Life Care Final Expense Insurance

Life Care Final Expense Insurance: A Must-Have For Every Family

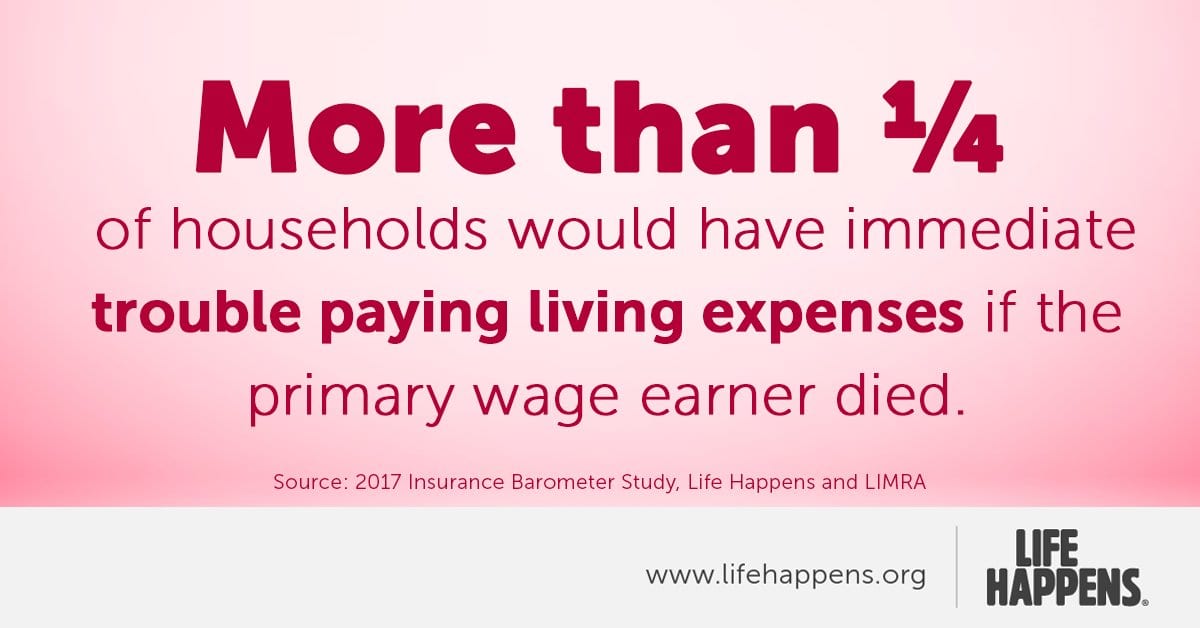

Death is an inevitable part of life. Whether it is anticipated or sudden, it can leave a family in a state of shock and grief. While most families are well aware of the emotional and mental stress of losing a loved one, some are unaware of the financial implications of death. Final Expense or Life Care Insurance is a form of insurance coverage that is designed to help families cover the costs associated with death, such as funeral expenses.

What is Life Care Final Expense Insurance?

Life Care Final Expense Insurance is a type of whole life insurance policy that provides a death benefit. It is specifically designed to help families pay the costs associated with funerals, burial expenses, and other final arrangements. It can also be used to help pay any outstanding debts, such as medical bills or credit card balances. Unlike other types of life insurance, Final Expense Insurance does not require a medical exam and is typically very affordable.

Who Should Consider Life Care Final Expense Insurance?

Final Expense Insurance is a great option for any family who wishes to protect their loved ones from the financial burden of death. It is especially beneficial for individuals who are retired, on a fixed income, or otherwise unable to purchase a more comprehensive life insurance policy. Final Expense Insurance is relatively easy to obtain, and can help provide financial security for families who may not have the resources to cover the costs associated with a funeral or other arrangements.

What is Covered By Life Care Final Expense Insurance?

Final Expense Insurance typically covers the cost of burial expenses, such as caskets, burial plots, and headstones. It can also be used to pay for funeral costs, such as flowers, catering, and transportation. In addition, the death benefit can be used to pay off any outstanding debts, such as medical bills or credit card balances. In some cases, the death benefit can also be used to provide financial support for the surviving family members.

What is the Benefit Of Life Care Final Expense Insurance?

Final Expense Insurance provides a death benefit that can help families cover the costs associated with death. It also provides peace of mind, knowing that loved ones will not be burdened with the financial implications of a funeral or other arrangements. In addition, Final Expense Insurance is typically much more affordable than other life insurance policies, making it an attractive option for those on a budget.

Conclusion

Life Care Final Expense Insurance is a great option for families who wish to protect their loved ones from the financial burden of death. It is an affordable and easy to obtain form of life insurance that can help provide financial security for those who may not have the resources to cover the costs associated with a funeral or other arrangements. For those looking for a way to protect their family and provide peace of mind, Life Care Final Expense Insurance is a must-have.

Final Expense Life Insurance - SeniorBenefitsConsulting

Final Expense Insurance for Seniors

Final Expense | Life Insurance Free Info

Final expense life insurance from Final Wishes Covered℠ can help cover

Life & Final Expense Insurance | TCG Insurance Solutions