Car Insurance More Than Car Payment

Car Insurance More Than Car Payment - Here's What You Need to Know

Car insurance is an important part of owning a vehicle. Without it, you are risking a lot of potential damages and liabilities. But what if your car insurance costs more than your car payments? Is it worth it?

The answer to this question depends on a few factors. First, you need to consider the type of car you have. If it is a luxury vehicle, expensive to purchase and maintain, then it is probably worth it to pay more for the insurance. This is because the cost of repairs and liability costs could easily exceed what you are paying for the car payments. On the other hand, if you have a basic car, then you may want to consider other options.

Another factor to consider when deciding if it is worth it to pay more for car insurance is the deductibles. If you have a high deductible, then it may be worth it to pay more for the insurance. This is because you can often get a lower rate on your premiums if you are willing to pay more out of pocket in the event of an accident. This can help offset some of the cost of the insurance.

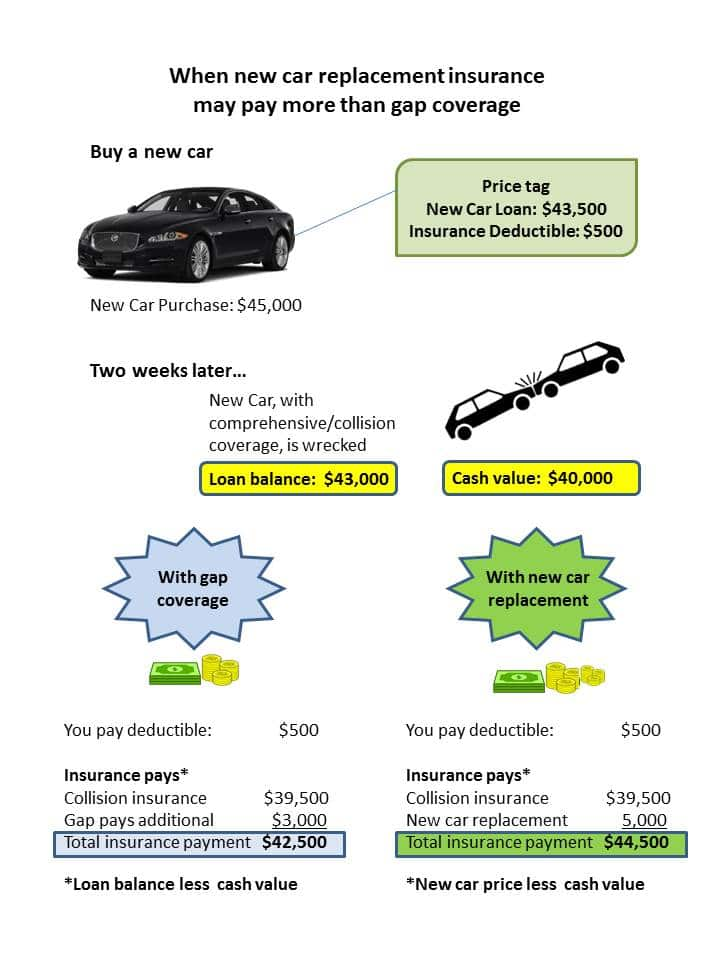

Finally, you need to consider the types of coverage you are getting with your car insurance. Comprehensive and collision coverage are important and should be included in most policies, but you may want to consider additional coverage such as rental car reimbursement or roadside assistance. This can help you in the event of an accident or other emergency.

Tips for Shopping for Car Insurance

When shopping for car insurance, it is important to compare rates from multiple insurers. This will help you get the best deal for your money. You should also consider the types of coverage you need and the deductibles you are willing to pay. It is also a good idea to ask your insurer about any discounts they may offer.

It is also important to remember that the cost of car insurance is based on a variety of factors, and these factors can change over time. Be sure to review your policy regularly and make changes if necessary. This will help ensure you are getting the best coverage for your money.

Conclusion

In conclusion, it is important to consider all of the factors involved when deciding if it is worth it to pay more for car insurance. If your car is expensive to purchase and maintain, then it may be worth it to pay more for the coverage. On the other hand, if you have a basic vehicle, then you may want to look at other options. Additionally, you should make sure to compare rates from multiple insurers and consider any discounts they may offer.

