Best Auto Insurance For High Risk Drivers

Best Auto Insurance For High Risk Drivers

What Is High Risk Auto Insurance?

High risk auto insurance is a type of insurance policy that is specifically designed to meet the needs of high risk drivers. These are drivers who have been classified as such because they have been involved in a number of accidents, have multiple speeding tickets, or have been convicted of driving under the influence of alcohol or drugs. High risk auto insurance policies typically have higher premiums than standard policies, but can provide the coverage needed for these individuals to stay on the road.

Which Auto Insurance Companies Offer High Risk Insurance?

There are a number of different auto insurance companies that offer high risk insurance policies. Some of the most popular companies include Allstate, Progressive, Nationwide, and State Farm. Each of these companies offers different coverage options, so it is important to shop around and compare rates to find the best policy for your individual needs.

What Types of Coverage Are Available?

High risk auto insurance policies typically offer a wide range of coverage options. Liability coverage is usually the most important coverage to have, as it will provide protection in the event of an accident or other incident that causes injury or property damage. Optional coverage options, such as comprehensive and collision coverage, can be added to the policy as well. Comprehensive coverage will provide protection for damage caused by events other than accidents, such as theft or vandalism, while collision coverage will provide coverage for damage caused by an accident.

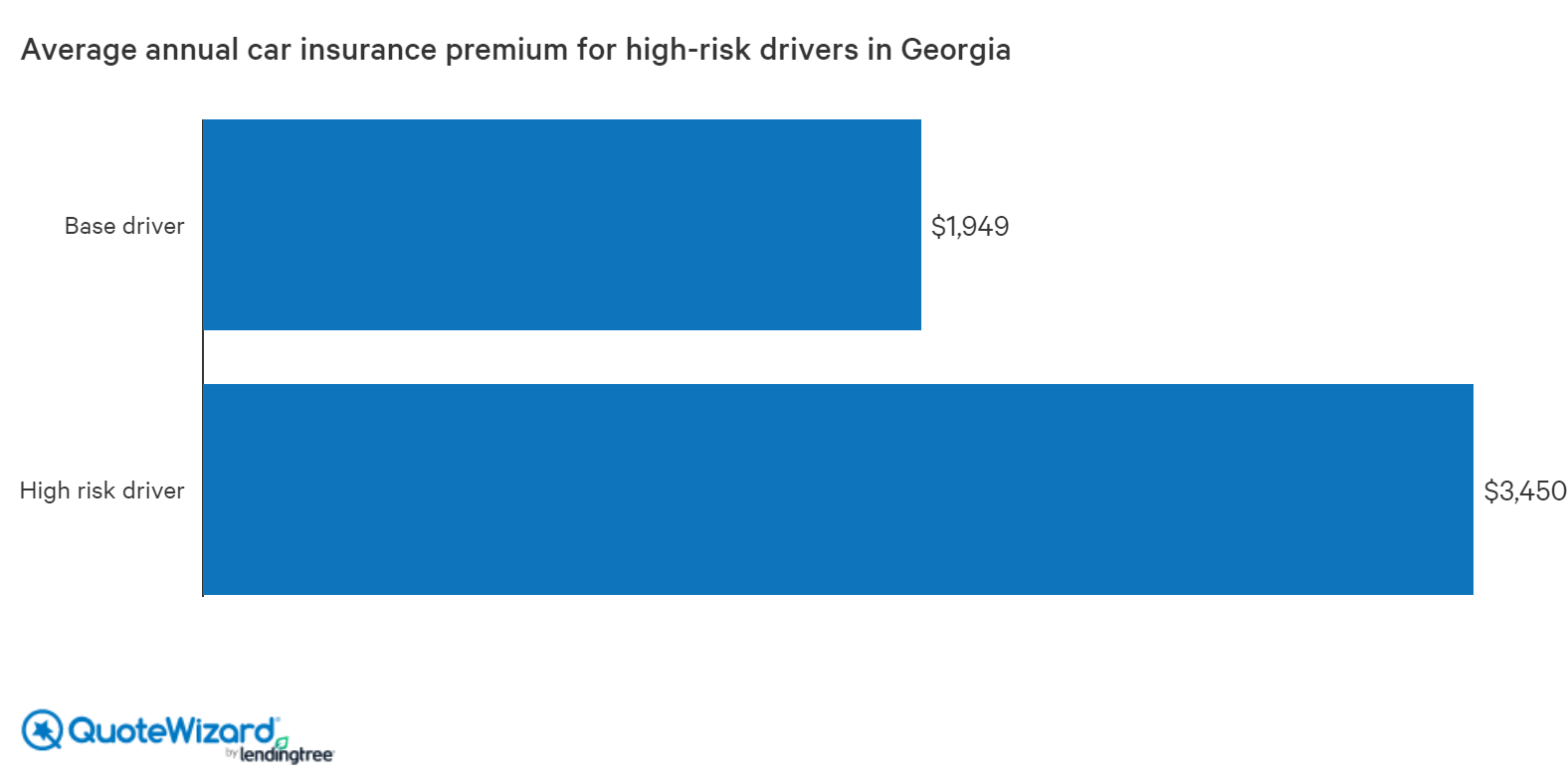

How Much Does High Risk Auto Insurance Cost?

The cost of high risk auto insurance will vary depending on the type of coverage you are looking for and the company you choose. Generally speaking, the higher the risk, the higher the premium. Some companies may also offer discounts to high risk drivers, so it is important to shop around and compare rates to find the best deal. It is also important to remember that the cost of high risk auto insurance may be higher than standard policies, but the coverage can be worth it in the long run.

What Are Some Tips For Finding the Best High Risk Auto Insurance Policy?

When looking for the best high risk auto insurance policy, it is important to shop around and compare rates. It is also important to make sure that you understand all of the coverage options offered and what each one covers. Additionally, it is important to read the policy carefully to make sure that you are getting the coverage you need. Finally, remember that the cost of high risk auto insurance may be higher than other policies, but the coverage can be worth it in the long run if an accident or other incident occurs.

The Best Auto Insurance for High Risk Drivers

High Risk Car Insurance: Best Insurance for High-Risk Drivers in 2020

Everything You Need to Know About High-Risk Car Insurance

Best Cheap Car Insurance for High-Risk Drivers - ValuePenguin

Finding Cheap Car Insurance in Georgia | QuoteWizard