What Is Gap Coverage Car Insurance

What Is Gap Coverage Car Insurance?

Are you considering purchasing gap coverage car insurance, but you’re not sure what it is or why you need it? If so, you’re not alone. Many car owners are unfamiliar with gap coverage and what it does, which makes it easy to overlook when shopping for auto insurance. To help you make the best decision for your car and your wallet, here’s a closer look at what gap coverage is, how it works, and why it might be a good option for you.

What Is Gap Coverage?

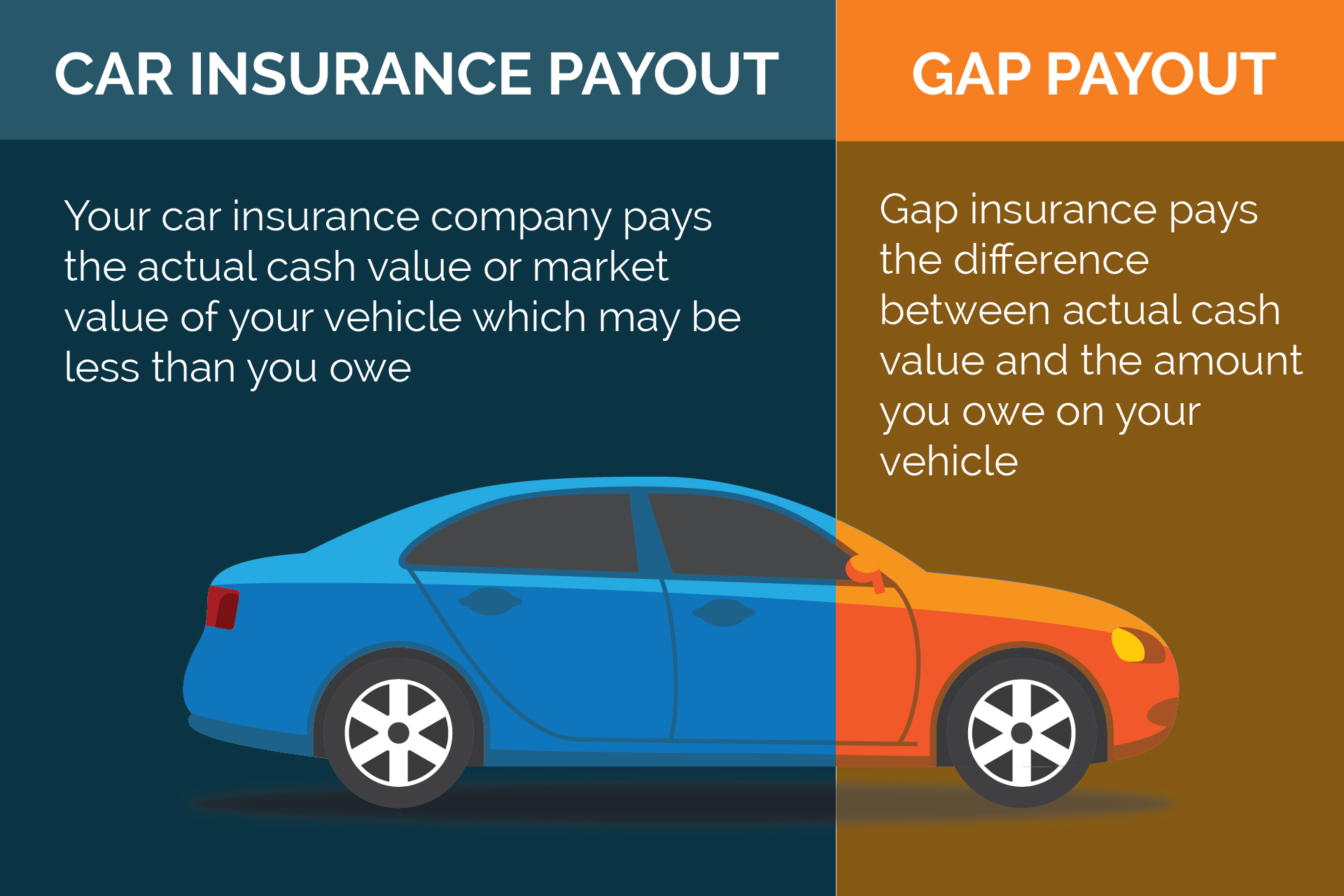

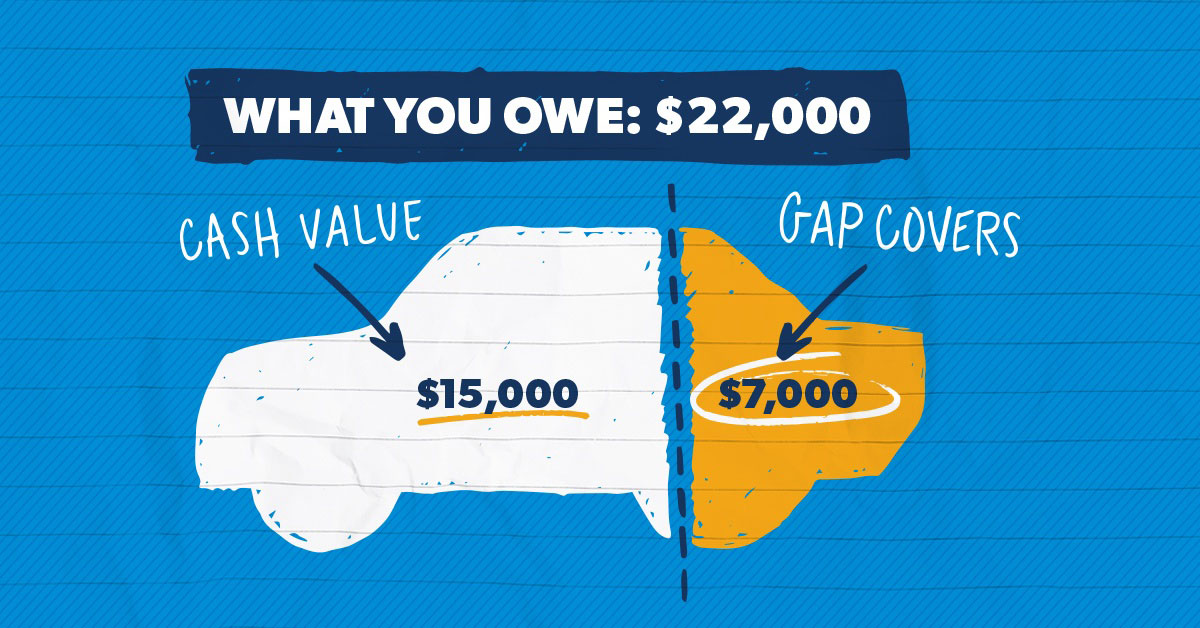

Gap coverage, or Guaranteed Auto Protection, is a kind of insurance that covers the “gap” between what you owe on your car and the car’s actual cash value. The cash value of a car is determined by the market, and typically decreases as the car gets older and/or has more miles on it. As a result, if you have a car loan and you’re in an accident, your insurance company may not cover the full balance of your loan if your car is totaled – because the car isn’t worth as much as you owe.

Gap coverage is designed to bridge this gap and cover the difference between the cash value of your car and what you still owe. This way, if your car is totaled, you won’t be stuck with a large bill from your loan company.

How Does Gap Coverage Work?

