Indiana State Minimum Car Insurance

Indiana State Minimum Car Insurance Requirements

What Is Required?

In the State of Indiana, drivers are required to carry a minimum level of car insurance coverage in order to legally operate a motor vehicle. This requirement is in place to ensure that drivers are financially responsible if they cause an accident resulting in personal injury or property damage. Drivers who do not carry the minimum required coverage face stiff penalties, such as fines, license suspension, and even jail time.

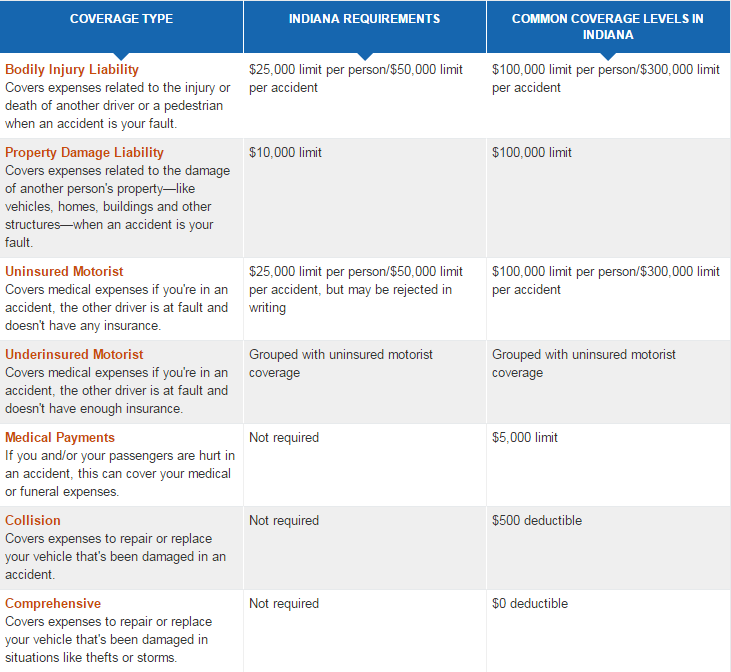

The State of Indiana requires drivers to carry the following minimum coverage: liability coverage of 25/50/10, uninsured motorist coverage of 25/50/10, and personal injury protection (PIP) of $25,000 per person, $50,000 per accident. Liability coverage pays for damages caused to another person or their property, uninsured motorist coverage pays for damages caused by an uninsured driver, and personal injury protection pays for medical expenses and lost wages for you and your passengers.

When Do I Need to Obtain Coverage?

The State of Indiana requires drivers to obtain car insurance coverage before they can register their vehicle. When registering your vehicle, you will need to provide proof of insurance in the form of an insurance card, policy, or certificate. If you are leasing your car, you may need to provide proof of insurance to the leasing company as well.

You will also need to provide proof of insurance if you are stopped by a law enforcement officer. Failure to do so can result in fines, license suspension, and even jail time. If you are involved in an accident and you do not have the required coverage, your license may be suspended for up to one year.

How Do I Obtain Coverage?

