Marks And Spencer Car Insurance Cancellation

Monday, July 24, 2023

Edit

Marks And Spencer Car Insurance Cancellation

Cancelling Car Insurance with Marks & Spencer

Cancelling car insurance with Marks & Spencer is not difficult, but it can be confusing. The key is to understand the process and make sure you follow the terms and conditions of your policy. The good news is that Marks & Spencer car insurance policies are backed by a variety of major insurers, so you can be sure you’ll be getting the best deal. Here’s a step-by-step guide to cancelling car insurance with Marks & Spencer.

Step 1: Read Your Policy

Before you decide to cancel your Marks & Spencer car insurance policy, it’s important to read through your policy to understand the terms and conditions. You’ll want to make sure you understand any penalties or fees you may incur by cancelling your policy early.

Step 2: Contact Customer Service

Once you’ve read through your policy and made sure you understand the terms and conditions, the next step is to contact Marks & Spencer customer service. This can be done by phone or online, and they should be able to provide you with all the information you need to cancel your policy.

Step 3: Submit Your Cancellation Request

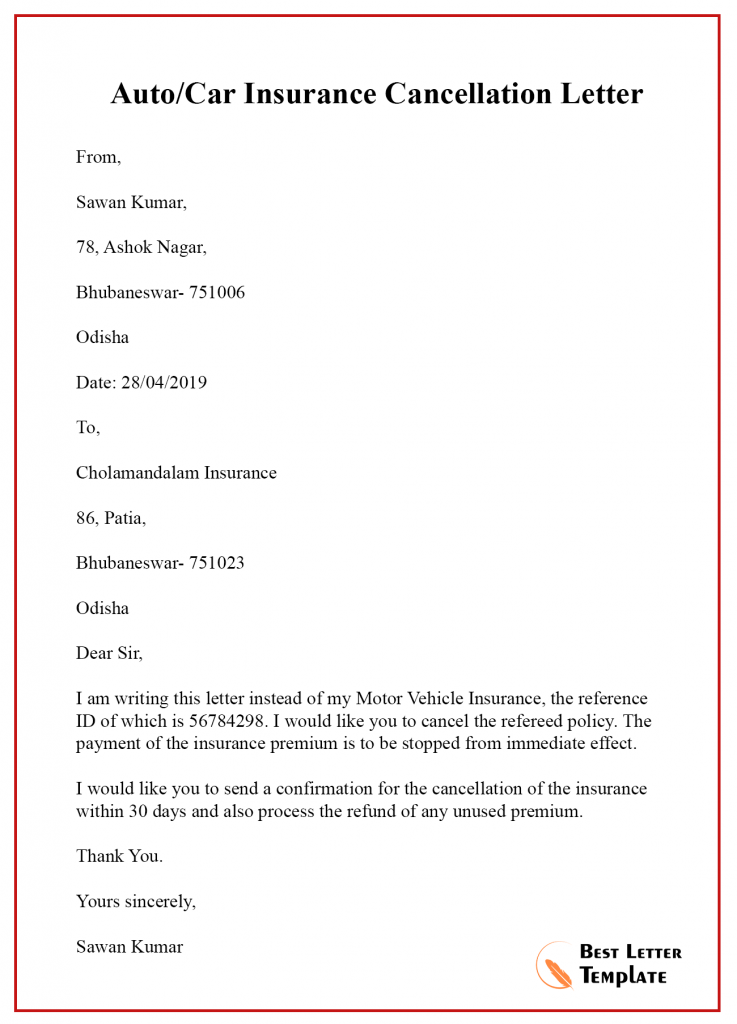

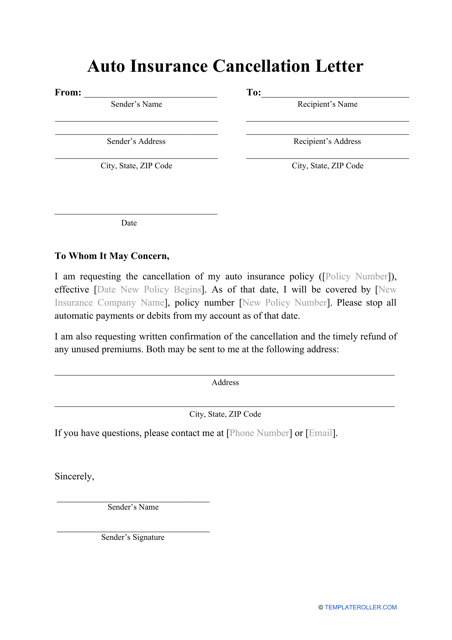

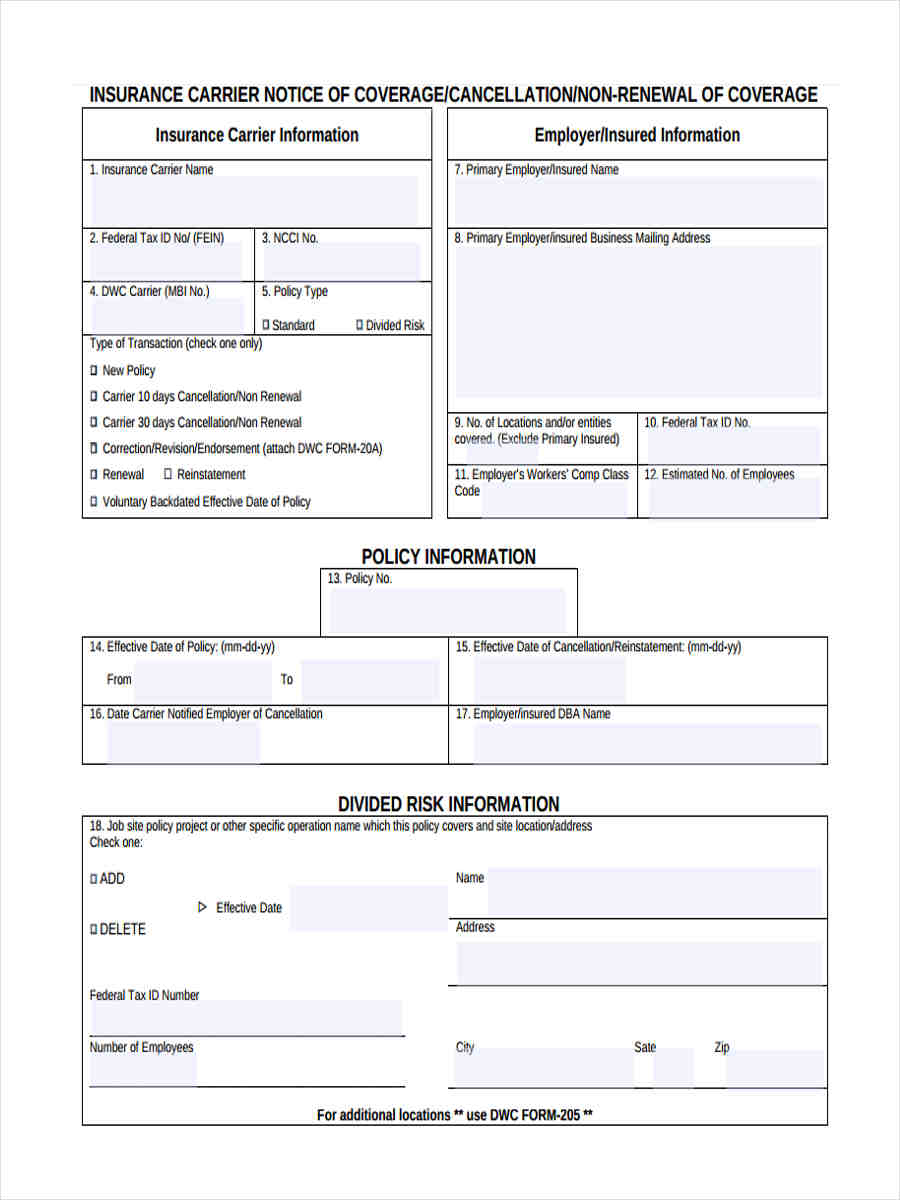

Once you’ve contacted customer service and received all the information you need, the next step is to submit your cancellation request. This can be done by phone, email, or mail and typically requires you to provide proof of cancellation. This could include a copy of your policy, a form, or a letter from your insurer.

