Cheapest Insurance For Young Drivers

Cheapest Insurance For Young Drivers

Why Is Insurance Expensive For Young Drivers?

Young drivers often face expensive insurance premiums. This is because young drivers are considered a higher risk for insurers. Statistics show that young drivers are more likely to be involved in an accident or to have a conviction for a motoring offence. As a result, insurers increase their premiums to cover the cost of any claims.

Insurers also consider the type of car a young driver is likely to drive. High performance or modified cars are likely to cost much more to insure than a small, low performance car. This is because it is more expensive to repair or replace a high performance car should it be damaged in an accident.

How to Get Cheaper Insurance For Young Drivers

The best way to get cheaper insurance for young drivers is to shop around. Different insurers will have different premiums, so it’s worth getting quotes from a few different companies. Additionally, some insurers offer discounts for young drivers who have completed an approved driving course.

It can also be beneficial to add an older, more experienced driver to the policy. Adding a more experienced driver to the policy can help to reduce the cost of the premium, as the experienced driver will be seen as a lower risk by the insurer.

Types of Insurance for Young Drivers

There are several types of insurance available for young drivers:

Third-Party Insurance

Third-party insurance offers the most basic level of cover. It covers the cost of any damage caused to another person’s vehicle or property, but will not cover the cost of any damage to the policy holder’s car.

Third-Party, Fire & Theft Insurance

This type of insurance offers the same level of cover as third-party insurance, but also covers the cost of any damage caused by fire or theft. It does not cover the cost of damage caused to the policy holder’s car in an accident.

Fully Comprehensive Insurance

Fully comprehensive insurance offers the highest level of cover. It covers the cost of any damage caused to the policy holder’s car, as well as any damage caused to another person’s vehicle or property. It also includes cover for fire and theft.

Conclusion

Young drivers often face expensive insurance premiums, but there are ways to reduce the cost. Shopping around and comparing quotes from different insurers is the best way to get cheaper insurance for young drivers. Additionally, adding an experienced driver to the policy can help to reduce the cost. There are several types of insurance available for young drivers, ranging from basic third-party cover to fully comprehensive cover.

What Is The Cheapest Car Insurance For Young Drivers

Cheap car insurance for young drivers

How To Get Cheap Car Insurance First Time Driver - Young Drivers Car

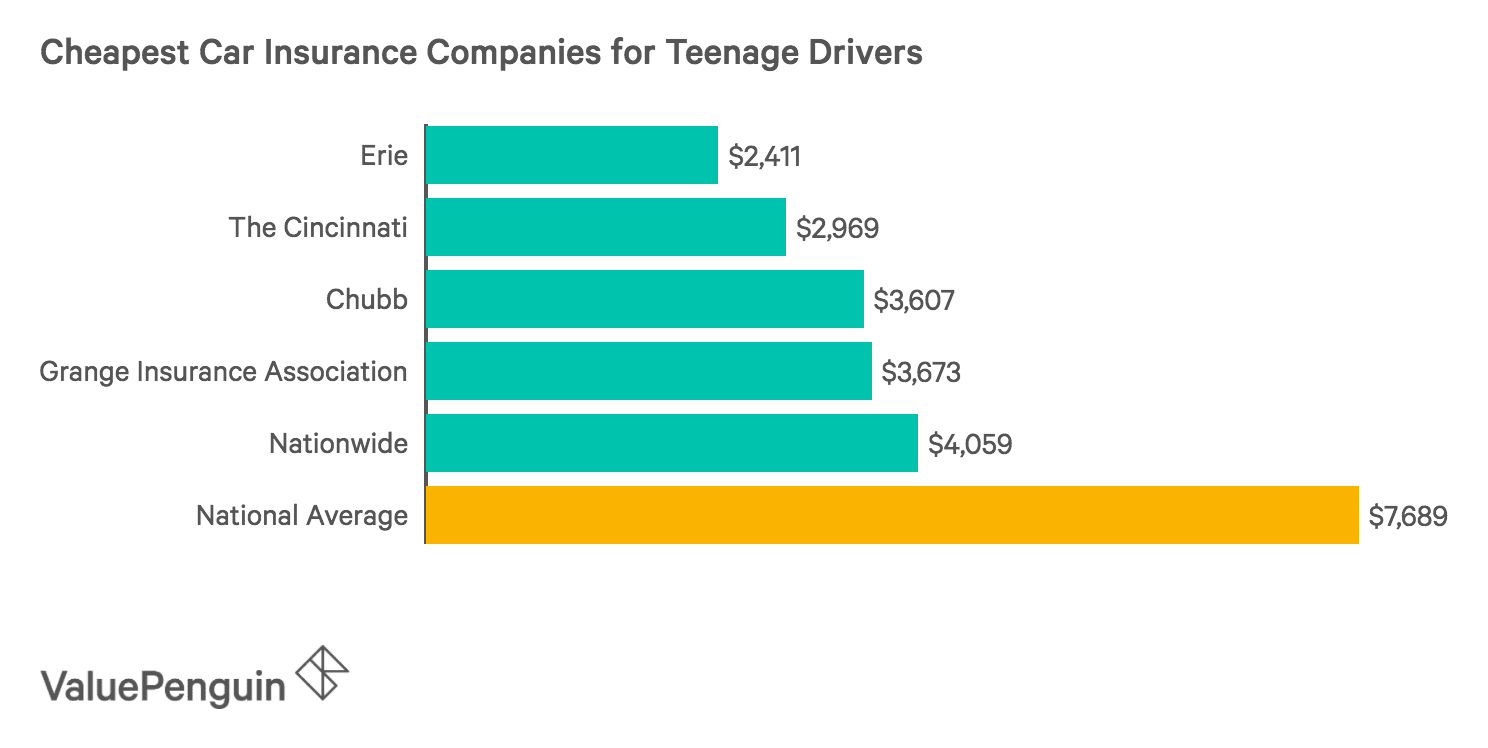

Best Car Insurance For Teen Drivers - ValuePenguin

Cheap car insurance for young drivers