How Much Is Liability Insurance For A Car

How Much Is Liability Insurance For A Car?

Understanding Liability Insurance

Liability insurance is an important part of any car insurance policy. It provides financial protection in case you are involved in an accident that causes injury or damage to another person’s property. Liability insurance will cover medical costs, legal fees, and the cost of repairing or replacing the damaged property. Liability insurance is required in most states in order to legally drive a car. However, the amount of coverage you need will depend on your individual circumstances.

The Difference Between Bodily Injury Liability and Property Damage Liability

When it comes to liability insurance, there are two types to consider: bodily injury liability and property damage liability. Bodily injury liability covers medical expenses and other costs associated with an injury to another person in an accident you caused. Property damage liability, on the other hand, covers the cost of repairing or replacing another person’s property that was damaged in an accident you caused. It is important to understand the difference between these two types of coverage as they both provide important protection.

How Much Liability Insurance Do You Need?

The amount of liability insurance you need will depend on your individual circumstances. Generally speaking, you should have at least $100,000 in bodily injury liability and $50,000 in property damage liability. However, if you live in a state with higher minimum requirements or if you have assets to protect, you may want to consider purchasing more than the minimum amount of coverage. It is important to speak to your insurance provider to determine the right amount of coverage for your situation.

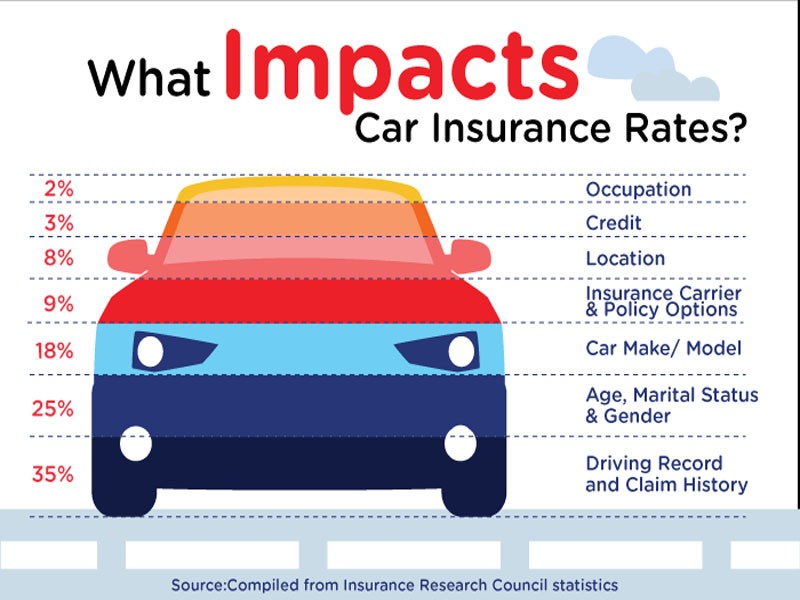

What Factors Affect Liability Insurance Rates?

The amount you pay for liability insurance will depend on a number of factors. Your age, driving record, and the type of vehicle you are insuring will all play a role in determining your rates. Other factors such as your credit score, the area you live in, and the amount of coverage you purchase can also affect your premiums. Insurance companies use these factors to assess the risk associated with insuring you and will adjust your rates accordingly.

What Are the Benefits of Liability Insurance?

Liability insurance provides important financial protection in the event of an accident. It can help you avoid expensive legal fees and medical bills that could otherwise put a financial strain on your family. It can also help you repair or replace another person’s property if you are found to be at fault in an accident. It is important to understand the different types of coverage available and to purchase the right amount of coverage for your needs.

Conclusion

Liability insurance is an important part of any car insurance policy and is required in most states. The amount of coverage you need will depend on your individual circumstances and it is important to speak to your insurance provider to determine the right amount of coverage for you. Your rates will depend on a number of factors such as your age, driving record, and the type of vehicle you are insuring. Liability insurance provides important financial protection in the event of an accident and can help you avoid expensive legal fees and medical bills.

What Is Car Insurance Liability? | Visual.ly

Auto Insurance Liability Limits: What Do The Numbers Mean? | Visual.ly

Liability Coverage Made Easy - Direct Connect

What is Full Coverage Car Insurance? - eTrustedAdvisor

Learn the Different Types of Car Insurance Policies