State Farm Liability Car Insurance Coverage

Everything You Need to Know About State Farm Liability Car Insurance Coverage

Why You Need Liability Coverage

State Farm liability car insurance coverage is an essential protection for drivers, who must legally carry it in order to legally drive on public roads. Liability coverage helps to protect you from financial hardship in the event you are responsible for a car accident in which you cause injury or property damage to another person or their property. It covers the costs of medical bills and repairs for the other party, and can even provide legal representation in the event of a lawsuit.

What Does Liability Coverage Include?

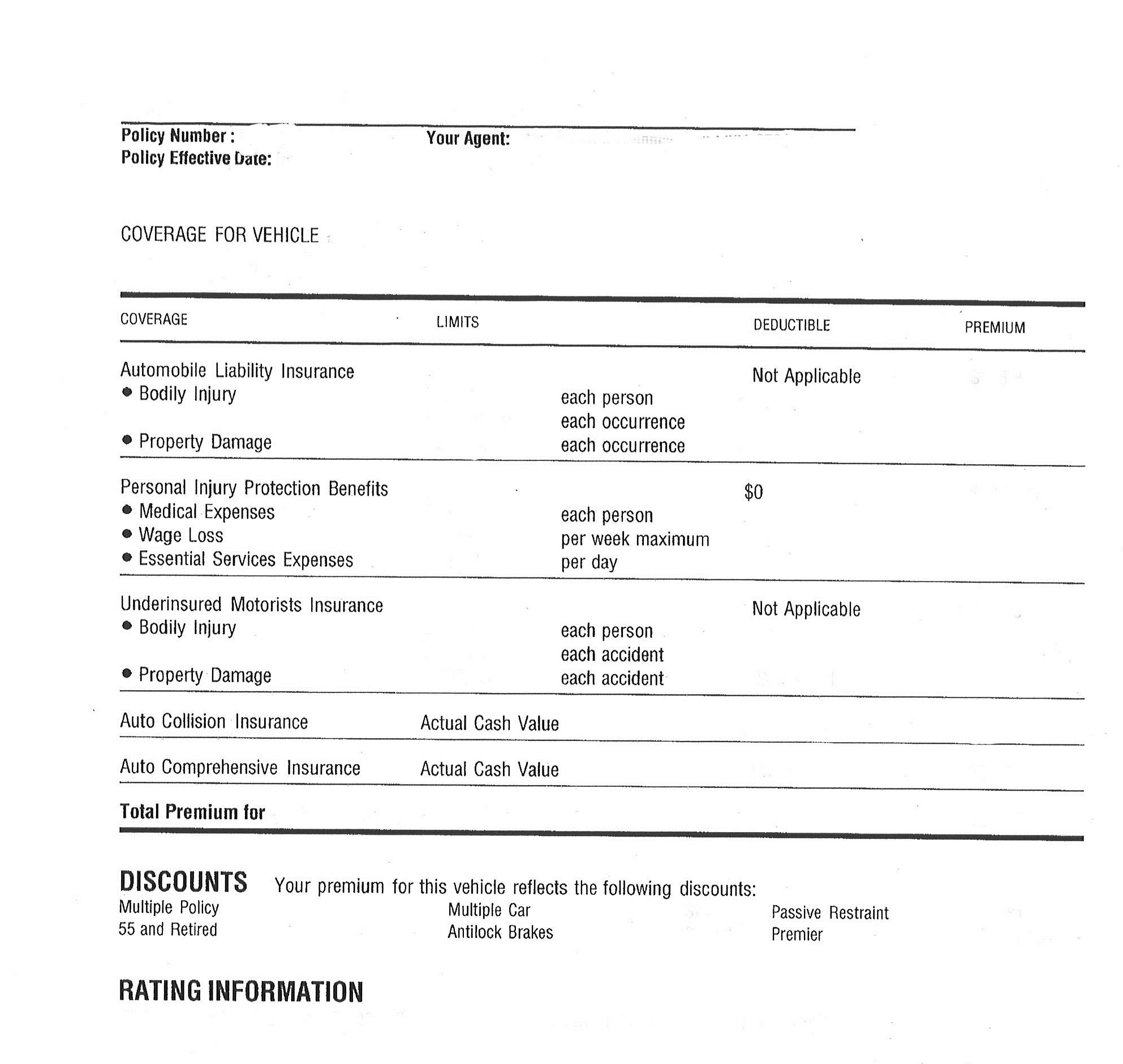

State Farm liability car insurance coverage typically includes two types of coverage: bodily injury liability, which covers medical bills and expenses for the other person if you are responsible for the accident; and property damage liability, which covers repairs for the other party's car and property if you cause the accident. Depending on the state you live in, you may also be required to carry uninsured/underinsured motorist coverage and/or personal injury protection (PIP) coverage.

How Much Liability Coverage Do I Need?

The amount of liability coverage you need depends on the state you live in, as some states have minimum coverage requirements. Generally, it’s a good idea to carry more than the minimum required coverage, as the cost of medical bills and car repairs can quickly exceed the limits of the minimum coverage. State Farm provides a range of liability coverage options to choose from, allowing you to customize your coverage to fit your needs and budget.

What if I'm Involved in an Accident?

If you are involved in an accident, the first thing you should do is call the police and report the accident. You should also exchange information with the other driver, and take pictures of the scene and any damage to the vehicles. Be sure to also contact your insurance agent to report the accident and start the claims process. State Farm representatives are available 24/7 to answer your questions and help you through the process.

Why Choose State Farm?

State Farm is one of the nation’s leading providers of car insurance, offering a wide range of coverage options designed to meet your needs. With its network of agents, State Farm makes it easy to find the right policy for you. Plus, its 24/7 customer service team is available to answer any questions you may have and help you through the claims process.

Get the Right Coverage for You

When it comes to liability car insurance coverage, State Farm has you covered. Its range of coverage options makes it easy to find the right policy for your needs, and its 24/7 customer service team is always available to answer any questions you may have. So if you’re in the market for car insurance, be sure to check out what State Farm has to offer.

How Does State Farm Rideshare Insurance Work?

State Farm Car Insurance PDF | Corporate Law | Insurance

What is a Responsible Amount of Liability Coverage on My Auto Insurance

State Farm Auto Insurance Declaration Page

State Farm General Liability Insurance For Contractors - blog.pricespin.net