Third Party Liability Insurance California

Saturday, July 22, 2023

Edit

Understanding Third Party Liability Insurance in California

It’s important to understand the third party liability insurance in California. It’s likely that you’ll need at least some coverage to protect you and your assets in the event of an accident or injury. Knowing the specifics of third party liability insurance can help you make an informed decision when it comes to selecting the right policy for your needs.

What is Third Party Liability Insurance?

Third party liability insurance is a type of coverage that provides protection for you, as the policyholder, in the event that you are found to be at fault for an accident or injury that has caused harm to another person or their property. This type of coverage typically pays for the legal costs associated with defending you in the event of a lawsuit, as well as any damages that you may be found liable for.

What Does Third Party Liability Insurance Cover?

Third party liability insurance covers damages that you may be liable for in the event of an accident or injury. This includes medical expenses, lost wages, pain and suffering, property damage, and legal fees. Depending on the policy and the circumstances of the accident or injury, the coverage limits may vary. It’s important to understand the terms of your policy so you know what types of damages are covered.

Do I Need Third Party Liability Insurance?

In California, it’s required by law that you carry at least some type of third party liability insurance. This is to protect yourself and others from any financial losses that might be incurred in the event of an accident or injury. If you are found to be at fault, you may be held liable for the damages and thus need coverage to protect you.

How Much Third Party Liability Insurance Do I Need?

The amount of third party liability insurance you need will depend on the type of policy you have and the specific circumstances of the accident or injury. In general, it’s a good idea to have enough coverage to protect yourself and your assets in the event of an accident or injury.

Finding the Right Third Party Liability Insurance in California

It’s important to shop around and compare policies when looking for the right third party liability insurance in California. Make sure you understand the coverage limits and any exclusions or restrictions that may apply. It’s also a good idea to work with an experienced insurance agent who can help you find the right policy for your needs.

When it comes to third party liability insurance in California, it’s important to understand what you’re getting and how it can protect you in the event of an accident or injury. Knowing the specifics of the coverage and shopping around for the best policy can help you make an informed decision and ensure that you’re properly protected.

How is a group insurance scheme effective? - MyAnmol Insurance

PPT - Third Party Liability PowerPoint Presentation, free download - ID

Third Party Property Car Insurance | iSelect

PPT - 3560 & Third Party Liability Data Collection in CYBER PowerPoint

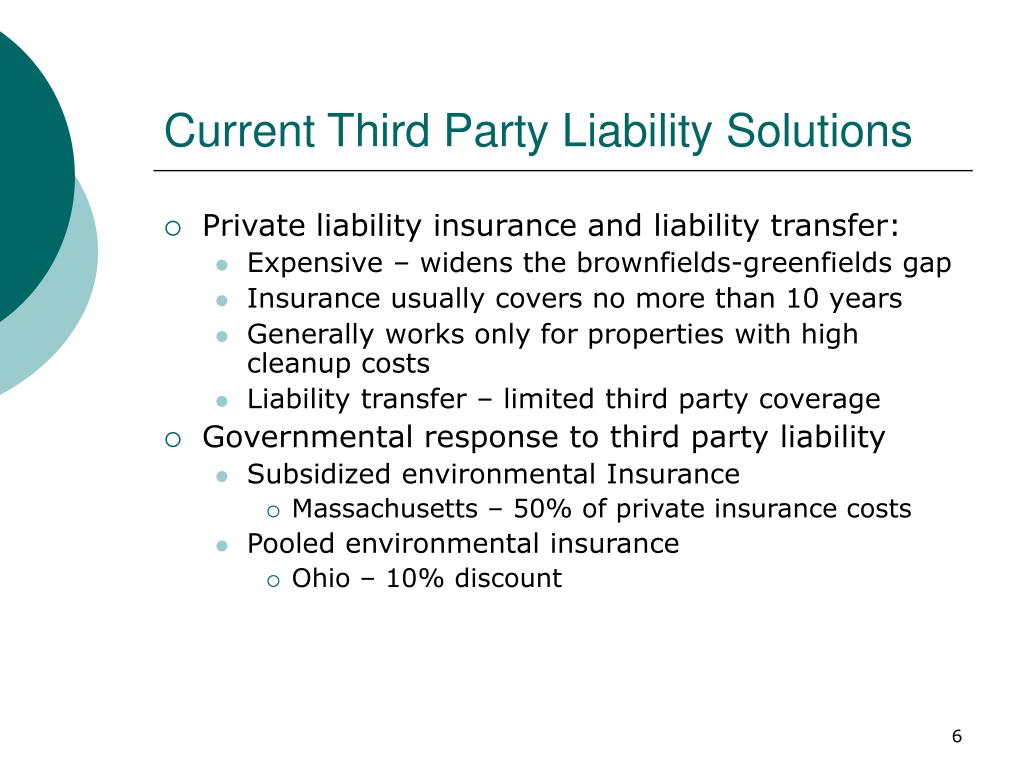

PPT - Third Party Liability Protections – The Next Wave of Brownfields