How To Cancel Motor Insurance Policy

How To Cancel Motor Insurance Policy

Steps to Cancel Your Motor Insurance Policy

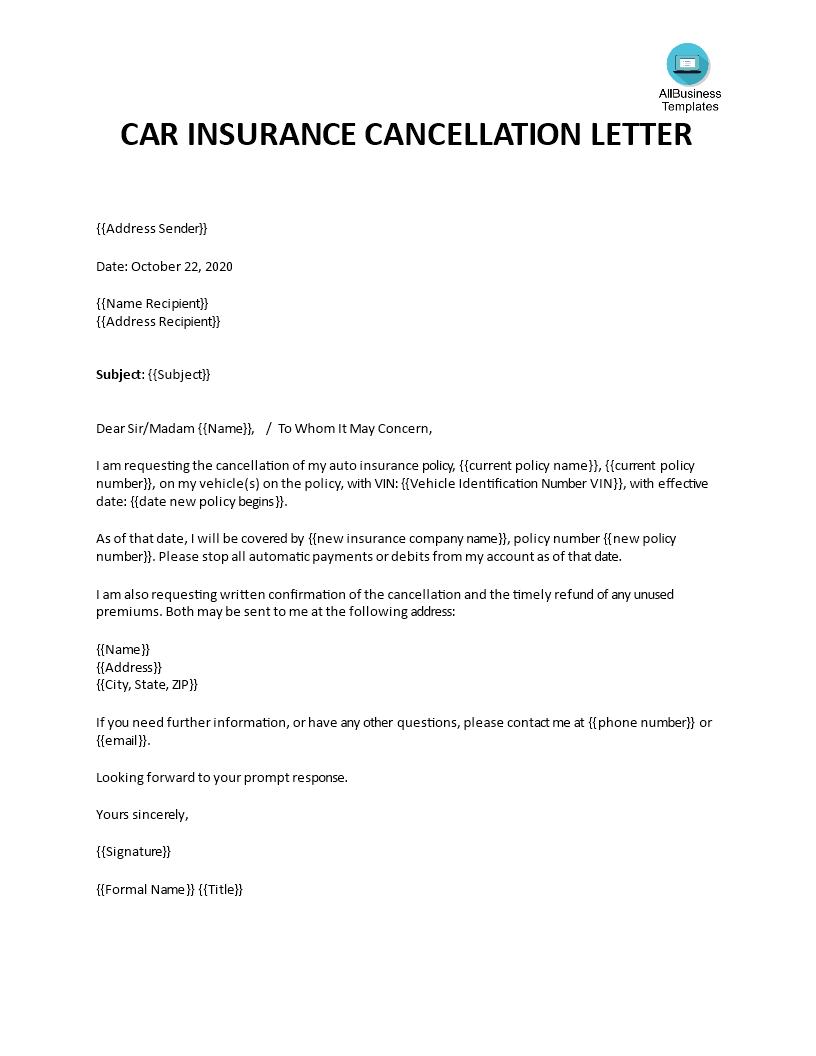

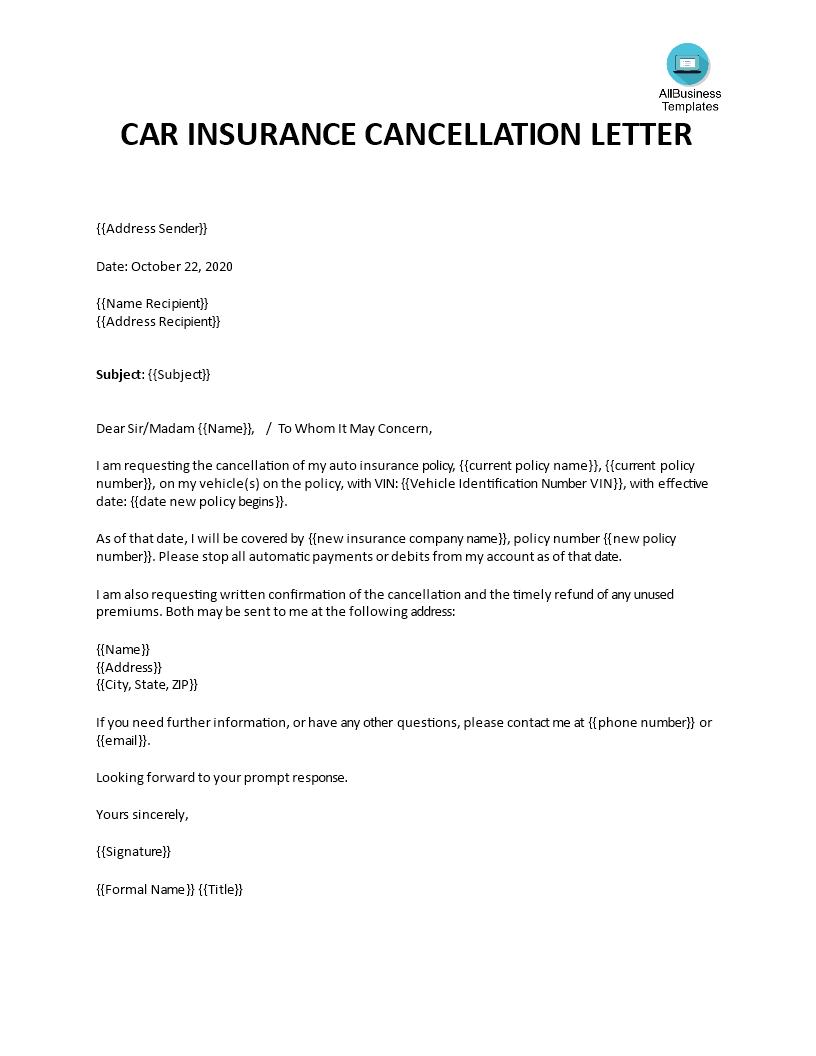

Cancelling your motor insurance policy is a relatively straightforward process. To begin, you’ll need to contact your insurance provider and inform them of your intention to cancel. You should also be prepared to provide your policy reference number and the reason for cancelling. Your insurance provider may also require you to provide proof of a new policy if you are switching to a different provider.

