liability coverage pays for damages to someone else’s vehicle or property. Liability coverage also pays for medical expenses resulting from an accident. Collision coverage is usually required if you are financing or leasing a vehicle, while liability coverage is usually mandatory in most states.

What Does Collision Insurance Cover?

Collision insurance pays for damages to your vehicle if you are involved in an accident. It will cover the cost of repairs to your vehicle, as well as any other losses that result from the accident, such as the cost of a rental car while your car is being repaired. Collision insurance is optional, but it is usually required if you are financing or leasing a vehicle.

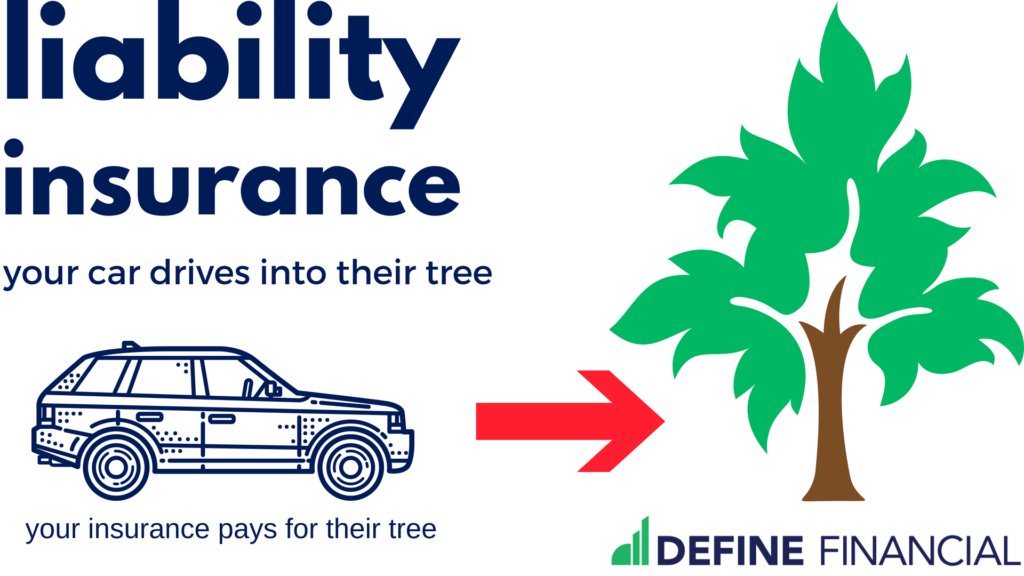

What Does Liability Insurance Cover?

Liability insurance pays for the medical expenses and property damage of the other driver if you cause an accident. It will also cover any legal expenses resulting from a lawsuit. Liability insurance is mandatory in most states, and it is typically the least expensive type of auto insurance.

Which Type of Coverage is Best for You?

Choosing the best type of coverage for you depends on your individual needs and circumstances. If you have an older car, it may not be worth having collision coverage. However, if you have a newer car, it is usually a good idea to have both collision and liability coverage. It is also important to consider the risks associated with driving in your state. Some states have higher rates of accidents than others, and having both types of coverage can help protect you in the event of an accident.

Conclusion

Auto insurance is an important part of owning a car, and it is important to understand the different types of coverage available. Collision and liability coverage both have their advantages and disadvantages, and it is important to consider your individual needs and circumstances when deciding which type of coverage is best for you. Ultimately, having both collision and liability coverage can provide you with the most comprehensive protection in the event of an accident.

Liability Car Insurance

Car Insurance | Liability Vs Collision Vs Comprehensive Coverage 2017

Collision Vs Comprehensive Car Insurance – Full Guide - YouTube

How To Compare Car Insurance Quotes Online - Get The Best Coverage and

How to Save Money on Auto Insurance - Define Financial