Car Insurance By The Month

The Benefits of Paying for Car Insurance by the Month

Car insurance is an important part of owning a vehicle. It is a way to protect your assets in the event of an accident or other unforeseen event. In most cases, car insurance must be purchased and paid for in full, in advance. But there is an alternative to this traditional method of payment: pay for car insurance by the month.

Paying for car insurance by the month has some distinct advantages over making an annual payment. First, it allows you to spread the cost of coverage over a period of time, rather than having to pay a large sum upfront. This makes it easier to budget for car insurance, as it can be paid for in smaller amounts each month. This can be especially helpful for those who are on a tight budget, as it makes it easier to manage the cost of car insurance.

Another benefit of paying for car insurance by the month is that it can be more flexible than other payment methods. If your circumstances change, you can easily make adjustments to the amount you are paying each month. For example, if you experience a financial hardship or take a new job with a lower salary, you can adjust the amount you are paying for car insurance accordingly. This flexibility can be a lifesaver for those who need to manage their finances more closely.

What You Should Know Before Paying for Car Insurance by the Month

Before signing up for car insurance by the month, it’s important to understand the terms and conditions of your policy. Most car insurance companies charge extra for this type of payment plan, so it’s important to read the fine print and make sure you understand all the fees associated with this type of payment plan. Additionally, it’s important to make sure that you are able to keep up with the monthly payments. If you miss a payment, your policy could be cancelled, so it’s important to make sure you can afford the payments before signing up.