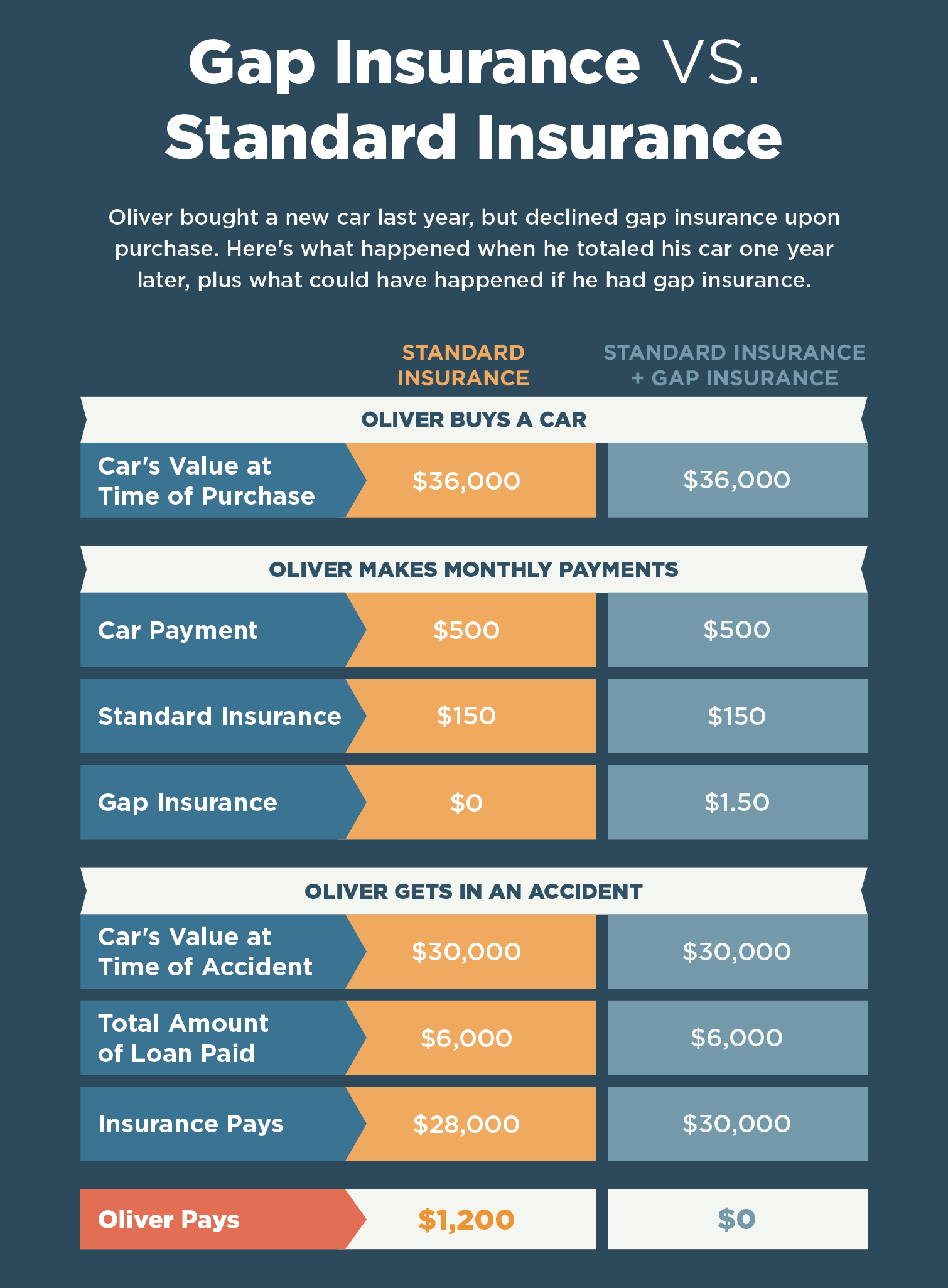

Gap coverage kicks in when your car is totaled and you owe more on the car than its cash value. So, if you had a car loan of $20,000 and your car was totaled in an accident, but its cash value was only $17,000, gap coverage would cover the remaining $3,000. This makes sure you don’t have to pay the full loan amount out of pocket.

Is Gap Coverage Worth It?

Gap coverage is a good option if you have a car loan and you’re in an accident. However, it’s important to note that not all car insurance policies include gap coverage. If you’re not sure if your policy includes it, be sure to check with your insurance provider. If gap coverage is not included, it’s typically available for an additional fee.

It’s also important to consider the age and mileage of your car. If you’re driving an older car with higher miles, it’s likely not a good investment to pay for gap coverage. This is because the cash value of an older car is typically much less than what you owe on the car. However, if you’re driving a newer car or a car you just recently financed, gap coverage can be a good idea.

Get the Coverage You Need

Gap coverage can be a great way to protect yourself from having to pay out of pocket if your car is totaled in an accident. But it’s important to do your research and make sure you’re getting the coverage you need at a price that fits your budget. Talk to your auto insurance provider to find out if gap coverage is included in your policy and how much it will cost if you decide to add it.

Understanding Auto Insurance “Gap Coverage“

Gap Insurance For Cars Is It Worth It - Is Car GAP Insurance Worth It

What Is Gap Insurance? - Lexington Law

How Does Gap Insurance Work? | RamseySolutions.com

Car Leasing GAP Insurance - Jim Peplinski Leasing