How Much Is Insurance On A Gmc Terrain

How Much Is Insurance On A GMC Terrain?

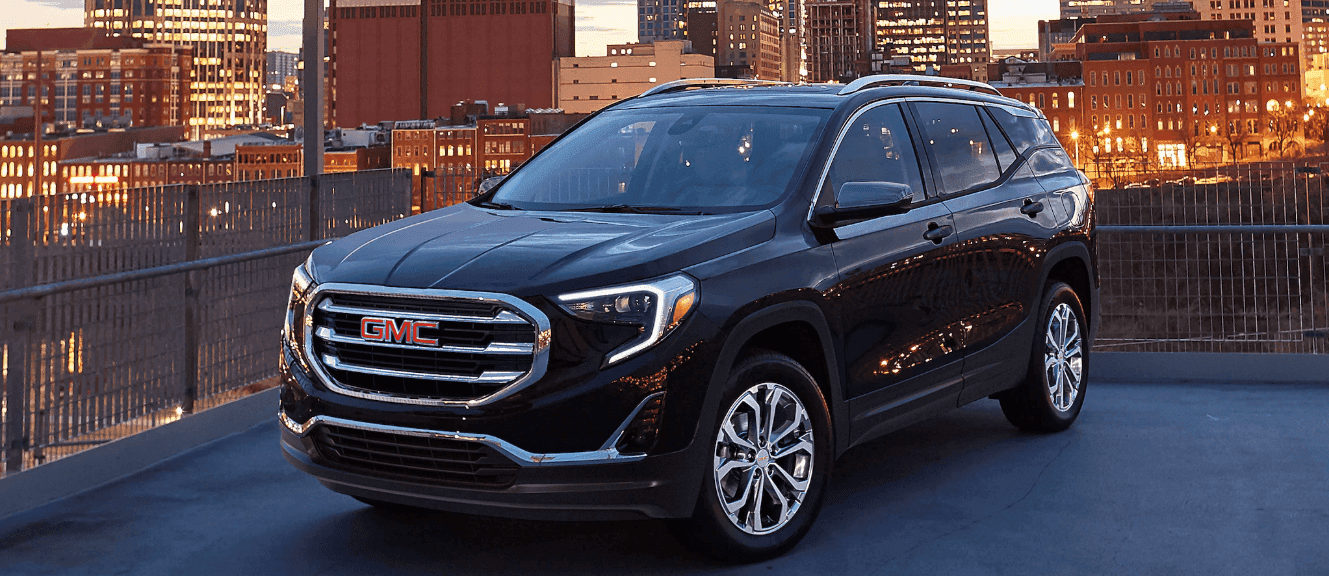

Overview of GMC Terrain

GMC Terrain is a small SUV produced by General Motors. It is designed to be a smaller, more fuel-efficient alternative to the larger GMC Acadia. It comes with a variety of engine options, including a 2.4-liter four-cylinder and a 3.6-liter V6. It also offers a variety of features, including a rearview camera, a power liftgate, and a sunroof. It is a great option for those looking for a smaller SUV with a lot of features and excellent fuel economy.

Factors That Affect Insurance Cost

The cost of insurance for a GMC Terrain can vary greatly depending on several factors, including the driver's age, driving record, and location. In general, younger, inexperienced drivers, and drivers with a poor driving record will pay more for insurance than those with a clean driving record and more experience. The cost of insurance can also vary based on the type of coverage chosen, the deductible, and the vehicle's safety features.

Average Cost of Insurance

The average cost of insurance for a GMC Terrain depends on the factors mentioned above. However, it is generally cheaper to insure than larger SUVs. According to ValuePenguin, the average cost of insuring a GMC Terrain is $1,314 per year. This is significantly lower than the average cost of insuring a GMC Yukon, which is $1,819 per year.

Tips for Lowering Insurance Costs

There are several things that drivers can do to lower their insurance costs. First, drivers should make sure to shop around and compare rates from different insurance companies. It is also important to maintain a safe driving record and to take advantage of any available discounts. Additionally, drivers can opt for higher deductibles and less comprehensive coverage to reduce their insurance costs.

Conclusion

The cost of insurance for a GMC Terrain can vary greatly depending on the driver's age, driving record, and location. On average, the cost of insurance for a GMC Terrain is lower than larger SUVs. There are several steps drivers can take to lower their insurance costs, such as shopping around for the best rate, maintaining a safe driving record, and taking advantage of any available discounts.

How Much Does GMC Terrain Car Insurance Cost? | Finder Canada

GMC Terrain Insurance Quotes in Aurora, CO

GMC Terrain 2016 llega a México desde $415,500 pesos - Autocosmos.com

2020 GMC Terrain Towing Capacity | Payload, Cargo Space | Chevrolet

GMC Terrain specs - 2016, 2017 - autoevolution