How Does Turo Insurance Work For Renter Reddit

What is Turo Insurance and How Does it Work for Renters?

Turo is one of the most popular car-sharing services, allowing drivers to rent cars from other drivers. By connecting drivers with renters, Turo has made it easier than ever for drivers to find a vehicle that suits their needs. But what about insurance? Does Turo provide insurance, and if so, how exactly does it work?

Turo offers insurance coverage to drivers and renters. This coverage is provided through the company's partner, Liberty Mutual. When renting a vehicle through Turo, drivers and renters have the option to purchase insurance coverage. This coverage includes liability, physical damage, and personal accident coverage. The coverage is customizable and based on the type of vehicle being rented and the level of coverage needed.

What Does Turo Insurance Cover?

Turo insurance provides renters and drivers with a range of coverage options. Depending on the type of vehicle being rented, the coverage can include liability, physical damage, and personal accident coverage. Liability coverage covers third-party damages and injuries caused by the driver of the rental vehicle. Physical damage coverage covers damages to the rental vehicle, including theft and vandalism. Personal accident coverage provides coverage for medical expenses, legal expenses, and lost wages resulting from an accident involving the rental vehicle.

What Does Turo Insurance Not Cover?

Turo insurance does not cover any damages caused by the driver to other vehicles or property. It also does not cover any damages caused by the driver while they are under the influence of drugs or alcohol. Additionally, it does not cover any damages caused by the driver that are not related to the rental vehicle, such as damages to personal items. Finally, it does not cover any damages caused by a third-party while the vehicle is being rented.

How Much Does Turo Insurance Cost?

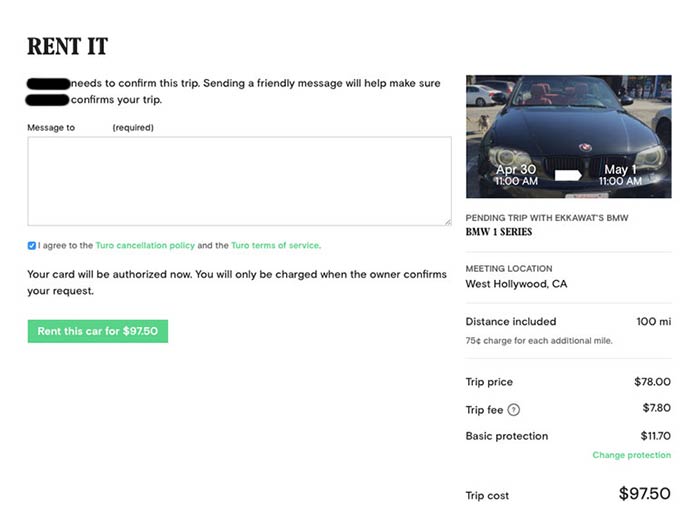

The cost of Turo insurance varies based on the type of vehicle being rented and the level of coverage purchased. Generally, the cost of Turo insurance ranges from $20 to $30 per day. The cost of the insurance is added to the total cost of the rental. It is important to note that Turo insurance does not cover all damages and that renters should always check their own insurance to make sure they are adequately covered.

What Do Renters Need to Know About Turo Insurance?

Renters should always read the Turo insurance policy thoroughly before renting a vehicle. It is important to note that coverage may vary depending on the type of vehicle being rented and the level of coverage purchased. Additionally, renters should always check their own insurance policy to make sure they have adequate coverage in case of an accident. Finally, renters should always remember that Turo insurance does not cover all damages and that they should always be aware of their own insurance coverage.

Everything You Need to Know About Using Turo - Part 2 - ECI Insurance

Turo Insurance Reddit / Car Sharing Company Turo Comes To B C Vancouver

Turo, the 'Airbnb for cars,' could upend the car-rental industry

HOW TURO INSURANCE WORKS/ HOW I PROTECT MY RENTAL ASSETS - YouTube

17+ Best Money Making Apps For Fast Cash in 2023 (Ranked)