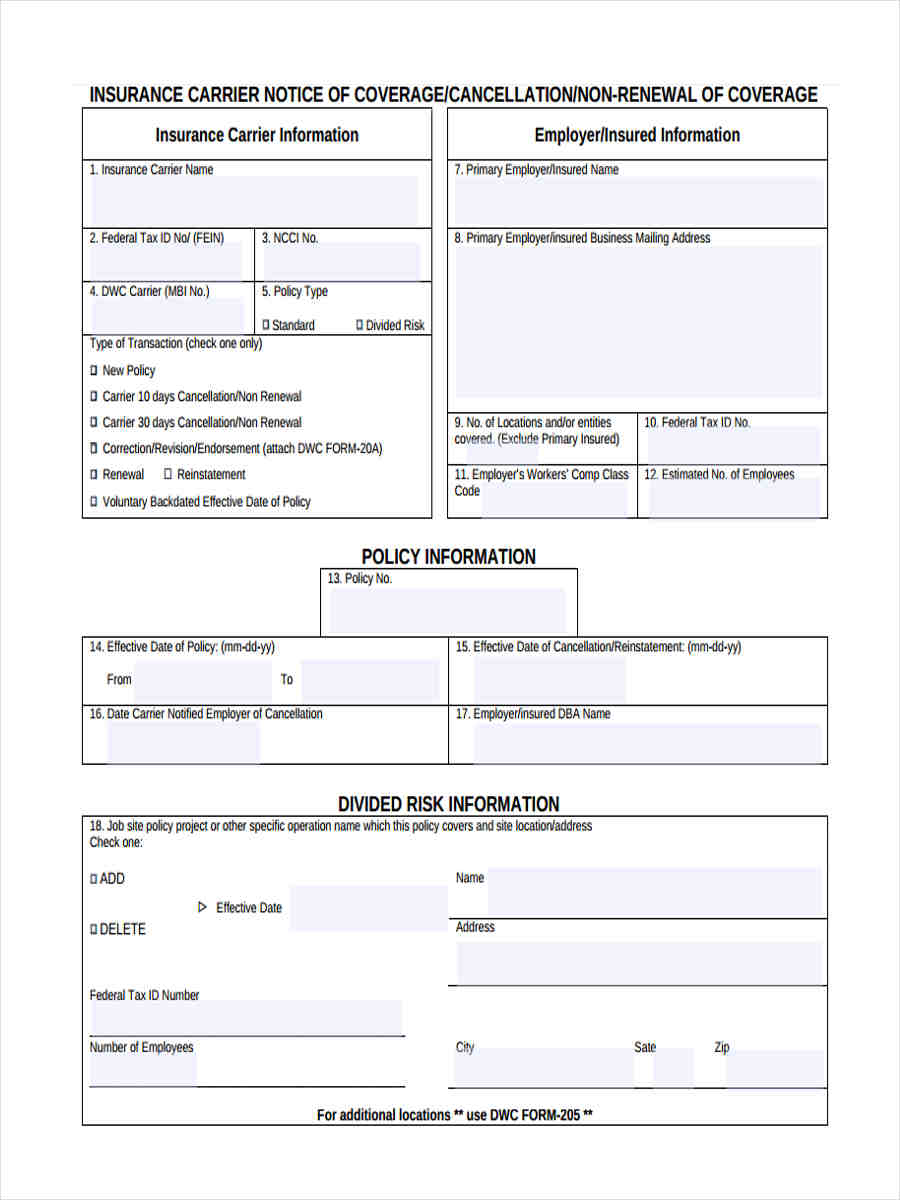

Most insurance companies will allow you to cancel your policy over the phone or online. However, it is important to note that some insurers may require you to fill out a cancellation form – so it’s best to check with your provider before making any decisions. Additionally, you may need to provide proof of a new policy if you are switching to a different provider.

