Cheap Car Insurance For Full Coverage

Cheap Car Insurance For Full Coverage

Introduction

Getting car insurance is an important decision that every driver must make. It's essential to have some kind of coverage in case of an accident or other emergency. However, car insurance can be expensive. Fortunately, there are ways to get cheap car insurance for those who need full coverage. In this article, we'll discuss the different types of car insurance and the best ways to get cheap car insurance for full coverage.

Types of Car Insurance

The first step in getting cheap car insurance for full coverage is to understand the different types of coverage available. The most common types of car insurance are liability, comprehensive, collision, and personal injury protection. Liability insurance covers damages that you cause to other people's property. Comprehensive insurance covers damages to your own vehicle caused by events like theft, fire, and floods. Collision insurance covers repairs to your car if you're in an accident. Finally, personal injury protection covers medical costs if you or your passengers are injured in an accident.

Shopping Around

Once you understand the different types of car insurance, the next step is to shop around for the best rates. Compare rates from multiple insurance companies to make sure you're getting the best deal. It's also important to read the fine print on the policy to make sure you understand what you're buying. Pay special attention to the deductible amounts and coverage limits to make sure you're getting the coverage you need.

Discounts

Another way to get cheap car insurance for full coverage is to take advantage of any discounts available. Many insurance companies offer discounts for things like having a good driving record, being a student, or having multiple cars insured with the same company. Ask your insurance agent about any discounts that may be available to you.

Raise the Deductible

Raising your deductible is one of the most effective ways to get cheap car insurance for full coverage. The deductible is the amount of money you must pay out of pocket before the insurance company will pay out. Increasing the deductible means you'll have to pay more out of pocket in the event of an accident, but it also means you'll get a lower monthly premium. This can be a great way to save money on car insurance if you're willing to take on a bit more risk.

Consider Usage-Based Insurance

Finally, consider looking into usage-based insurance. This type of insurance is based on how often you drive and how you drive. Many insurance companies offer discounts to drivers who use their cars sparingly and drive safely. This type of insurance can be a great way to save money on car insurance if you don't drive often.

Conclusion

Getting cheap car insurance for full coverage is possible if you know how to shop around. Consider the different types of coverage available, shop around for the best rates, take advantage of any discounts available, and consider raising your deductible or looking into usage-based insurance. With a bit of research and effort, you can find the best car insurance for your needs.

PPT - Cheap Full Coverage Car Insurance For All People PowerPoint

How to Get Cheap Full Coverage Auto Insurance Plan by Helvin Hills - Issuu

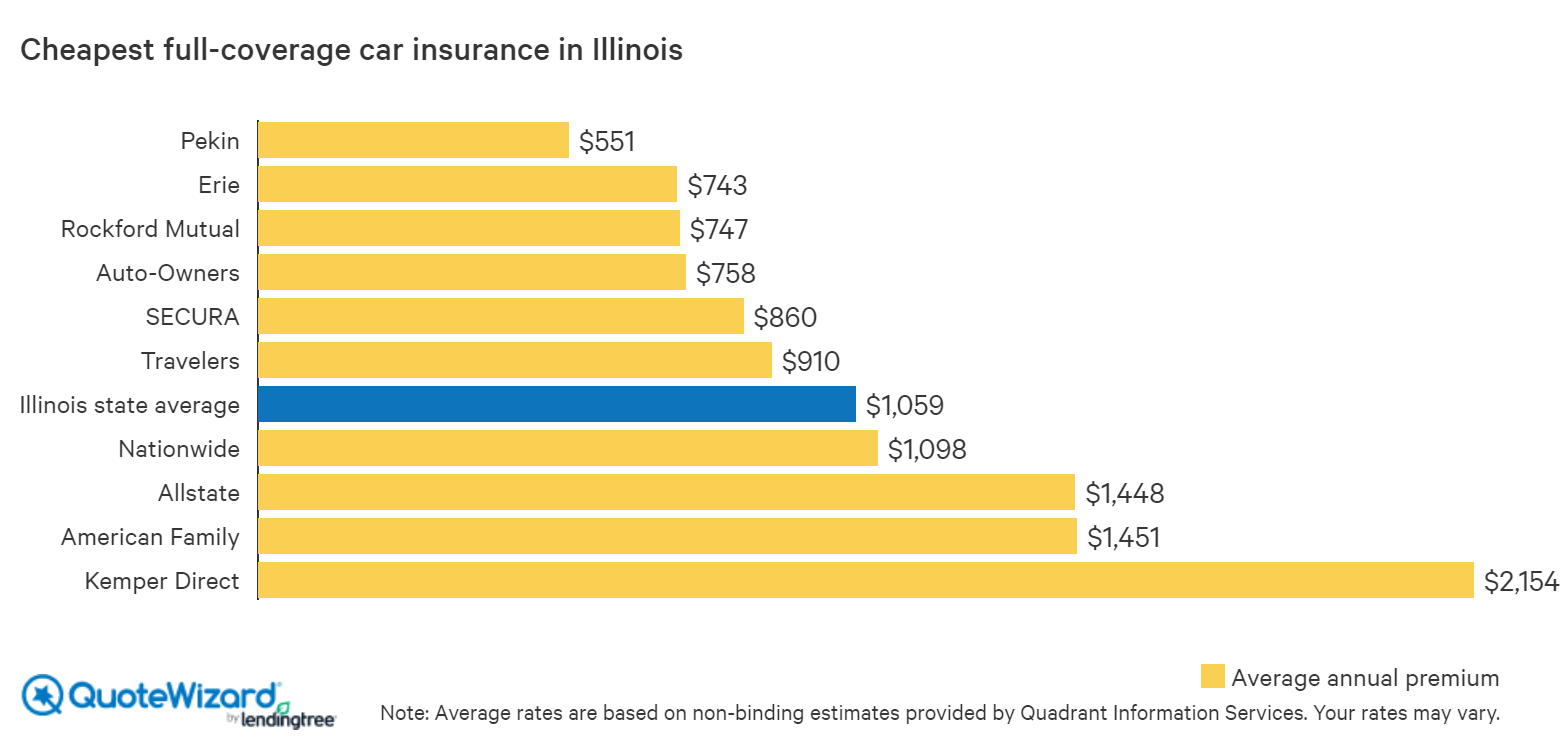

Find Cheap Car Insurance in Illinois | QuoteWizard

California Cheap Car Insurance Quote With Full Coverage

PPT - Cheap full coverage auto insurance PowerPoint Presentation, free