Car Rental Liability Insurance Coverage

What Is Car Rental Liability Insurance Coverage?

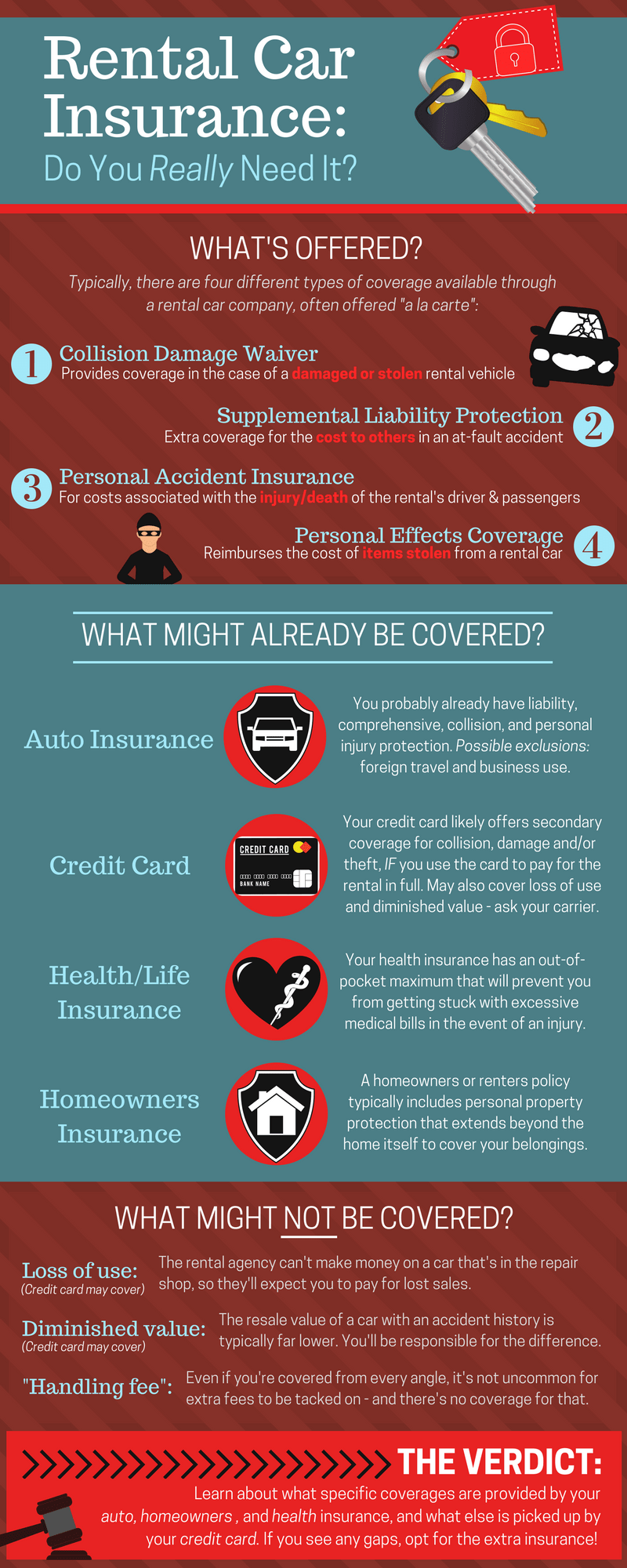

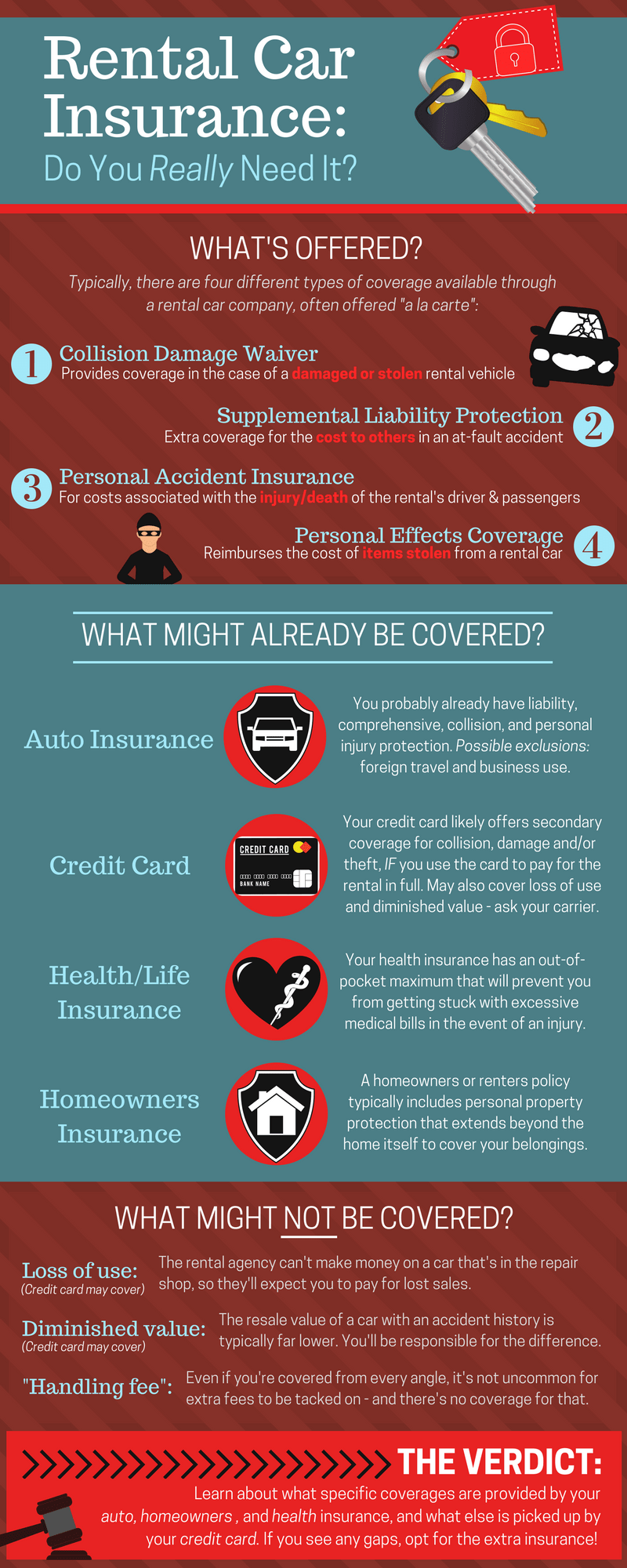

Car rental liability insurance coverage is a type of insurance that covers the cost of property damage and/or bodily injury that you may be responsible for in the event of an accident. It’s an important form of protection for those who rent vehicles on a regular basis, as it can help protect them financially if they’re found liable for an accident. In many cases, rental liability insurance is already included in the rental agreement, though it may also be offered as an optional add-on. It’s important to understand what this type of coverage entails before agreeing to it.

What Does Car Rental Liability Insurance Cover?

Car rental liability insurance coverage typically covers the cost of property damage and/or bodily injury caused by the rental vehicle. This means that if you’re in an accident and the other party sues you for damages, the insurance policy may help you cover the cost of their injuries or repair their car. It’s important to note that this type of coverage is limited in scope and typically won’t cover your own medical bills or repair costs. It’s also important to note that this type of coverage typically won’t cover the cost of damage to the rental vehicle itself.

Who Should Get Car Rental Liability Insurance?

Anyone who rents a car on a regular basis should consider getting car rental liability insurance coverage. This type of coverage can be a lifesaver if you’re ever found liable for damages in an accident. Additionally, some rental companies may require you to have this type of coverage before they’ll rent you a vehicle. It’s important to read the rental agreement carefully and make sure you understand the terms of the rental before signing anything.