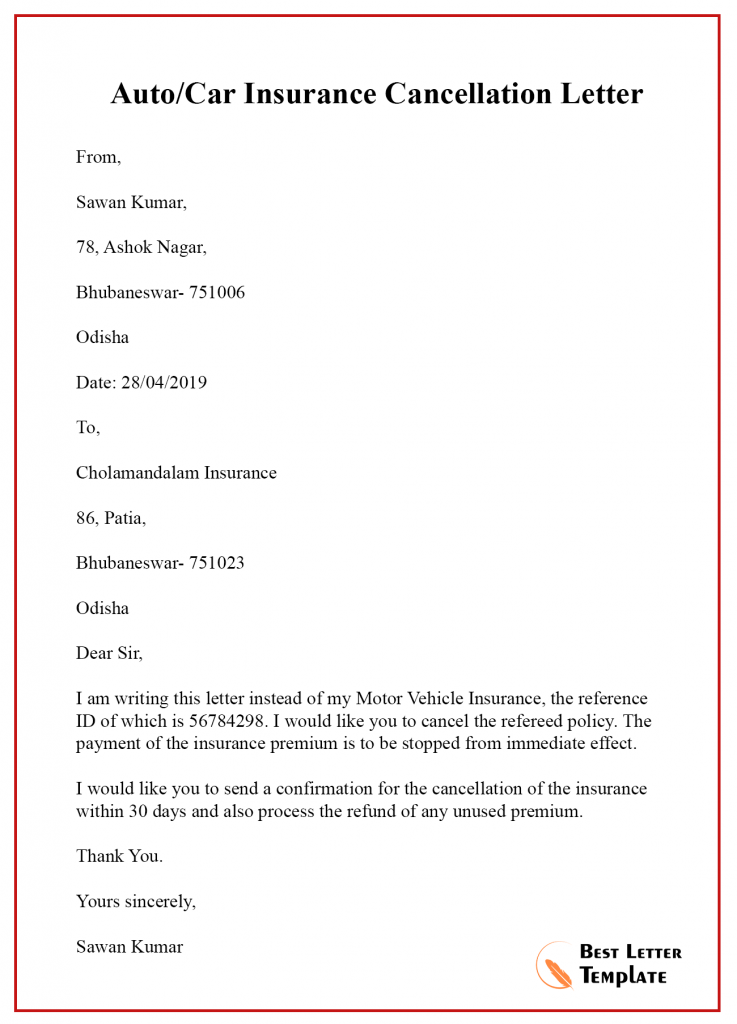

Once you have informed your insurance provider of your intention to cancel, they will usually send you a cancellation letter. This letter will confirm the date your policy will be cancelled and the amount of any refund you may be entitled to. It is important to keep this letter in case you need to provide proof of cancellation to another insurer.