Finding the Right Car Insurance Provider

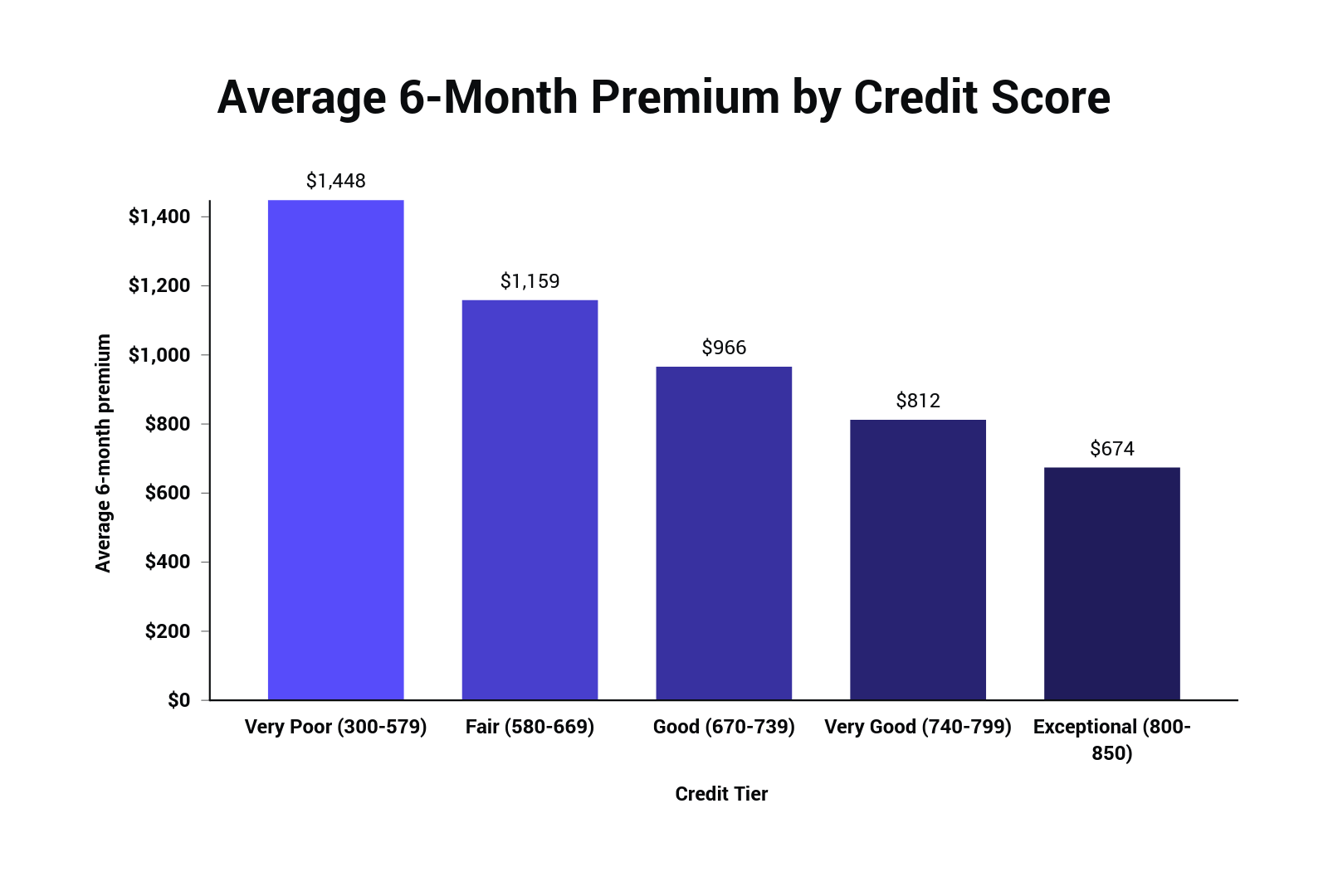

When choosing a car insurance provider, it’s important to do your research. Different companies offer different levels of coverage and different payment plans. It’s important to compare the different plans and choose the one that best suits your needs. It’s also a good idea to read customer reviews to see what other people have to say about the company and their service. Additionally, look for a company that offers discounts for certain types of drivers, such as those with a good driving record or those who have multiple cars insured through the same company.

Paying for car insurance by the month can be a great way to manage your finances and ensure that you are always covered in the event of an accident. However, it’s important to understand the terms and conditions of your policy and make sure you can afford the monthly payments. With the right car insurance provider, you can find a plan that fits your budget and provides the coverage you need.

