Indiana State Minimum Car Insurance Requirements

Sunday, July 16, 2023

Edit

Indiana State Minimum Car Insurance Requirements

The Laws of Auto Insurance in Indiana

If you're driving in Indiana, you must be aware of the state's car insurance requirements. Indiana is slightly different than other states when it comes to auto insurance regulations. It is important to know the laws and regulations to ensure that you are not breaking them. In this article, we will discuss the Indiana State minimum car insurance requirements.

Minimum Liability Coverage in Indiana

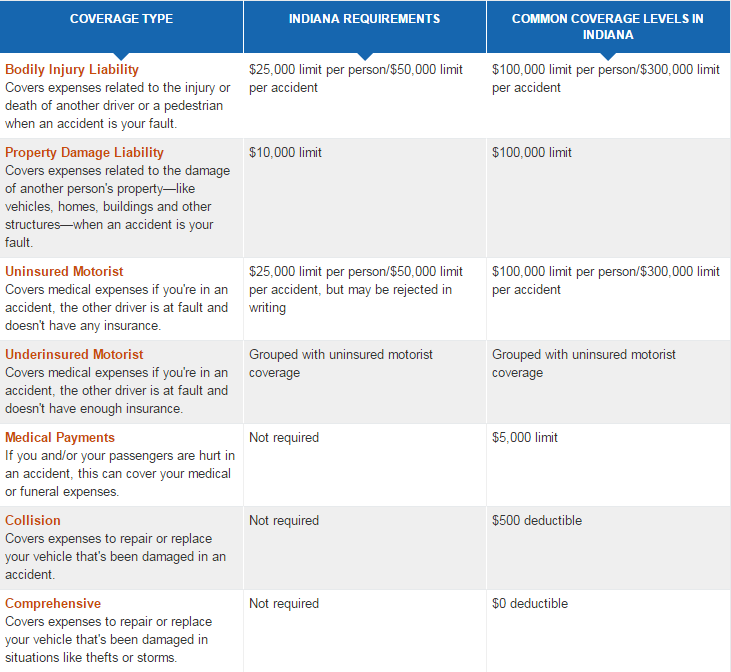

The minimum liability coverage in the state of Indiana is $25,000 per person and $50,000 per accident for bodily injury. This coverage is designed to protect you if you are liable for an accident. The minimum coverage for property damage is $10,000. This coverage is designed to protect you if you are liable for damage to another person's property. In addition to these minimums, there are other coverage options that you can purchase to further protect yourself.

UM/UIM Coverage in Indiana

It is important to note that the state of Indiana does not require you to purchase uninsured/underinsured motorist (UM/UIM) coverage. However, it is highly recommended that you purchase this coverage as it will protect you if you are in an accident with an uninsured or underinsured driver. This coverage can help to pay for medical expenses, lost wages, and other damages.

Personal Injury Protection Insurance in Indiana

The state of Indiana does not require you to purchase personal injury protection (PIP) insurance. However, it is important to note that PIP insurance can be very beneficial if you are in an accident. PIP insurance can help to pay for medical expenses, lost wages, and other damages. It is highly recommended that you purchase PIP insurance if you are driving in the state of Indiana.

Comprehensive and Collision Coverage in Indiana

The state of Indiana does not require you to purchase comprehensive and collision coverage. However, it is important to note that these coverages can be very beneficial if you are in an accident. These coverages can help to pay for repair or replacement of your vehicle. It is highly recommended that you purchase comprehensive and collision coverage if you are driving in the state of Indiana.

Conclusion

It is important to be aware of the state of Indiana's car insurance requirements. The state requires a minimum of liability coverage to protect you if you are liable for an accident. In addition, you should consider purchasing UM/UIM and PIP insurance to further protect yourself. Lastly, you should consider purchasing comprehensive and collision coverage to protect your vehicle. By following these guidelines, you can be sure that you are following the laws and regulations of the state of Indiana.

Things You Should Know About Purchasing Car Insurance In The USA by

car insurance - cheap car insurance indiana - Top 10 best car insurance

Understanding the Minimum Car Insurance Requirements by State - Quote

A Guide to the BEST 9 Car Insurance Hacks No One Talks About | Cheap

Car Insurance Requirements for California Vehicle Owners