How Much Does Sr22 Insurance Cost In Illinois

Thursday, July 6, 2023

Edit

SR-22 Insurance Costs in Illinois

What is SR-22 Insurance?

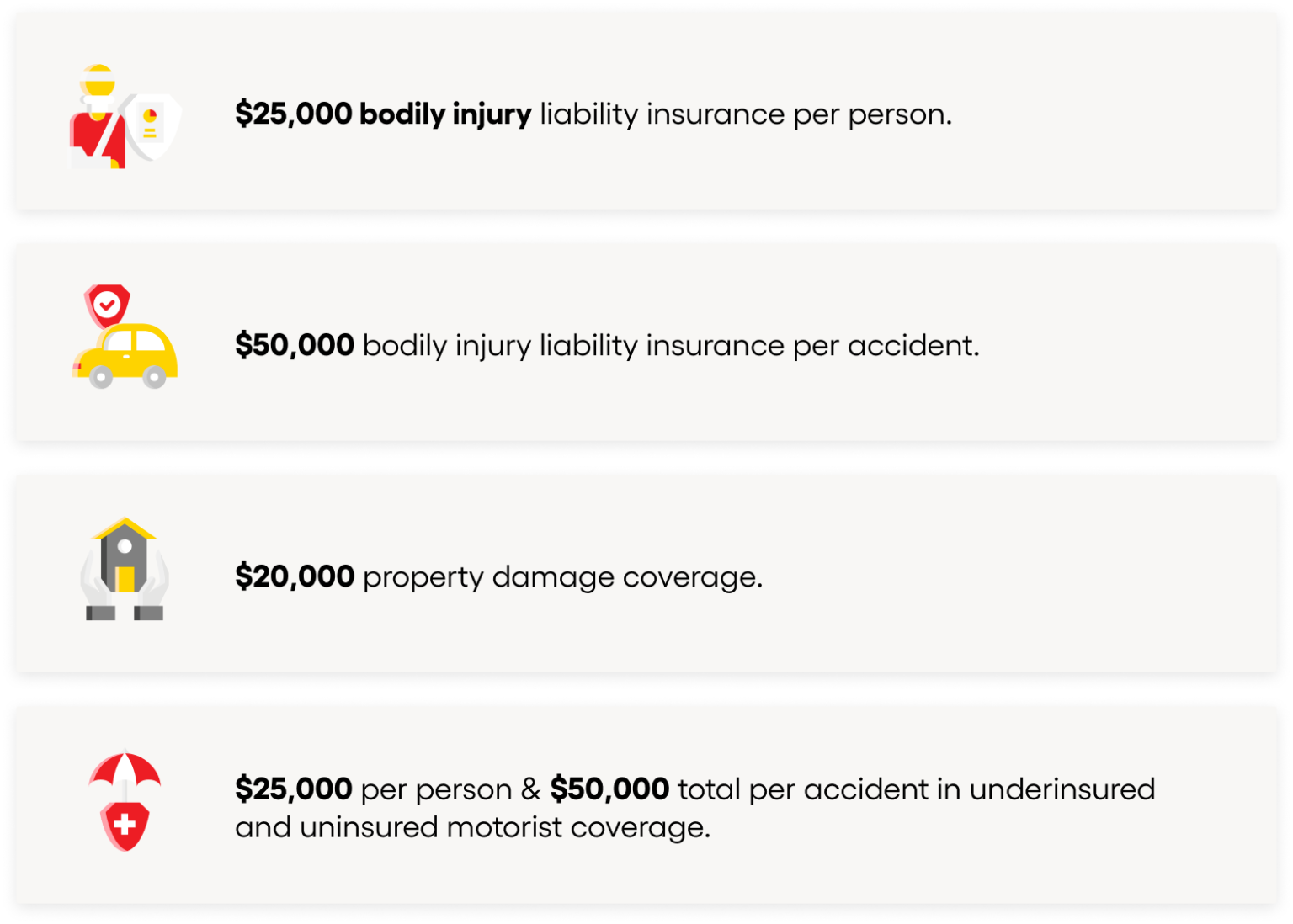

SR-22 insurance is a type of auto insurance that is required for drivers who have been convicted of driving without insurance or have been involved in an accident without auto insurance. It is a form of proof that the driver has fulfilled their financial responsibility requirements as mandated by their state. In the state of Illinois, drivers are required to have SR-22 insurance if they have been convicted of any of the following: DUI/DWI, reckless or negligent driving, or operating a motor vehicle without insurance.How Much Does SR-22 Insurance Cost in Illinois?

