How To Cancel Icbc Car Insurance

How To Cancel ICBC Car Insurance

Understanding the Cancellation Process

Canceling your ICBC car insurance policy can be a difficult and confusing process, especially for those who are unfamiliar with the procedures and terminology involved. To make sure you understand the process, it’s important to take the time to read the ICBC’s policy documents and familiarize yourself with the terminology and procedures. In general, the process involves a written request to the ICBC, which is followed by a confirmation of cancellation and a refund of any unused premiums.

Submitting a Cancellation Request

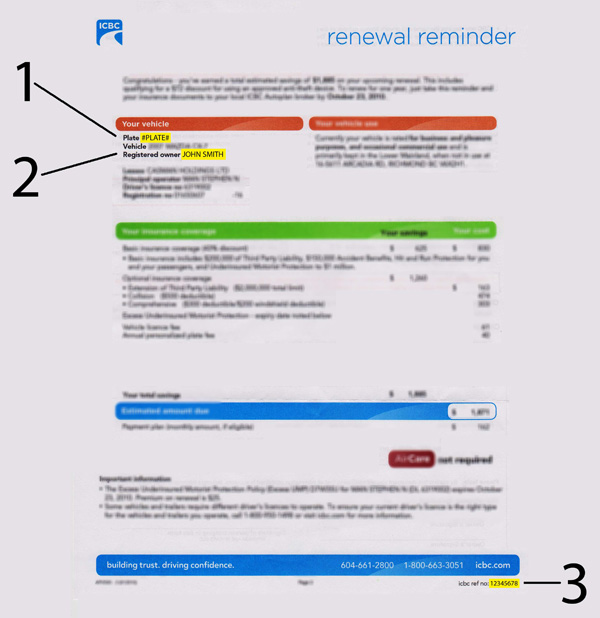

To cancel your ICBC car insurance policy, you will need to submit a written request to the ICBC. This request can be sent either in person or by mail. When submitting your request, make sure to include your name, policy number, and the reason for the cancellation. If you are cancelling due to non-payment, you will need to provide the necessary documentation to prove that you have paid any outstanding premiums.

Confirming Cancellation

Once the ICBC receives and processes your request for cancellation, you will receive a confirmation letter in the mail. This letter will contain information about how you can cancel your policy and the date when the policy will be cancelled. It is important to keep this letter in a safe place, as it may be needed in the future if there are any issues with the cancellation. The letter will also include any applicable refunds and how they will be applied.

Refunds

If you paid your premiums in full at the start of the policy period, then you may be eligible for a refund of unused premiums. The amount of the refund will depend on the type of policy you have and how much time is remaining on the policy. To receive your refund, you will need to provide proof of payment and submit a written request for a refund. The ICBC will then review your request and process the refund if you are eligible.

Other Considerations

When cancelling your ICBC car insurance policy, it is important to remember that you are still responsible for any damages or liabilities incurred during the policy period. This means that even if you have cancelled the policy, you may still be liable for any damages caused while the policy was in force. Additionally, any claims that were reported to the ICBC before you cancel the policy will still be processed and paid out according to the terms of the policy.

Conclusion

Cancelling your ICBC car insurance policy is not as complicated as it may seem. By following the steps outlined above, you can make sure that the process goes as smoothly as possible. Just make sure to take the time to understand the process and read the ICBC’s policy documents to make sure you are aware of all the procedures and terms involved. After all, you don’t want to miss out on any refunds or other benefits that you may be eligible for.

Icbc Cancel Insurance - noclutter.cloud

Icbc Cancel Insurance - noclutter.cloud

CIA Financial

Cancellation Letter Template - 5+ Free Word, PDF Documents Download

ICBC waiving cancellation, re-plating fees for savings during pandemic