How Much Is Car Insurance For Under 25

How Much Is Car Insurance For Under 25?

What Is Car Insurance?

Car insurance is a type of insurance policy that protects you against financial losses if you are involved in an accident or if your vehicle is stolen or damaged. It covers bodily injury and property damage caused to other people or vehicles, as well as damage to your own vehicle. Generally speaking, car insurance is required by law in most states, and in some cases, the state may even require you to have a certain amount and type of coverage. The purpose of car insurance is to protect you financially in the event of an accident, theft, or damage to your vehicle.

Why Is Car Insurance For Under 25 More Expensive?

Car insurance for under 25 is more expensive than for older drivers, due to the fact that younger drivers are considered more of a risk by insurers. Generally, car insurance premiums increase with age, and statistics show that younger drivers are more likely to be involved in accidents than older drivers. Also, younger drivers are more likely to take risks on the road, such as driving too fast or driving recklessly, which can increase their chances of being involved in an accident.

How Much Is Car Insurance For Under 25?

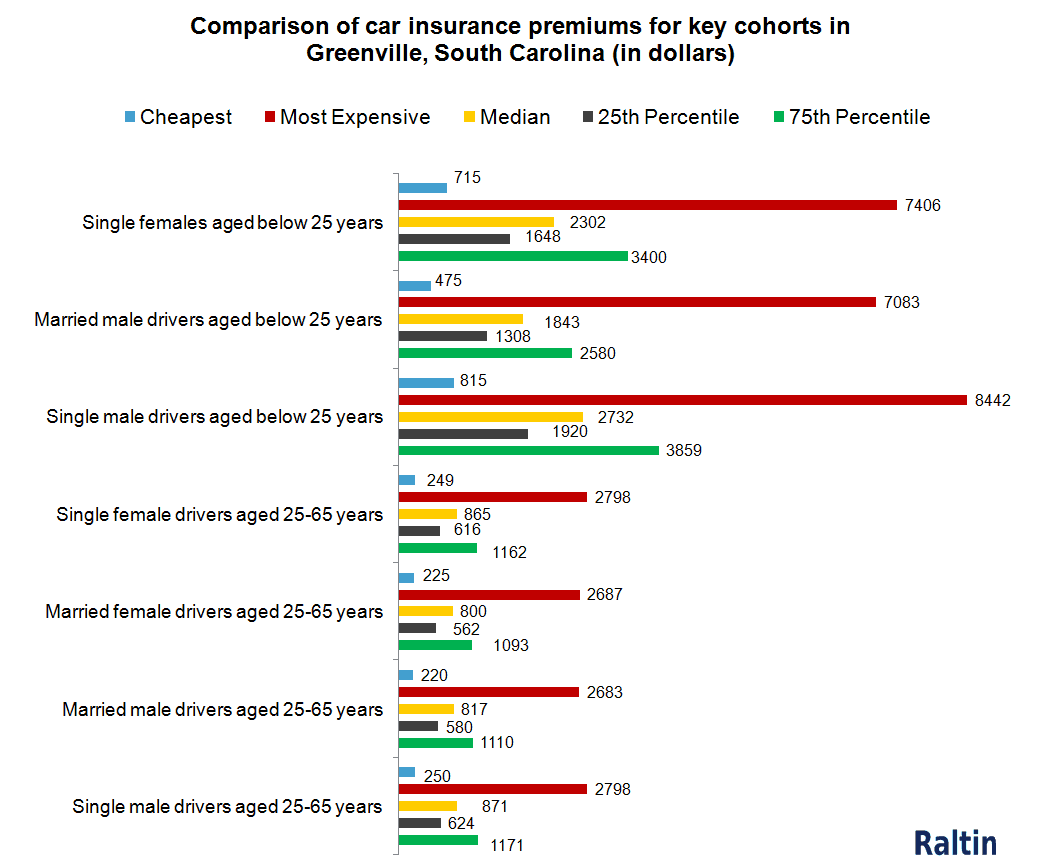

The cost of car insurance for under 25 varies depending on many factors, such as the type of vehicle, the age of the driver, the driving record of the driver, and the amount of coverage. The average cost of car insurance for under 25 is typically higher than for older drivers, as insurers consider younger drivers to be higher risk. Generally speaking, the cost of car insurance for under 25 is higher than that for older drivers, but there are ways to reduce the cost, such as choosing a car with a good safety rating, taking a defensive driving course, and maintaining a good driving record.

What Are Some Tips For Finding Cheap Car Insurance For Under 25?

If you're looking for cheap car insurance for under 25, there are a few tips you can follow to save money. Firstly, shop around and compare quotes from multiple insurers to get the best deal. Secondly, look for discounts, such as multi-car discounts, safety features discounts, or low-mileage discounts. Thirdly, consider raising your deductible, as this can lower your premiums. Lastly, consider taking a defensive driving course, as this can help to improve your driving record and help you to get lower premiums.

Conclusion

Car insurance for under 25 is typically more expensive than for older drivers, due to the fact that younger drivers are considered more of a risk by insurers. However, there are ways to reduce the cost, such as shopping around and comparing quotes, looking for discounts, raising your deductible, and taking a defensive driving course. By following these tips, you should be able to find cheap car insurance for under 25.

Car Insurance Under 25: Can I Get Cheap Car Insurance? - Cover

Average Car Insurance Rates Under 25 - Rating Walls

Under 25 Car Insurance – The Housing Forum

2021 Car Insurance Rates by Age and Gender - NerdWallet

Classic Car Insurance Under 25