Car Insurance Prices In New York

Monday, July 24, 2023

Edit

Car Insurance Prices In New York

High Car Insurance Prices in New York

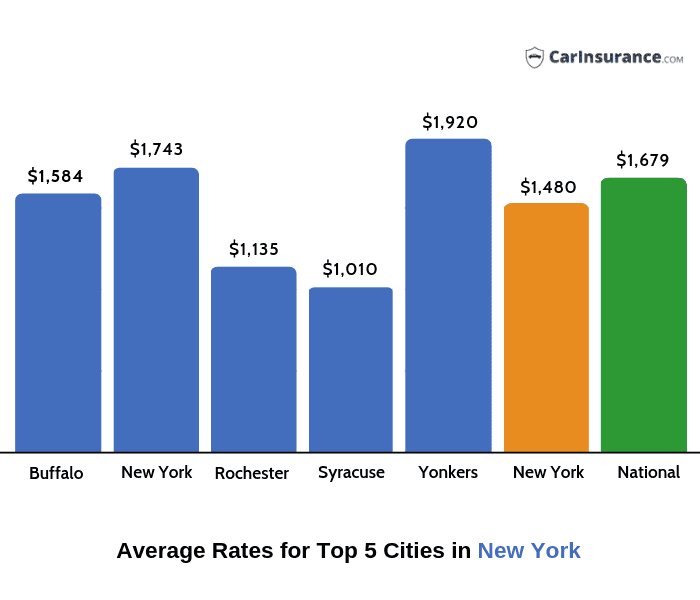

New York is one of the states with the highest car insurance prices. This is due to the fact that New York has a high population density and a lot of traffic on the roads. The risk of accidents is higher in these areas, which means that insurance companies need to charge higher rates to cover their costs. Furthermore, New York is a "no-fault" state, meaning that all drivers must have a minimum amount of car insurance coverage. As a result, car insurance premiums in the state of New York are often much higher than those in other states.

How to Find Cheap Car Insurance in New York

Finding cheap car insurance in New York can be a challenge, but there are some things you can do to lower your rates. One of the best ways to save money on car insurance is to shop around and compare rates from different companies. You can also look for discounts that may be available, such as discounts for good drivers or discounts for belonging to certain organizations. Additionally, you can look into different types of coverage and see if you can get by with less coverage or a higher deductible. Finally, you can look for ways to reduce your risk, such as taking a defensive driving course or installing safety devices in your car.

