Third Party Liability Insurance Tenncare

Wednesday, August 9, 2023

Edit

Third Party Liability Insurance Tenncare

What is Third Party Liability Insurance Tenncare?

Third Party Liability Insurance Tenncare (TPL) is a type of insurance that covers the cost of medical care for TennCare members who have been injured due to the negligence of another party. This type of insurance is typically required for TennCare members who are injured in motor vehicle accidents, workers' compensation claims, and slip and fall accidents. It is also commonly used for medical malpractice claims. TPL is an important protection for TennCare members, as it helps to ensure that they receive the medical care they need without having to pay out-of-pocket expenses.

Who is Eligible for Third Party Liability Insurance Tenncare?

All TennCare members are eligible for TPL. This includes children, adults, pregnant women, seniors, and those with disabilities. However, the coverage and benefits of TPL will vary depending on the individual's particular situation and the type of accident they were injured in. For example, those injured in motor vehicle accidents or workers' compensation claims may be eligible for more comprehensive coverage than those injured in other types of accidents.

What Does Third Party Liability Insurance Tenncare Cover?

TPL can cover a variety of medical expenses, including hospital stays, surgery, physician services, medical equipment, and physical therapy. It can also cover prescription drugs, mental health services, and other necessary treatments. In addition, TPL can cover the cost of travel to and from medical appointments and other necessary expenses related to the injury.

