Cost To Insure A Tesla

How Much Does It Cost To Insure A Tesla?

Tesla has been revolutionizing the car industry with its electric vehicles, and the company continues to be a leader in innovation with its designs, technology, and performance. But what about insurance? How much does it cost to insure a Tesla?

The cost of insuring a Tesla depends on a variety of factors, including the model of Tesla you own, the age of the car, your driving record, and the type of coverage you choose. It is important to shop around for the best rates, as different companies will offer different premiums. In general, though, the average cost of insuring a Tesla is higher than insuring a traditional gas-powered vehicle.

Factors That Affect The Cost Of Insuring A Tesla

The most important factor in determining the cost of insuring a Tesla is the model of the car. Tesla's cars are all electric, and they are more expensive to repair than traditional gas-powered cars because they have more complex parts. This means that the cost of insuring a Tesla is usually higher than insuring a traditional gas-powered vehicle.

The age of the car is another factor that affects the cost of insuring a Tesla. Generally, newer cars are more expensive to insure than older cars, and the same is true for Teslas. The type of coverage you choose will also affect the cost of insuring a Tesla. Liability coverage is typically the most affordable option, but if you want higher levels of coverage, such as comprehensive and collision, you will likely have to pay more.

Your driving record is also a factor in determining the cost of insuring a Tesla. If you have a clean driving record, you will likely be able to get a better rate than someone with a less-than-perfect record. Additionally, where you live can affect the cost of insuring a Tesla. If you live in an area with a high rate of auto theft and vandalism, you may pay more for your insurance than someone who lives in a safer area.

Tips To Save Money On Tesla Insurance

There are several ways to save money on Tesla insurance. First, shop around to find the best rates. Different insurers offer different premiums, so it pays to compare quotes. Additionally, consider raising your deductible. A higher deductible means lower premiums, but it also means you’ll have to pay more out of pocket if you need to file a claim.

You should also make sure you’re taking advantage of any discounts you may be eligible for. Many insurance companies offer discounts for good drivers, safe drivers, and for having multiple cars insured with the same company. If you have other Tesla vehicles, you may be able to get a multi-car discount.

Finally, consider joining a Tesla owners club. Many of these clubs offer group insurance discounts, which can help you save money on your Tesla insurance. With some research and shopping around, you can find an affordable policy that meets your needs.

Tesla Wants to Insure Its Drivers, and Will Double Down on Tracking

Tesla Model 3 Insurance Cost - Best Tesla Car Insurance Cost To Insure

Tesla Model 3 Insurance Massachusetts - The 10 Most Expensive Cars To

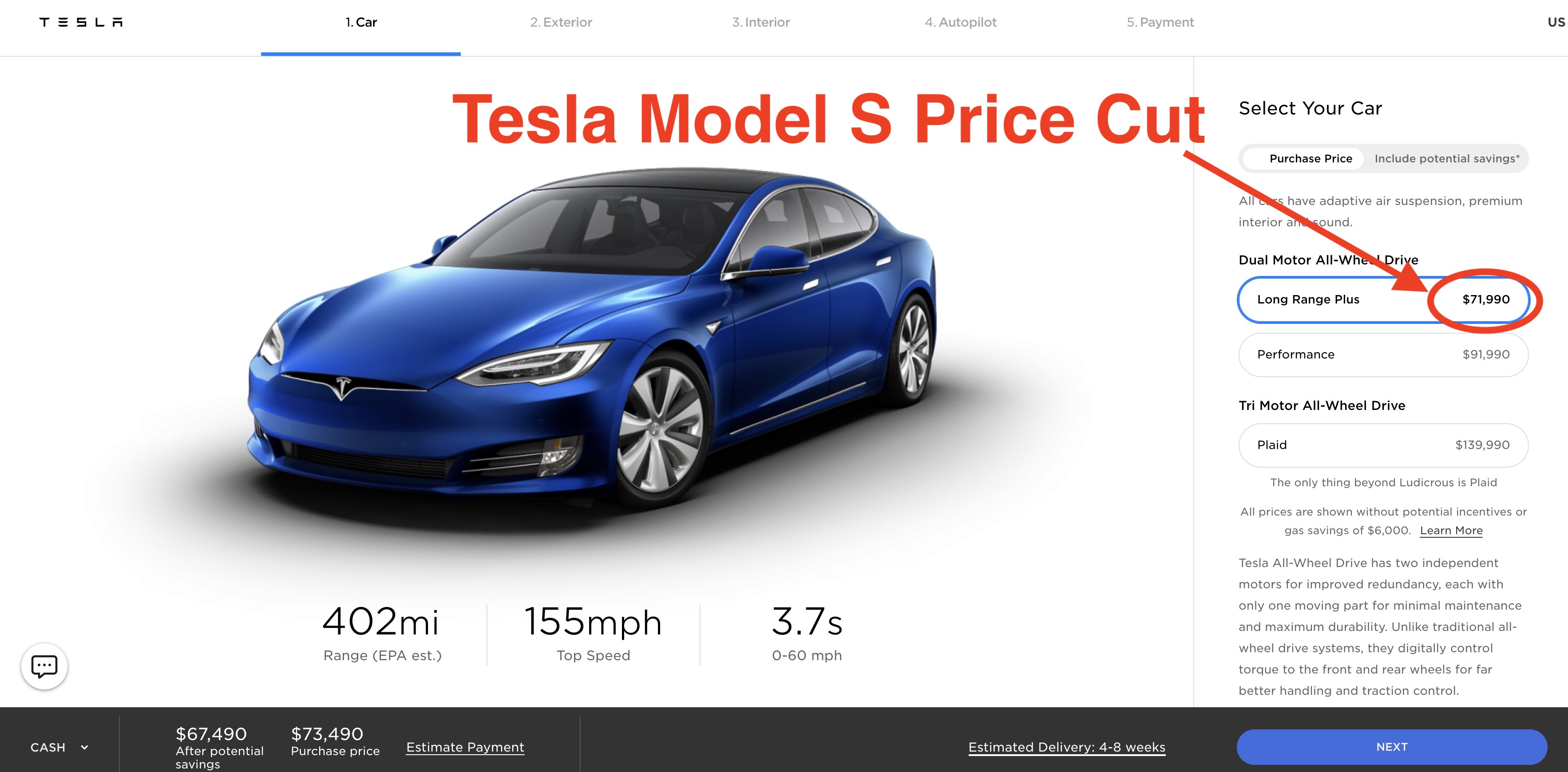

Tesla (TSLA) slashes Model S price, now starts at just $71,990 - Electrek

How Much Does Tesla Insurance Cost / How Much Does A Tesla Model 3 Cost