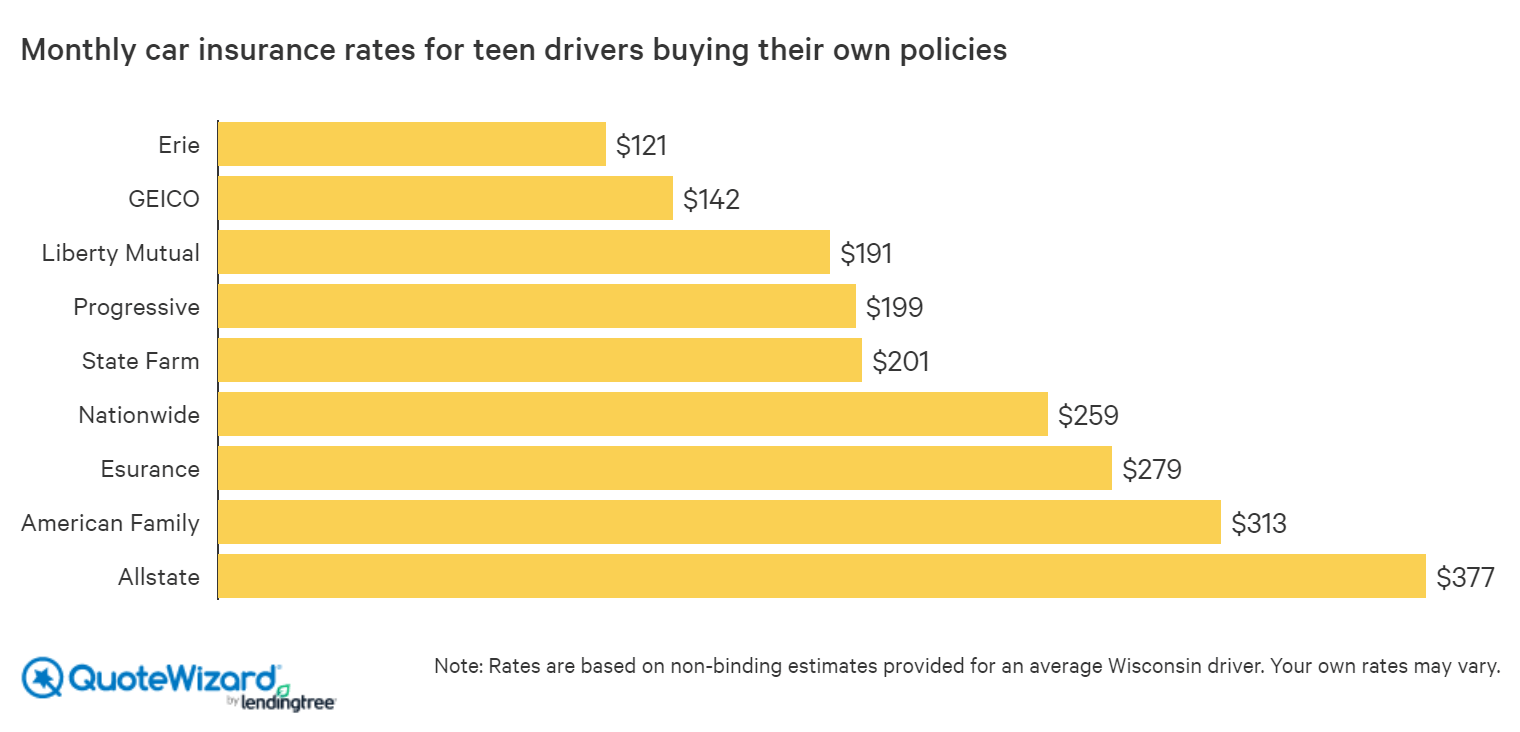

Best Car Insurance for Teens | QuoteWizard

Monthly Car Insurance Payment - Insurance Reference

How Much Is Car Insurance Per Month For A 18 Year Old ~ news word

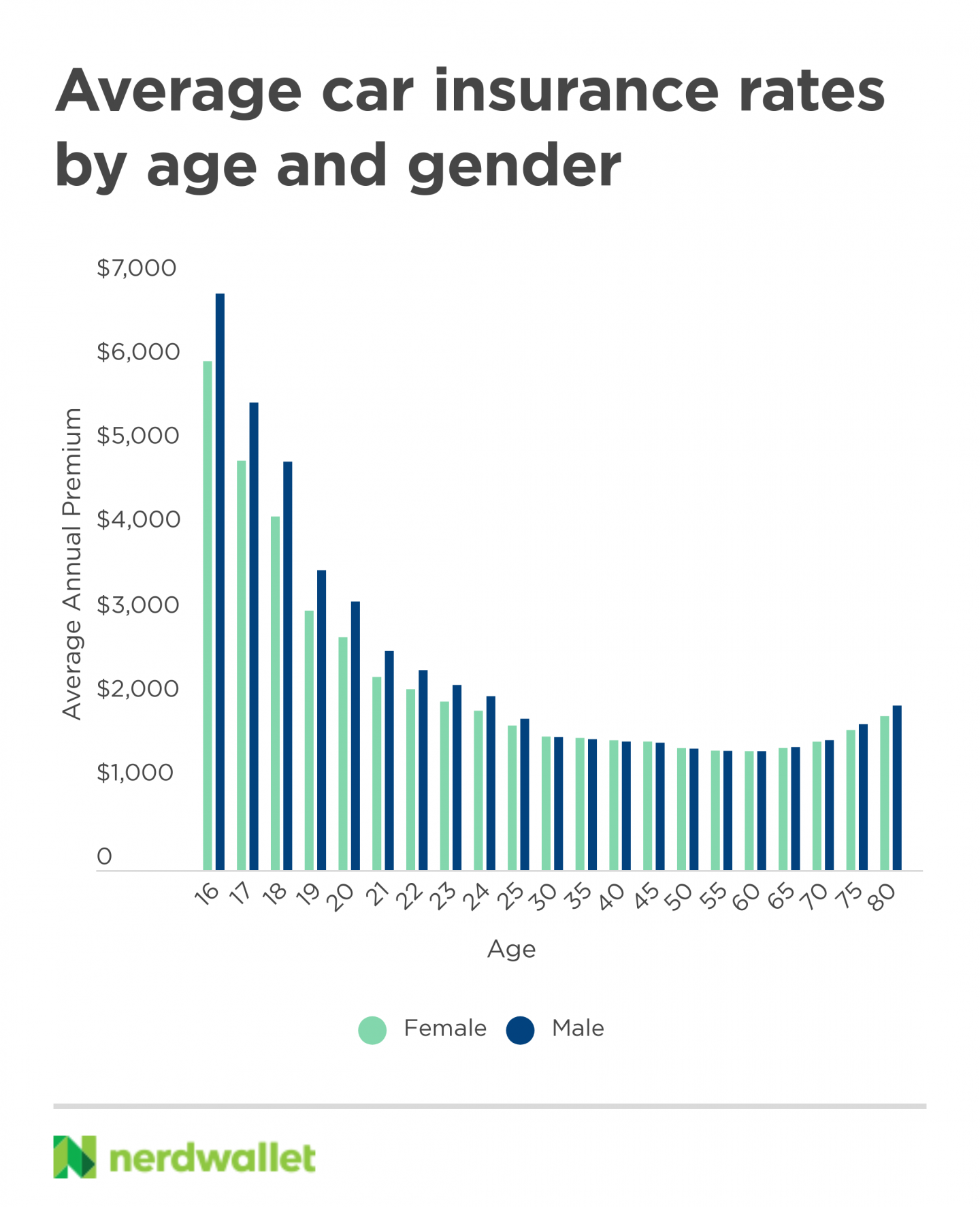

Common Automobile Insurance coverage Charges by Age and Gender