What Is Gap Insurance Coverage

What Is Gap Insurance Coverage?

Gap insurance is a type of financial protection that covers the difference between the amount you owe on a vehicle loan or lease and what your car insurance company will pay if your car is stolen or totaled in an accident. Gap insurance is usually recommended for those who are financing a vehicle or leasing one. It can help protect a driver from financial hardship if an accident or other incident causes their vehicle to be declared a total loss, and they owe more than what their insurance company will pay.

What Does Gap Insurance Cover?

Gap insurance covers the gap between the actual cash value of the vehicle and the amount the driver owes on the loan or lease. In other words, if the driver has a loan or lease on a vehicle that is worth less than what is owed, gap insurance will cover the difference. For example, if the driver owes $25,000 on a vehicle that is only worth $20,000, gap insurance will cover the $5,000 difference. Gap insurance is also known as loan/lease gap coverage, or loan/lease payoff coverage.

When Do You Need Gap Insurance Coverage?

Gap insurance is typically recommended for those who are financing a vehicle or leasing one. This is because the amount owed on the loan or lease is often more than the actual cash value of the vehicle. This is due to depreciation, which is the decrease in value of an asset over time. Depreciation is particularly rapid for new cars, which can lose up to 20% of their value as soon as they are driven off the lot. This means that a driver can owe more than the actual cash value of their vehicle if they get into an accident.

How Much Does Gap Insurance Coverage Cost?

The cost of gap insurance varies from company to company, but is generally quite affordable. It is usually sold as an add-on to a car insurance policy, and the cost can range from a few dollars to a few hundred dollars per year. The cost is usually based on the age and value of the vehicle, as well as the amount of coverage selected.

What Are the Benefits of Gap Insurance Coverage?

The main benefit of gap insurance is that it can help protect a driver from financial hardship if their vehicle is totaled in an accident or stolen. Without gap insurance, a driver could be stuck paying the difference between the actual cash value of the vehicle and the amount still owed on the loan or lease. This could be thousands of dollars, which could be difficult or even impossible to pay. Gap insurance can help save a driver from such a situation.

Conclusion

Gap insurance is a type of financial protection that can help protect drivers from financial hardship if their vehicle is totaled in an accident or stolen. It covers the difference between the actual cash value of the vehicle and the amount still owed on the loan or lease. Gap insurance is usually recommended for those who are financing a vehicle or leasing one, as the amount owed on the loan or lease is often more than the actual cash value of the vehicle. The cost of gap insurance is usually quite affordable, and can range from a few dollars to a few hundred dollars per year.

What Is Gap Insurance? - Lexington Law

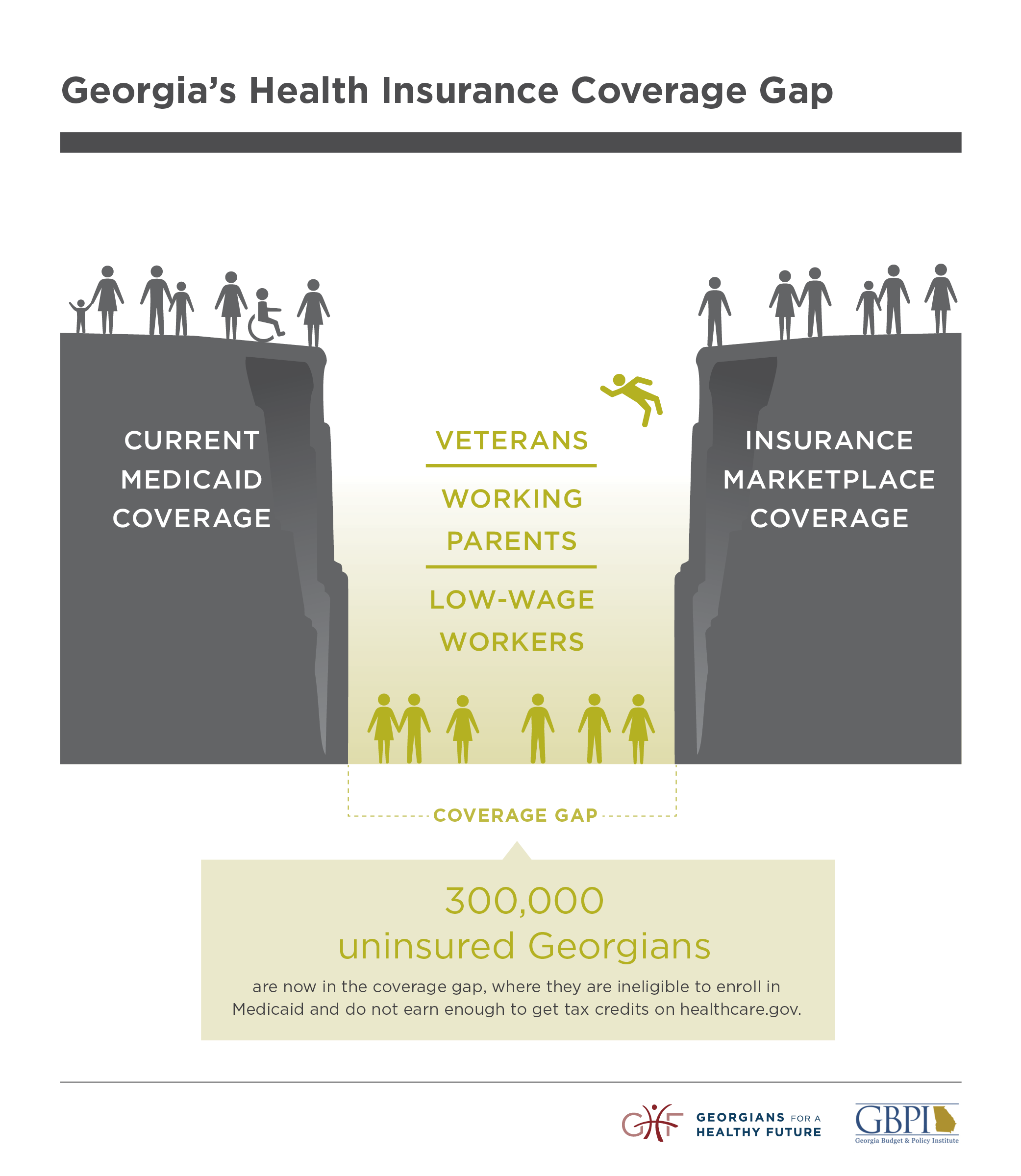

New illustrated Medicaid resource – Georgians for a Healthy Future

Gap Insurance: Usaa Gap Insurance Coverage

What is gap insurance coverage - insurance

Gap Coverage Insurance Puzzle Policy Hole Supplemental Protection Stock