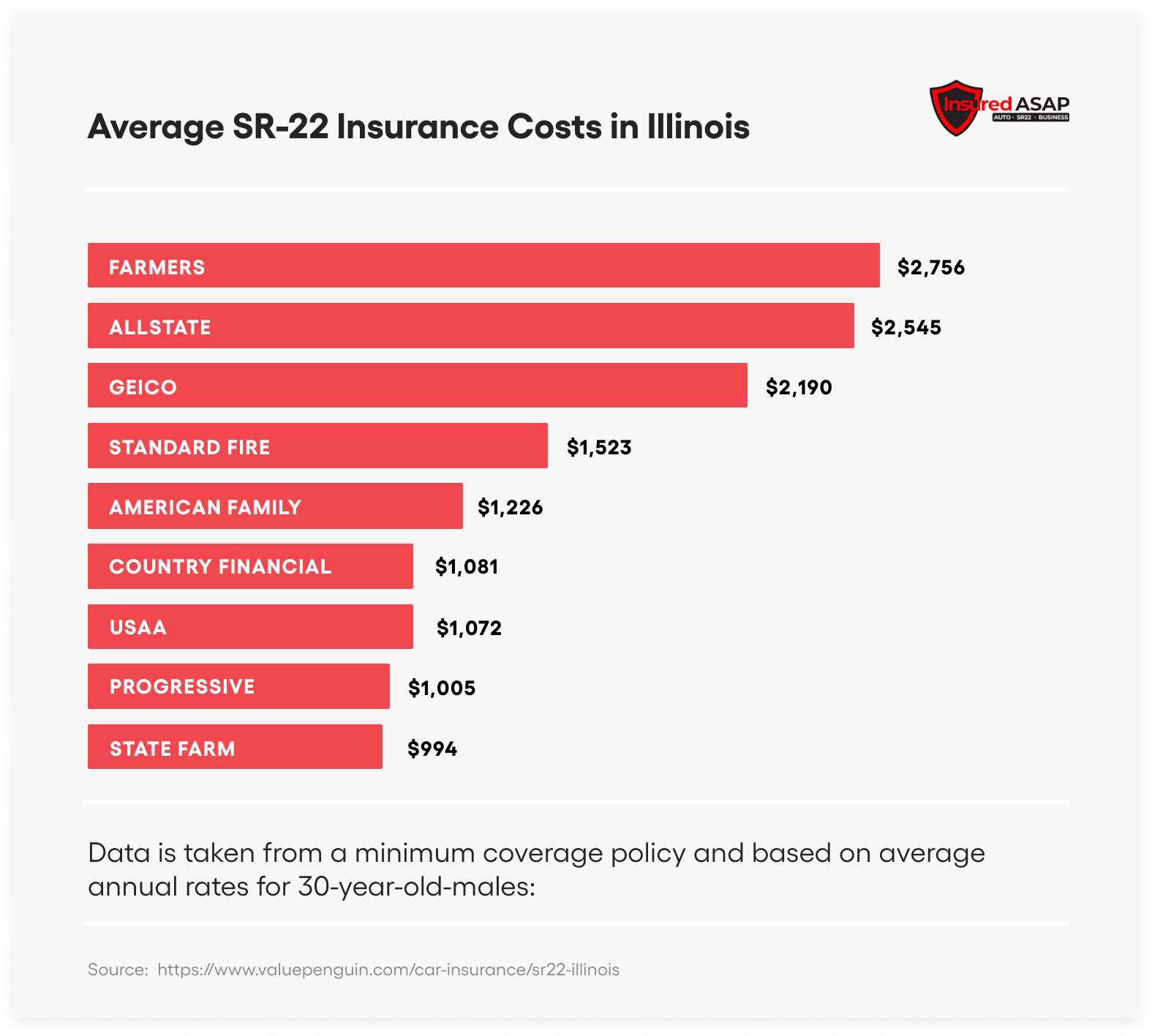

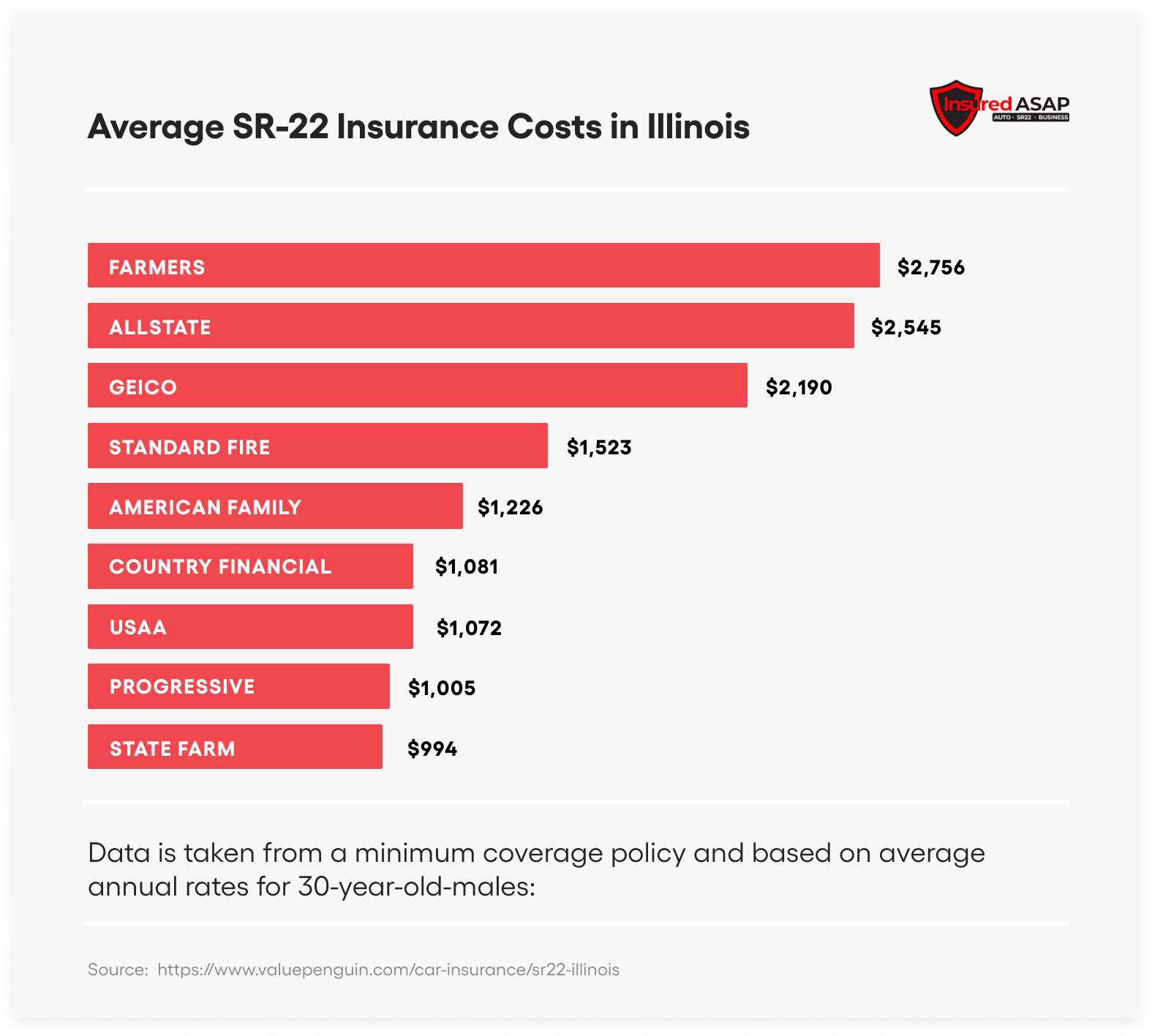

The cost of SR-22 insurance in Illinois depends on a variety of factors, such as the driver's age, driving record, type of vehicle, and the insurance company. Generally, the cost of SR-22 insurance in Illinois is more expensive than traditional auto insurance. The cost can range from $10 to $100 per month, depending on the factors mentioned above. For example, drivers under the age of 25 are typically charged more for SR-22 insurance because they are considered to be more of a risk. Similarly, drivers who have had multiple traffic violations or have been involved in an accident are also likely to be charged more for SR-22 insurance.How Long Do Drivers Need SR-22 Insurance in Illinois?

The length of time that a driver needs to have SR-22 insurance in Illinois depends on the type of violation they have committed. Typically, drivers must maintain SR-22 insurance for a period of three years. However, if the driver is convicted of multiple violations or is involved in an accident without insurance, the length of time may be extended. In some cases, drivers may be required to keep the SR-22 insurance for up to five years. It is important to note that if a driver fails to maintain SR-22 insurance for the required period of time, their driver's license may be suspended.Where Can Drivers Get SR-22 Insurance in Illinois?

Drivers in Illinois can purchase SR-22 insurance from most major auto insurance companies. In addition, some insurance companies specialize in providing SR-22 policies. It is important to compare rates and coverage from multiple companies to ensure that you are getting the best deal on your SR-22 insurance.What is the Process for Obtaining SR-22 Insurance in Illinois?

