Motor Third Party Insurance Online

Motor Third Party Insurance Online: What You Need to Know

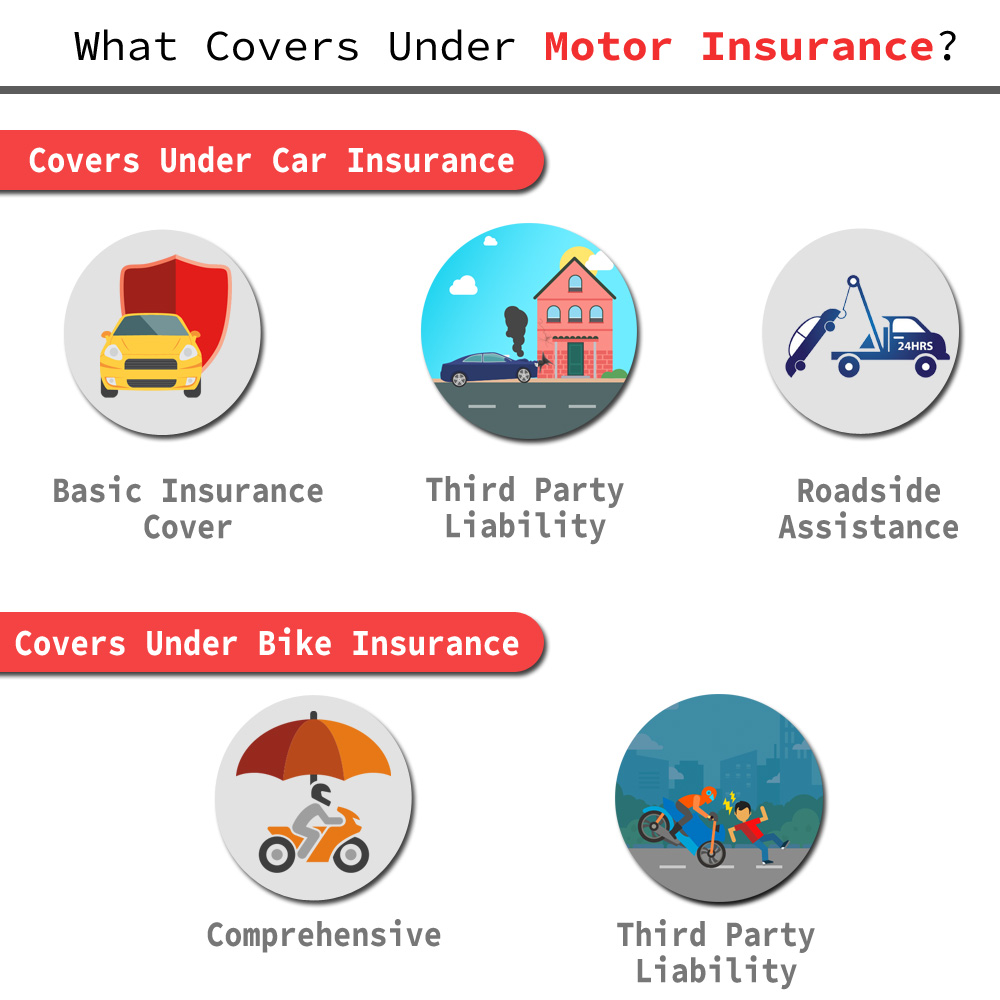

Motor third party insurance online is an affordable and convenient way to get the protection you need for your car. It is a type of insurance that pays for any third-party liability for injuries or damages caused by your vehicle. It covers the costs of the medical expenses of the injured party and any other losses or damages caused by your car. It also covers legal costs if you are found to be at fault for the accident.

When it comes to motor third party insurance online, it is important to make sure that you are getting the best coverage for your needs. You should take the time to shop around and compare different policies to make sure you are getting the most comprehensive coverage available. It is also important to make sure that you are getting the right amount of coverage for your particular vehicle and the type of driving you do.

Purchasing Motor Third Party Insurance Online

When you are looking to purchase motor third party insurance online, there are a few steps that you should take. First, you should check with your current insurance provider to see if they offer any type of third party coverage. If not, then you may want to shop around and compare different policies from different insurance companies. It is important to make sure that you are getting the most comprehensive coverage for your particular needs.

Once you have found a policy that fits your needs, you will need to fill out an online application. This will allow the insurance company to review your information and determine the best coverage for you. You will also want to make sure that you are providing accurate information to the insurance company so that you can get the best coverage for your needs.

What to Look for in Motor Third Party Insurance Online

Once you have purchased the motor third party insurance online, it is important to make sure that you are getting the best coverage possible. You should review the policy closely to make sure that you are getting the right amount of coverage for your particular vehicle and type of driving. It is also important to make sure that you are getting the right amount of coverage for your particular circumstances. For example, if you are a high-risk driver, then you may need to get a higher level of coverage.

You should also make sure that you are getting the best customer service from the insurance company. You should read the customer reviews on the company's website to make sure that you are getting the best coverage for your needs. You should also make sure that the company has a good reputation for customer service and is willing to help you if you have any questions or concerns.

Third Party Insurance: Buy & Renew Third Party Car Insurance Online

PPT - Third Party Car Insurance Online PowerPoint Presentation, free

Third Party Car Insurance Online - Comprehensive VS Third Party Car

Motor Insurance | Car Insurance | Two Wheeler Insurance Plans

Motor Third Party Claims Management | Indemnity | Insurance