When to Cancel Your Motor Insurance Policy

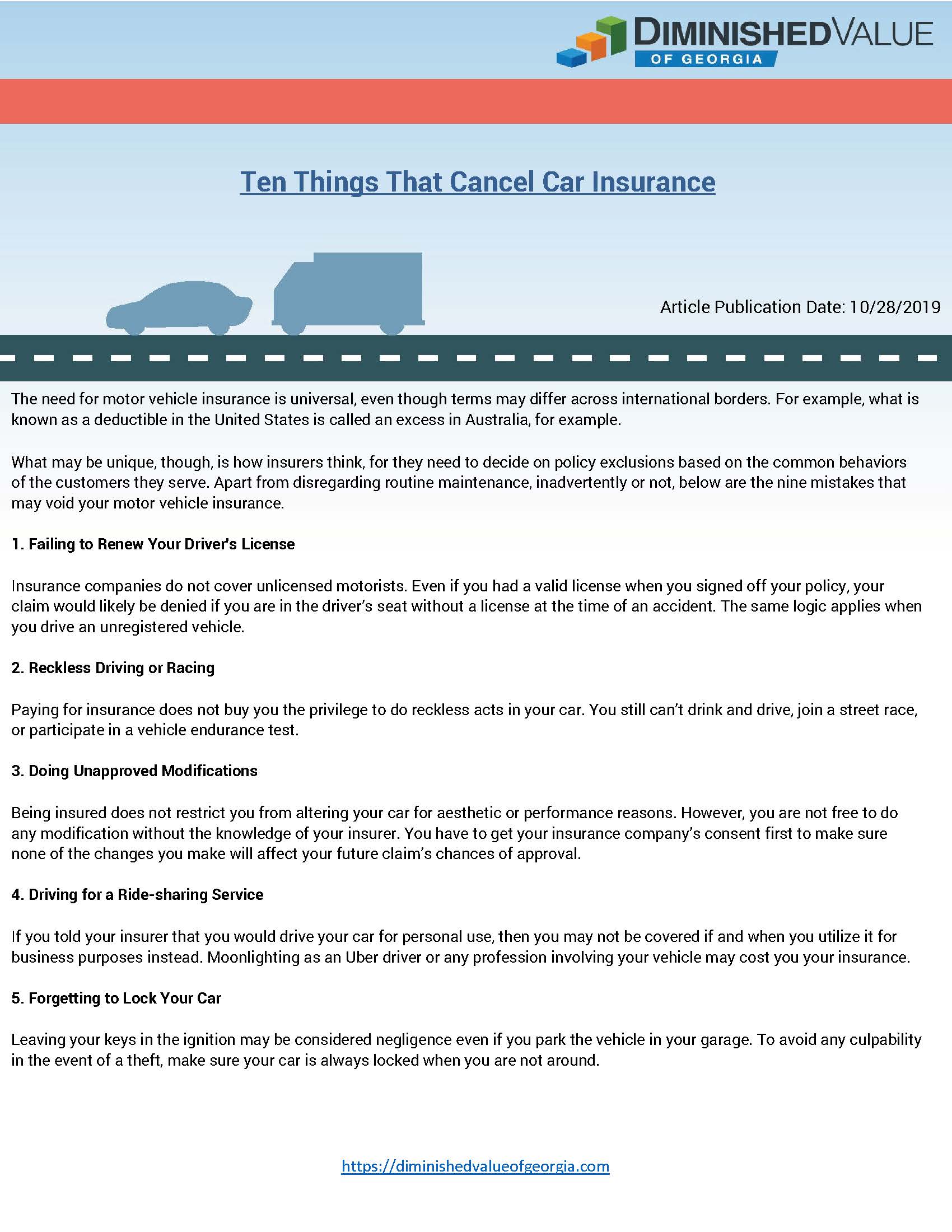

When it comes to cancelling your motor insurance policy, it is best to do so as early as possible. This is because most insurance companies will charge a cancellation fee if you decide to cancel your policy after the renewal date. Additionally, the cancellation fee may vary depending on when you decide to cancel – so it’s best to check your policy for details.

It is also important to note that some insurers may require you to provide proof of a new policy if you are switching to a different provider. This is because insurance companies generally don’t want to take on customers who have recently cancelled their policy with another provider.

What to Do After Cancelling Your Motor Insurance Policy

Once you have cancelled your motor insurance policy, you should inform the Motor Insurance Database (MID) of the cancellation. The MID is a central database that keeps track of all motor insurance policies in the UK, so it important to keep it up to date. To inform the MID of the cancellation, you should simply contact your insurer and they will handle the process for you.

If you are switching to a different insurance provider, you should also provide them with your previous policy details. This will ensure that your new policy is accurate and that you are not paying more than you need to for cover.

Conclusion

Cancelling your motor insurance policy is a relatively straightforward process. However, it is important to remember that you may be charged a cancellation fee and that you may need to provide proof of a new policy if you are switching to a different provider. Additionally, you should remember to inform the Motor Insurance Database of the cancellation, as this is essential to keeping the database up to date.

Keyword for Car Insurance Template

FREE 8+ Sample Notice of Cancellation Forms in MS Word | PDF

Insurance Company Cancellation Of Insurance Policy : Aa Insurance

How To Fill Out An Insurance Cancellation Form

Car Insurance Cover Note Sample - CARCROT