Factors that Impact Car Insurance Prices in New York

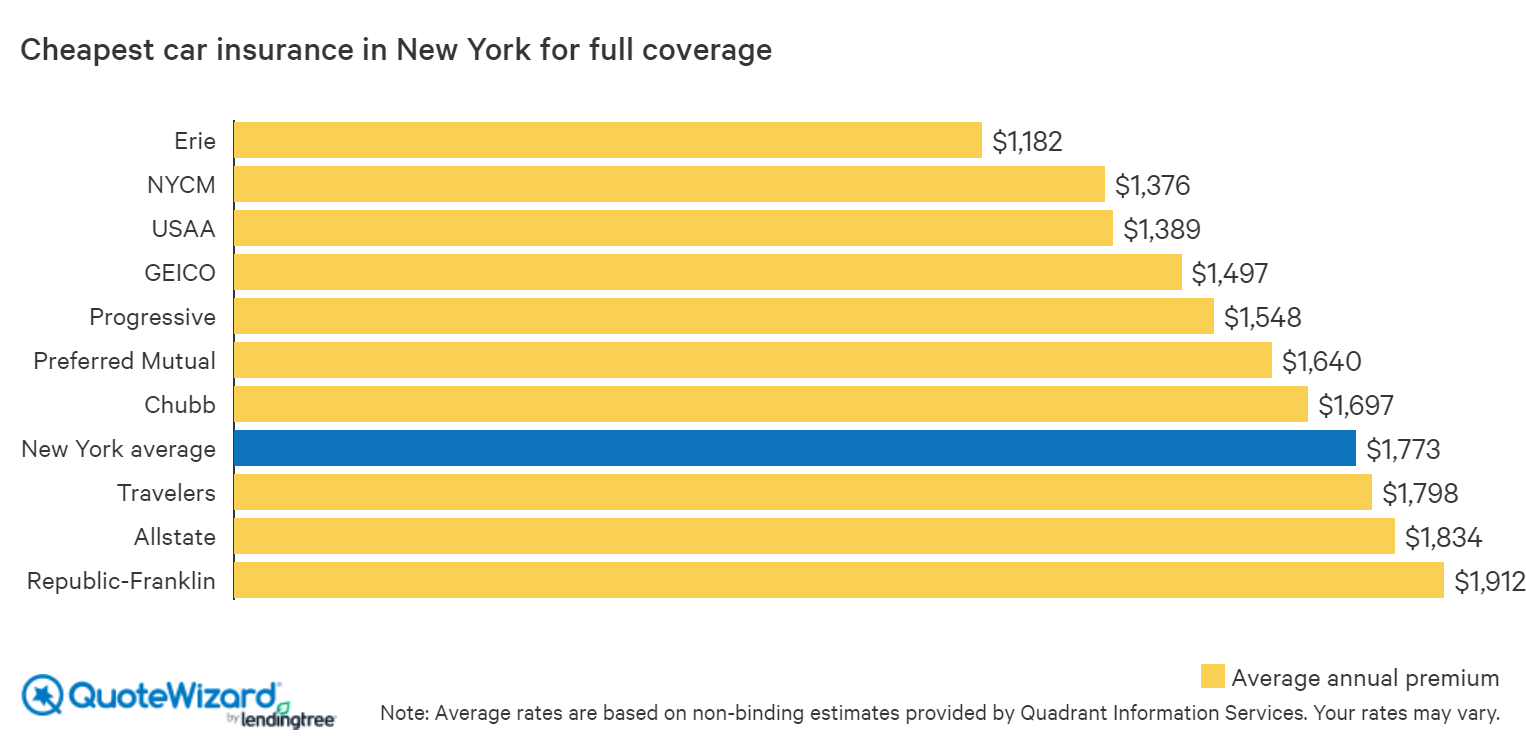

There are several factors that can affect the car insurance prices in New York. First, the age and driving history of the driver will be taken into consideration. Drivers with a history of accidents or violations will typically have to pay higher rates than those with a clean driving record. Additionally, the type of vehicle you drive can have an impact on your rates, as some cars are more expensive to insure than others. Finally, the area you live in can also have an impact on your rates. Areas with higher crime rates or more traffic can lead to higher premiums.

Getting the Most Out of Your Car Insurance

Getting the most out of your car insurance in New York requires some research and comparison shopping. You should compare rates from several different companies and look for discounts that may be available. Additionally, you should consider raising your deductible if you can afford to do so. This can help lower your rates, although you should make sure you can afford to pay the higher deductible if you are in an accident. Finally, you should make sure you are getting the coverage you need and that you are not overpaying for coverage you don’t need.

Tips for Saving on Car Insurance in New York

If you are looking for ways to save on car insurance in New York, here are a few tips to keep in mind: shop around and compare rates, look for discounts, consider raising your deductible, make sure you have the coverage you need, and take steps to reduce your risk, such as taking a defensive driving course or installing safety devices in your car. Additionally, if you are a student, you may be eligible for discounts. Finally, if you are a senior citizen, you may be able to get additional discounts.

Conclusion

Finding cheap car insurance in New York can be a challenge, but it is possible. By shopping around and looking for discounts, you can often find a rate that works for your budget. Additionally, you should make sure you are getting the coverage you need and that you are not overpaying for coverage you don’t need. Finally, you can take steps to reduce your risk, such as taking a defensive driving course or installing safety devices in your car.