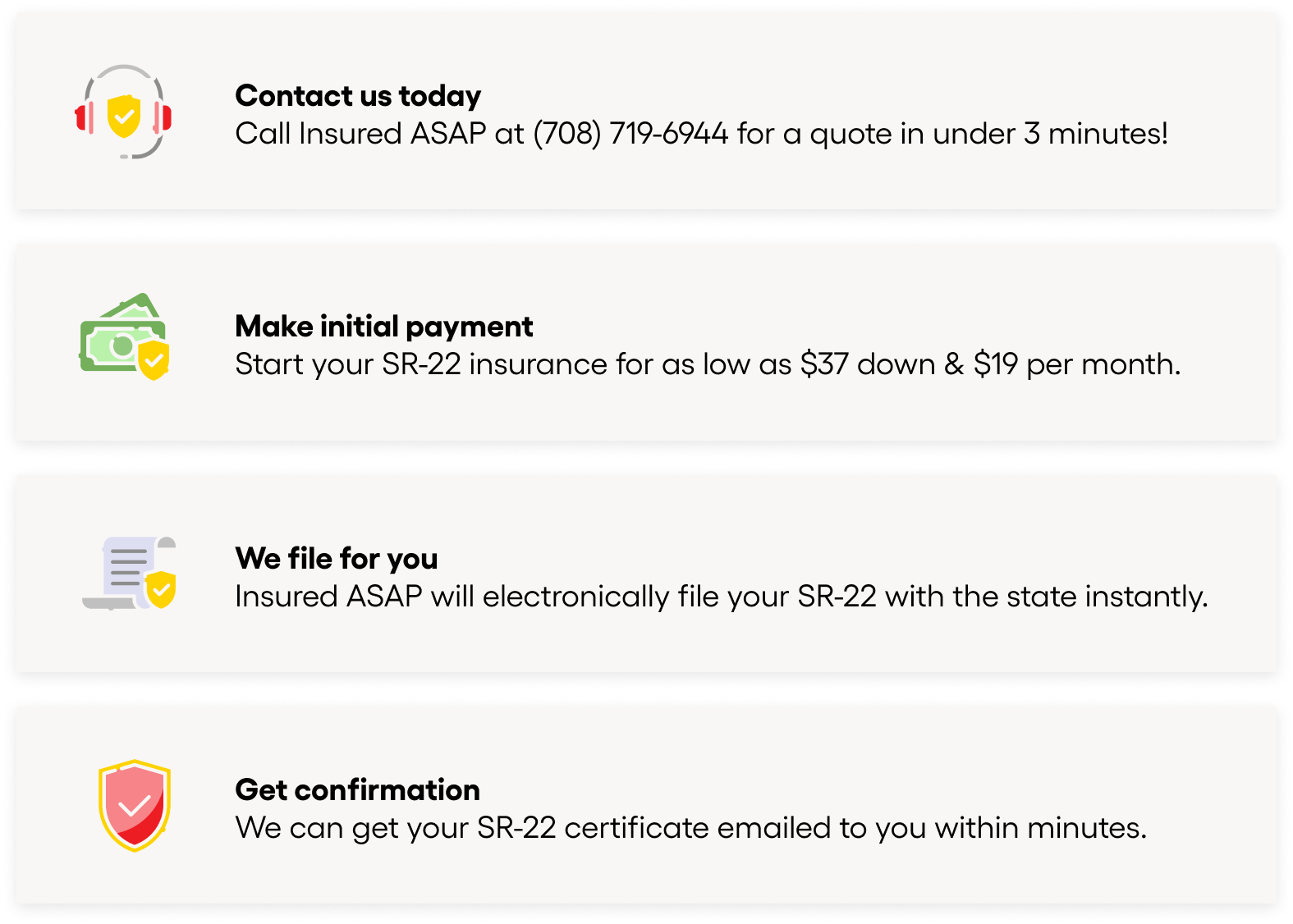

The process for obtaining SR-22 insurance in Illinois is fairly simple. First, drivers must contact their insurance company to determine if they offer SR-22 insurance. If they do, the driver will be required to fill out an application and provide proof of financial responsibility. The insurance company will then submit the required paperwork to the Illinois Secretary of State. Once the paperwork is approved, the driver will be issued a certificate of insurance.Conclusion

SR-22 insurance is a type of auto insurance that is required for drivers who have been convicted of driving without insurance or have been involved in an accident without auto insurance. The cost of SR-22 insurance in Illinois depends on a variety of factors, such as the driver's age, driving record, type of vehicle, and the insurance company. Generally, the cost of SR-22 insurance in Illinois is more expensive than traditional auto insurance. The length of time that a driver needs to have SR-22 insurance in Illinois depends on the type of violation they have committed. Drivers in Illinois can purchase SR-22 insurance from most major auto insurance companies. The process for obtaining SR-22 insurance in Illinois is fairly simple.How Much Does SR22 Cost in Illinois

Illinois SR22 Insurance Quotes - YouTube

How Much Does SR22 Cost in Illinois

How Much Does SR22 Cost in Illinois

All You Need To Know About SR22 Insurance – Insure On The Spot