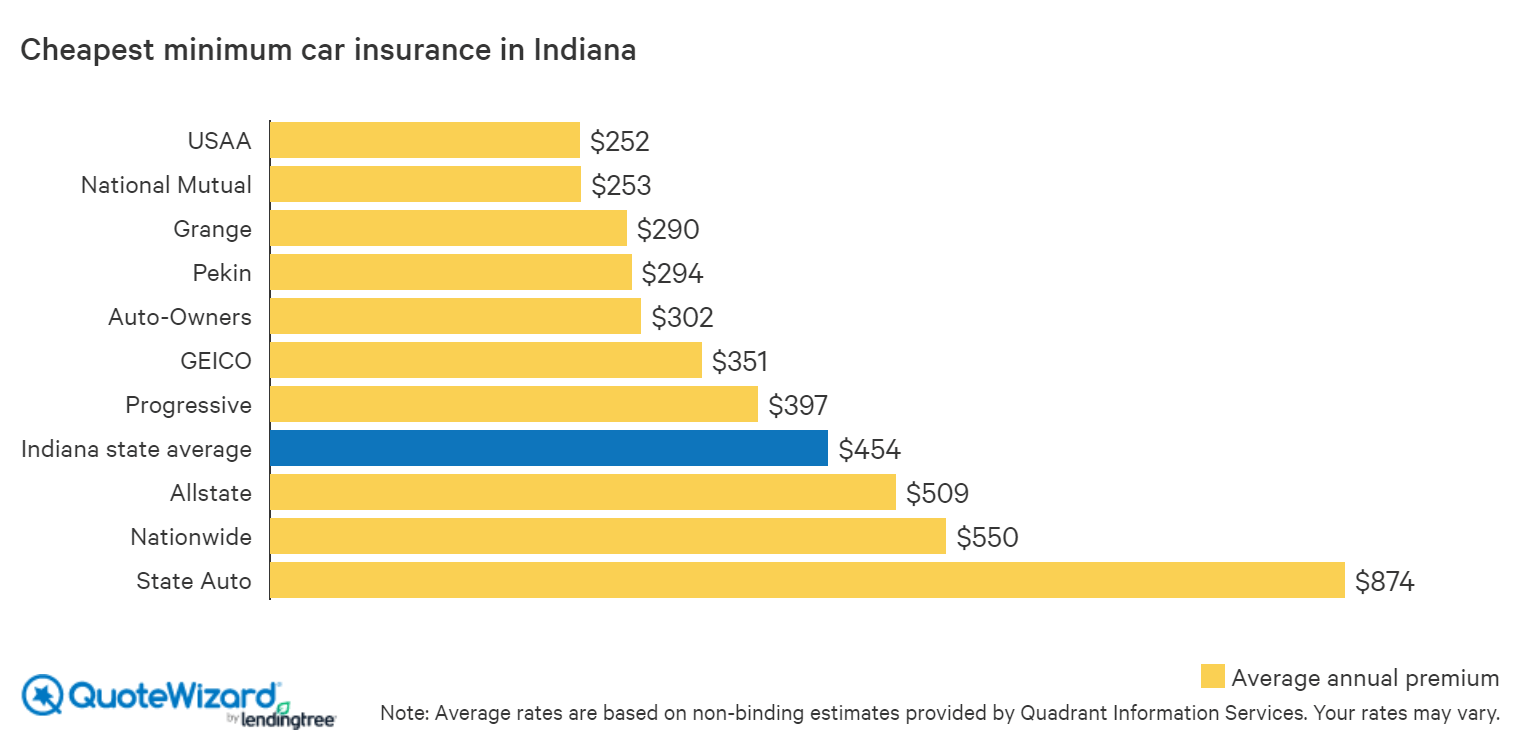

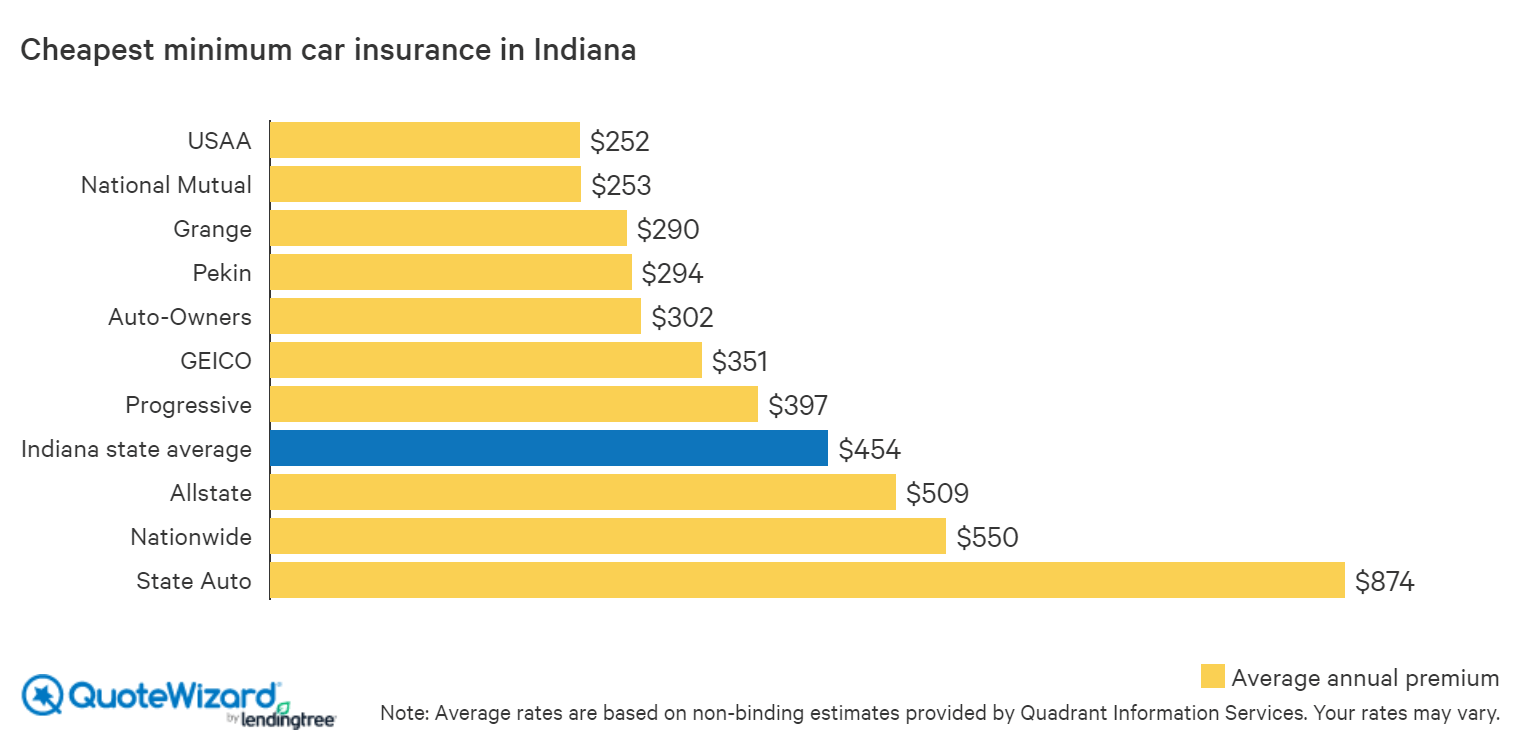

There are several ways to obtain car insurance coverage in the State of Indiana. You can purchase coverage from an insurance company, or you can purchase coverage from an online provider. You can also purchase coverage from an independent agent or broker. When selecting an insurance provider, it is important to compare rates, coverage levels, and discounts offered by each provider.

What If I Can't Afford Car Insurance?

If you are unable to afford car insurance, there are several options available to you. You can apply for a low-income car insurance program, which provides discounted rates to drivers who meet certain income requirements. You can also look into car insurance companies that offer discounts to certain groups, such as students and members of the military. Lastly, you can look into car insurance companies that offer pay-as-you-go plans, which allow you to pay for your coverage on a monthly basis.

Conclusion

In the State of Indiana, drivers are required to carry a minimum level of car insurance coverage in order to legally operate a motor vehicle. This requirement is in place to ensure that drivers are financially responsible if they cause an accident resulting in personal injury or property damage. Drivers must carry the following minimum coverage: liability coverage of 25/50/10, uninsured motorist coverage of 25/50/10, and personal injury protection (PIP) of $25,000 per person, $50,000 per accident. When selecting an insurance provider, it is important to compare rates, coverage levels, and discounts offered by each provider. If you are unable to afford car insurance, there are several options available to you, such as low-income car insurance programs, discounts for certain groups, and pay-as-you-go plans. Being informed and aware of the car insurance requirements in the State of Indiana will help ensure that you are driving legally and responsibly.

Where to Get Cheap Car Insurance in Indiana | QuoteWizard

What's the Cost of State Minimum Car Insurance? | Car Insurancee

Insurance Companies In Indiana / Best Home Insurance Companies in

A Guide to the BEST 9 Car Insurance Hacks No One Talks About | Cheap

Insurance Basics | Vehicle Insurance | Katherman Briggs & Greenberg