Home And Contents Insurance Quote Coles

Sunday, August 6, 2023

Edit

Home And Contents Insurance Quote Coles

What is Home and Contents Insurance?

Home and Contents Insurance protects your home and possessions from damage caused by fire, storms, theft and other disasters. It also covers the cost of temporary accommodation if you have to move out of your home while it is repaired. It is important to have adequate insurance to protect your home and belongings, as your home is likely to be the most expensive asset you own.

A Home and Contents Insurance policy covers the building and contents of your home. The building portion covers the physical structure of your home, including the walls, ceiling, floors and fixtures. The contents portion covers your possessions, including furniture, appliances, electronics, clothing and other personal items.

Why You Need Home and Contents Insurance?

Home and Contents Insurance provides financial protection against loss or damage to your home and possessions. Without adequate insurance, you could be left to pay for repairs and replacements out of pocket, which could be costly.

In addition to protecting your home and possessions, Home and Contents Insurance can also provide liability coverage. This means that if someone is injured or their property is damaged while on your property, you won't be held financially responsible for the damages.

What is Covered by Home and Contents Insurance?

Home and Contents Insurance covers damage to the building and contents of your home, as well as the cost of temporary accommodation if you have to move out while repairs are being made. It also covers your possessions against theft, fire, storms and other disasters. Some policies may also include additional benefits such as accidental damage and public liability protection.

It is important to read the policy wording carefully to ensure you understand what is covered and what is not. Some policies may include exclusions, such as floods and earthquakes, so it is important to be aware of these before you purchase a policy.

How Much Does Home and Contents Insurance Cost?

The cost of Home and Contents Insurance will depend on several factors, such as the size and value of your home, the level of cover you choose and the amount of excess you are willing to pay. It is important to compare policies from different insurers to ensure you are getting the best value for money.

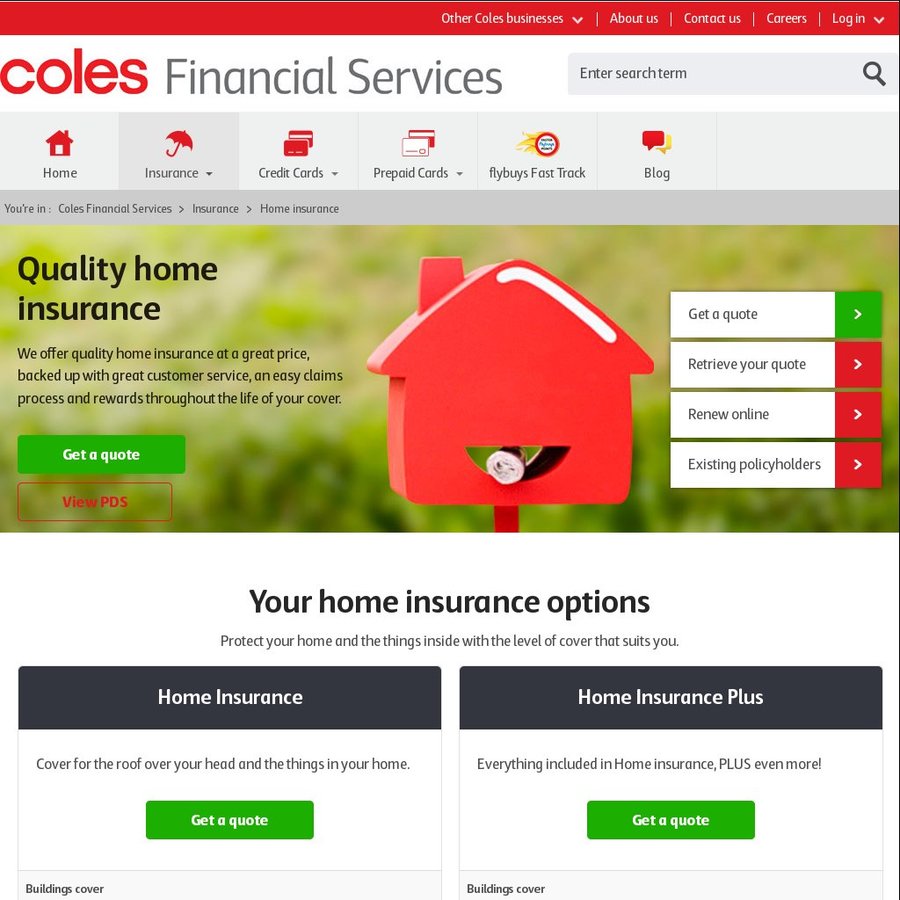

Coles Home and Contents Insurance is a popular option for Australians. Coles offers a range of comprehensive policies, with competitive premiums and a range of additional benefits. Coles also offers a 5% discount when you purchase a combined Home and Contents policy, so you can save money by bundling your insurance.

How to Get a Home and Contents Insurance Quote?

Getting a Home and Contents Insurance quote from Coles is easy. Simply visit the Coles website and fill out the online form. You will need to provide information about your home, such as the address, size and value, and details about the cover you require.

Once you have provided the required information, you will receive a quote for your Home and Contents Insurance policy. You can then compare the quote with other insurers to ensure you are getting the best deal.

Conclusion

Home and Contents Insurance is an important form of financial protection for your home and possessions. Coles Home and Contents Insurance provides comprehensive cover, with competitive premiums and a range of additional benefits. Getting a quote is easy, so it is important to take the time to compare different policies to ensure you are getting the best value for money.

Home Contents Insurance: Coles Home Contents Insurance

Coles: 35% off When You Buy Coles Home and Contents Insurance or 20%

Home contents insurance – MAKE SURE YOU’RE COVERED! – LBHF Get Involved

Household Contents Insurance Policy On A Desk Stock Photo - Download

House And Contents Insurance Quote Comparison at Listings