How Much Does Car Rental Liability Insurance Cost?

The cost of car rental liability insurance coverage varies depending on the type of coverage you choose and the amount of coverage you need. Generally speaking, the more coverage you buy, the higher your premium will be. Additionally, some rental companies may offer discounts if you purchase the coverage through them. It’s important to shop around and compare rates to make sure you’re getting the best deal.

What Should You Consider When Choosing Car Rental Liability Insurance?

When shopping for car rental liability insurance coverage, it’s important to consider the type of coverage you need and the amount of coverage you’re comfortable with. Additionally, you should consider the rental company’s reputation and read the fine print of the policy carefully to make sure you understand the terms of the coverage. Lastly, make sure you understand the limits of the coverage and what it does and does not cover.

Conclusion

Car rental liability insurance coverage can be an important form of protection for those who rent vehicles on a regular basis. It’s important to understand what this type of coverage entails and make sure you’re getting the right amount of coverage for your needs. Shop around and compare rates to make sure you’re getting the best deal and read the fine print carefully to make sure you understand the terms of the coverage.

Car Rental Insurance: Do I Really Need It? - Crush the Road

Liability Coverage Made Easy - Direct Connect

3Rd Party Liability Insurance Rental Car - designmakegame

Auto Insurance Liability Limits: What Do The Numbers Mean? | Visual.ly

Simple, Cars and Home insurance on Pinterest