Step 4: Pay Any Fees and Charges

If you cancel your policy before the stated date, you may incur fees or charges. These could include a cancellation fee, an administrative fee, or a refund of the unused portion of your policy. It’s important to understand these charges before you submit your cancellation request.

Step 5: Receive Your Final Policy Documents

Once your cancellation request has been accepted, you’ll receive a final policy document from Marks & Spencer. This document will outline the terms and conditions of your policy, as well as any fees or charges you may have incurred. Make sure you read through the document carefully and keep it in a safe place.

Step 6: Cancel Any Direct Debits

If you had a direct debit set up to pay your premiums, you’ll need to ensure it is cancelled before the next payment is due. This can be done by contacting your bank or Marks & Spencer customer service. Make sure you keep any paperwork or emails you receive as proof that you have cancelled your direct debit.

Cancelling your car insurance with Marks & Spencer is not difficult, but it’s important to make sure you understand the terms and conditions of your policy before you submit your cancellation request. Follow the steps outlined above to ensure you get the best deal and have a smooth cancellation process.

Marks & Spencer (M&S) renunță la magazinele din România - All About Jobs

Auto Insurance Cancellation Letter Template Download Printable PDF

FREE 8+ Sample Notice of Cancellation Forms in MS Word | PDF

33 jobs at risk as Marks & Spencer announces plans to close

Insurance Cancellation Letter Template - Format Sample & Example