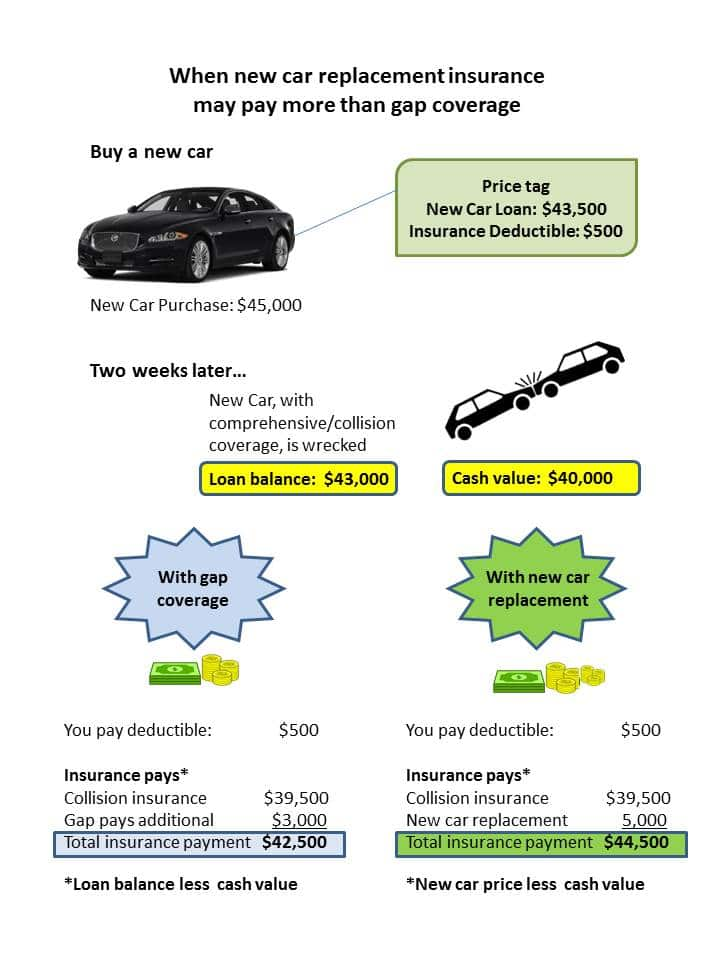

Gap Insurance for your New or Leased Cars

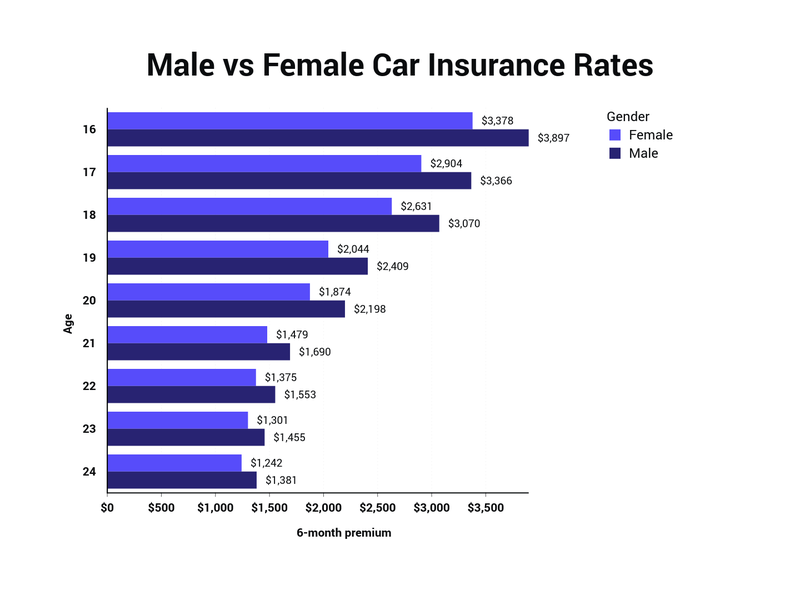

Male vs. Female Car Insurance Rates | The Zebra

Tips for Saving Money on Car Insurance - zoom blog The future of

Metlife Auto Insurance Customer Service Number : PNB METLIFE LIFE