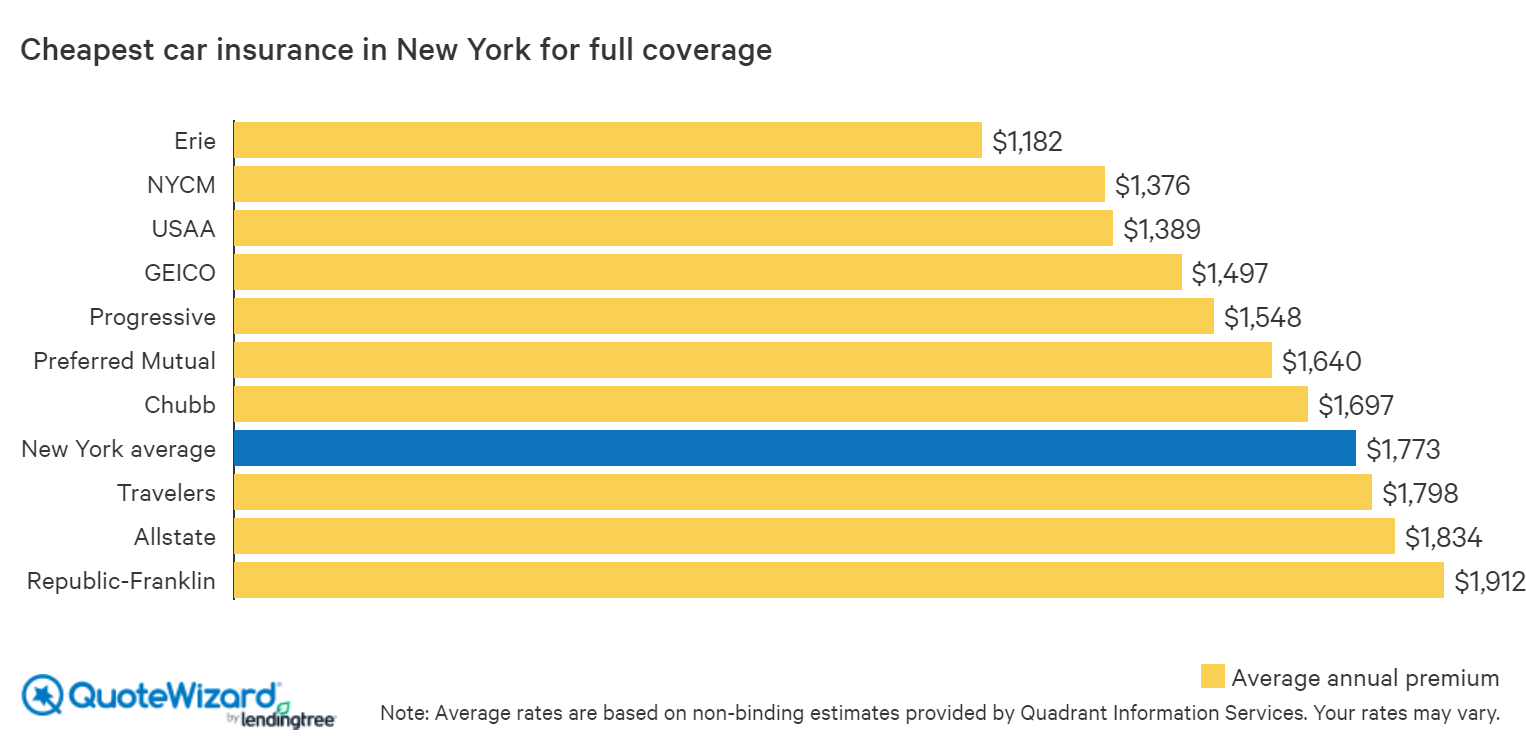

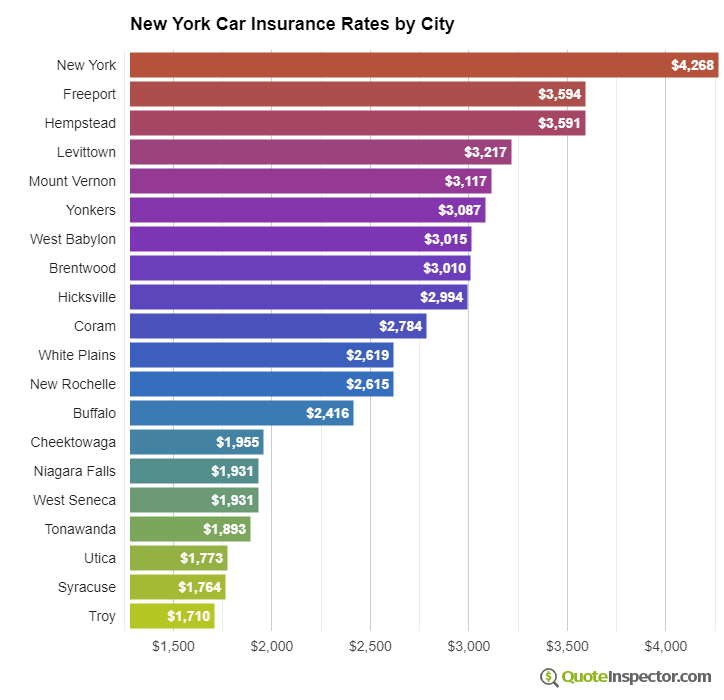

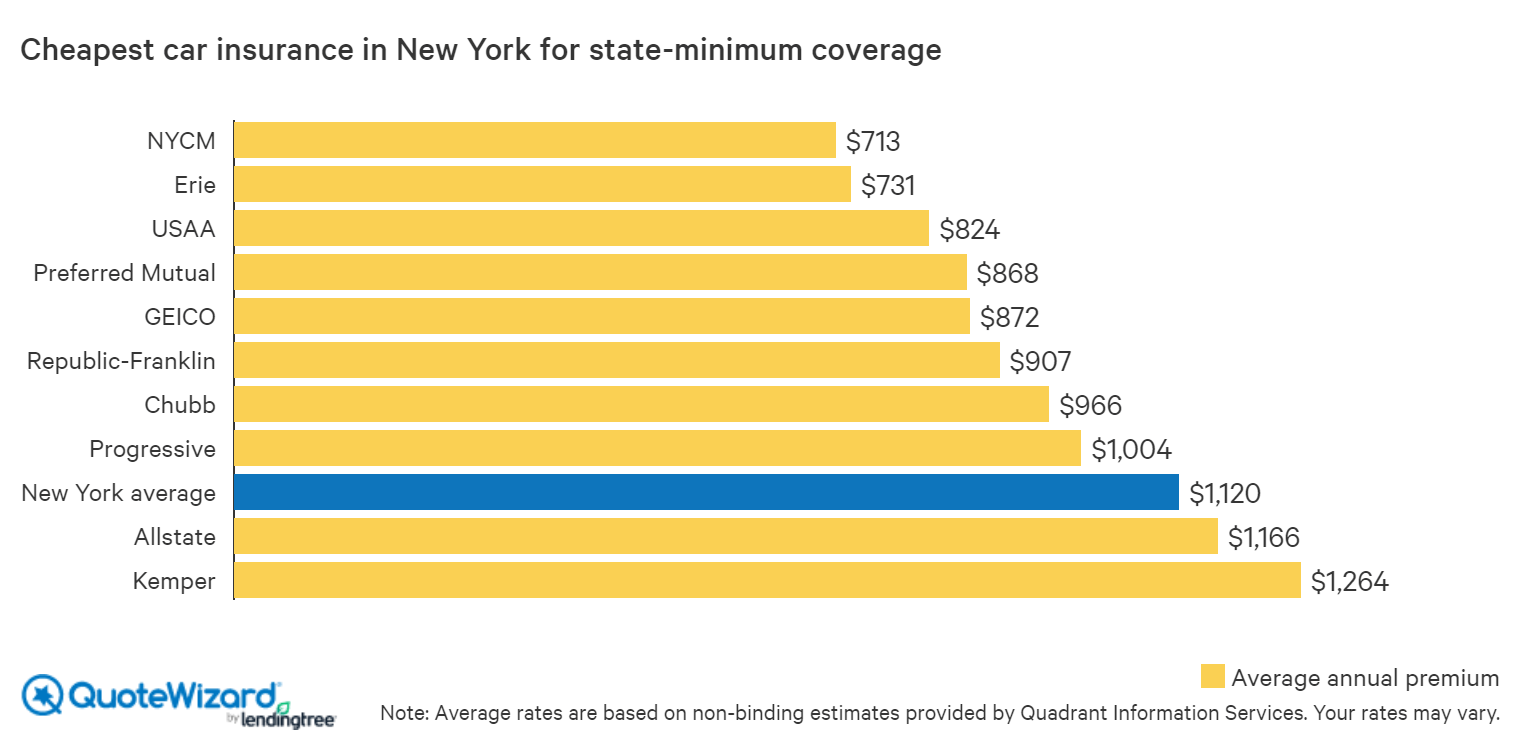

The Cheapest Car Insurance in New York | QuoteWizard

New York Car Insurance Information

The Cheapest Car Insurance in New York | QuoteWizard

Car Insurance in New York - Find Best & Cheapest Car Insurance in NY

Pin by Hurul comiccostum on comiccostum | Compare car insurance, Car