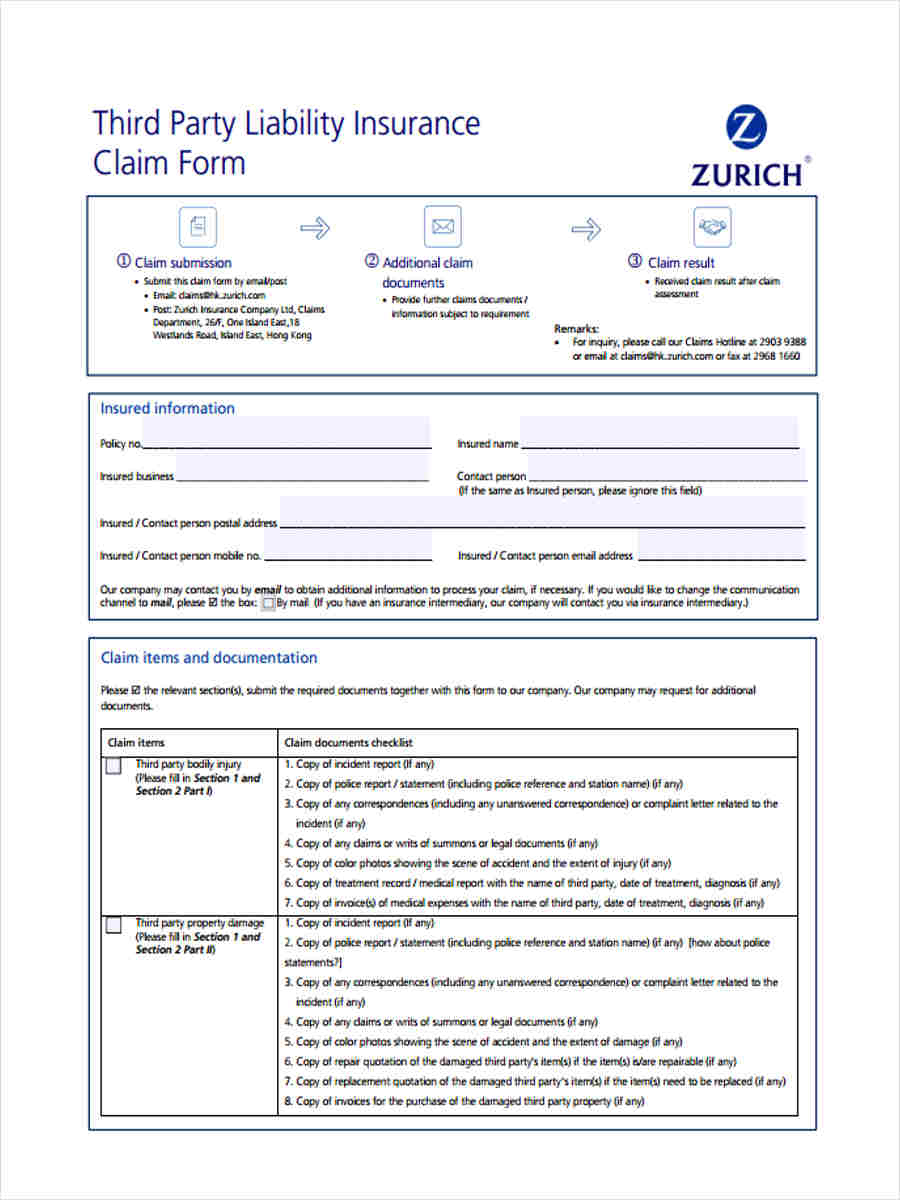

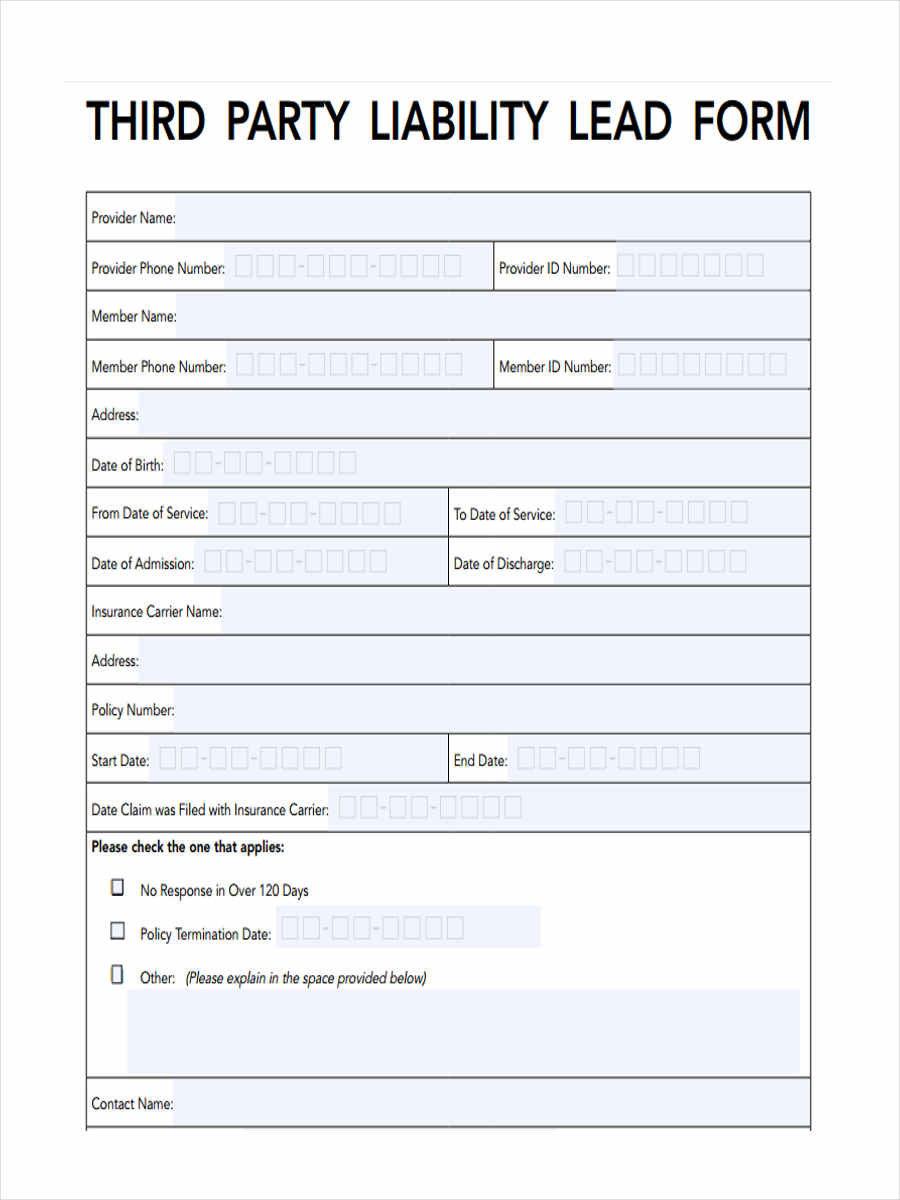

How to File a Claim for Third Party Liability Insurance Tenncare?

To file a claim for TPL, TennCare members must first contact the insurance company that provided their policy. They will need to provide the necessary documentation and information, such as medical bills and evidence of the accident. Once the claim is received, the insurance company will review it and determine whether or not it is valid. If the claim is approved, the insurance company will cover the cost of the medical expenses up to the limits of the policy.

What are the Benefits of Third Party Liability Insurance Tenncare?

The main benefit of TPL is that it helps to ensure that TennCare members receive the medical care they need without having to pay out-of-pocket expenses. This can be especially beneficial for those who have been injured due to the negligence of another party, as it can help to ensure that they receive adequate medical care. In addition, TPL can also provide peace of mind by protecting the individual from financial hardship in the event of an unexpected injury.

Conclusion

Third Party Liability Insurance Tenncare is an important type of insurance for TennCare members, as it can help to ensure that they receive the medical care they need without having to pay out-of-pocket expenses. It can also provide peace of mind by protecting the individual from financial hardship in the event of an unexpected injury. To file a claim, TennCare members must contact their insurance company and provide the necessary documentation and information.

What Is Third-party Insurance?

FREE 5+ Third Party Liability Forms in MS Word | PDF

Third Party Property Car Insurance | iSelect

FREE 5+ Third Party Liability Forms in PDF

Third Party Two Wheeler Insurance Claim