State Farm Insurance Full Coverage

What Does Full Coverage Insurance from State Farm Include?

When it comes to insurance, full coverage for individuals and businesses is an important consideration. But what does it mean, exactly, when you get full coverage from State Farm? Depending on the type of policy you choose, it can include any number of factors. Here's a breakdown of what you can expect from full coverage insurance from State Farm.

Liability Coverage

When you get full coverage from State Farm, you can expect to get liability coverage for your car, home, business, or other property. Liability coverage can help protect you financially if you are legally responsible for someone else's property damage or bodily injury. It can also provide protection if you are accused of causing an accident or causing property damage.

Liability coverage from State Farm typically includes bodily injury, property damage, and medical payments. Bodily injury coverage helps protect you from the costs of medical bills and other expenses related to an injury you cause. Property damage liability coverage helps cover the costs of repairs or replacements if you damage someone else's property. Medical payments coverage can help cover the costs of medical care for yourself and any passengers in your vehicle.

Collision Coverage

Collision coverage from State Farm is designed to help pay for repairs or replacement of your vehicle if it is damaged in an accident. This coverage can help protect you from the costs of repairs or replacements if you are at fault in an accident. It can also help protect you from the costs of repairs or replacements if you are not at fault in an accident.

Comprehensive Coverage

Comprehensive coverage from State Farm can help protect you from the costs of repairs or replacements if your vehicle is damaged in a non-collision event. This coverage can help protect you from the costs of repairs or replacements if your vehicle is damaged in an event such as fire, theft, or vandalism. It can also help protect you from the costs of repairs or replacements if your vehicle is damaged by a natural disaster such as a hurricane, tornado, or earthquake.

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist coverage from State Farm can help protect you from the costs of repairs or replacements if you are in an accident with an uninsured or underinsured driver. This coverage can help protect you from the costs of repairs or replacements if you are in an accident with a driver who does not have enough insurance coverage to pay for all of your damages.

The Benefits of Full Coverage Insurance from State Farm

Full coverage insurance from State Farm can provide you with financial protection in the event of an accident or other incident that results in damage to your property or injuries to yourself or another person. This coverage can help you to repair or replace your vehicle if it is damaged in an accident, and it can provide you with financial protection if you are at fault or if you are in an accident with an uninsured or underinsured driver. By understanding the types of coverage available with full coverage insurance from State Farm, you can make an informed decision on the best policy for you and your family.

How Does State Farm Rideshare Insurance Work?

We are State Farm. #statefarm #tomluscombe #likeagoodneighbor | State

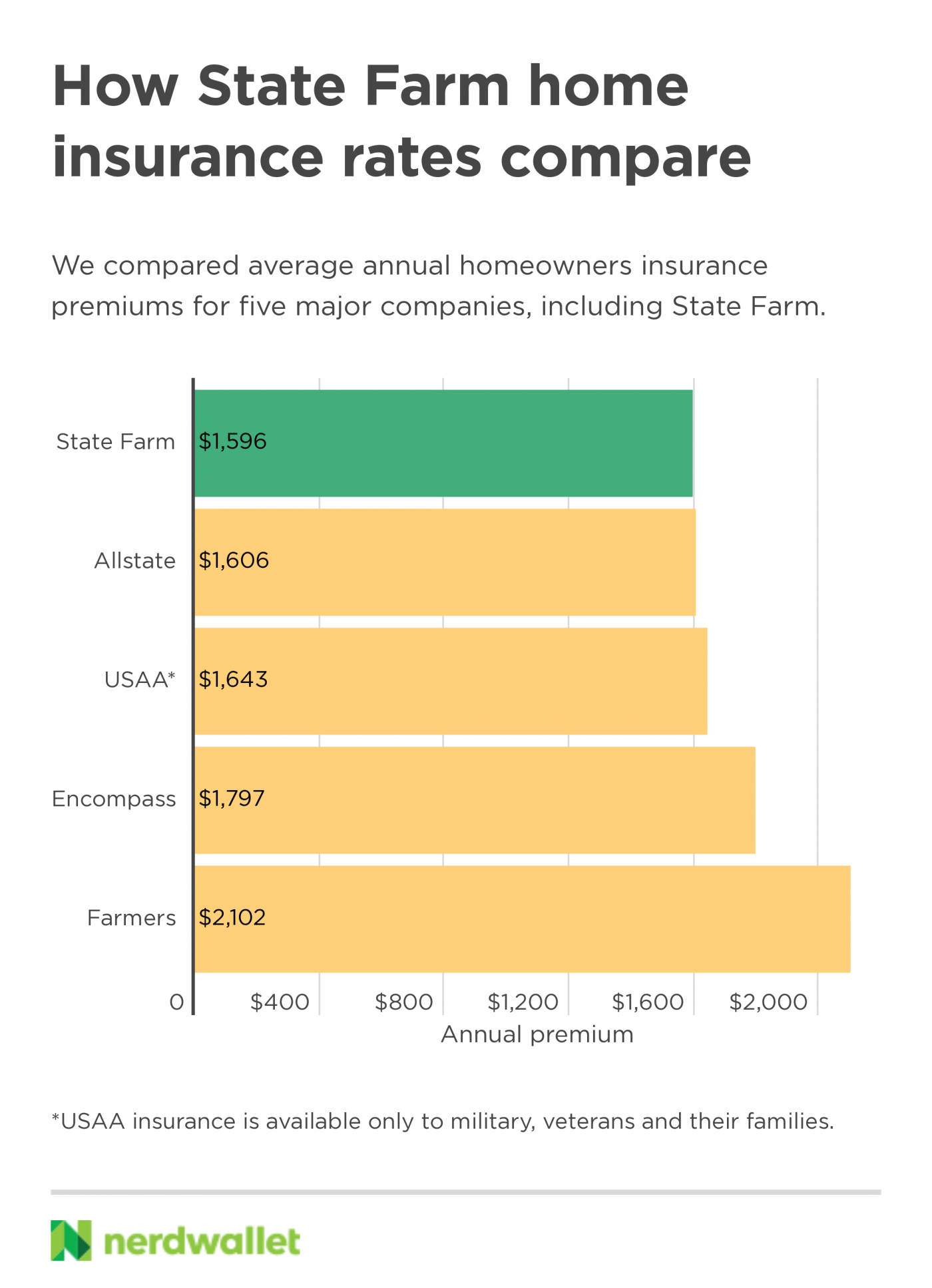

State Farm Home Insurance Review 2021 - NerdWallet

State Farm Insurance offers coverage for auto, life, home, health, and

State Farm Life Insurance Forms - Fill Out and Sign Printable PDF