Florida Motor Vehicle Insurance Laws

Everything You Need to Know About Florida Motor Vehicle Insurance Laws

Introduction

In the state of Florida, motor vehicle insurance is required for all drivers in order to legally operate a motor vehicle. Whether you own a car, truck, SUV, or motorcycle, you need to have the proper coverage. This article will give an overview of the Florida vehicle insurance laws, including what types of coverage are required and why it is important to make sure you have the right coverage.

Requirements

In Florida, all drivers must have at least the minimum coverage in order to legally operate a vehicle. This includes personal injury protection (PIP) coverage, property damage liability (PDL) coverage, and uninsured/underinsured motorist (UM/UIM) coverage. PIP coverage pays for medical bills, lost wages, and other damages that result from an auto accident. PDL coverage pays for damages to another person’s property as a result of an auto accident. UM/UIM coverage pays for damages to your own vehicle in the event of an accident.

Benefits

Having the proper coverage can provide peace of mind, knowing that you and your passengers are protected in the event of an auto accident. It can also help protect you from financial hardship, as the costs associated with an auto accident can be quite high. In addition, insurance companies may offer discounts for those who have multiple policies, so it can be beneficial to bundle your policies if possible.

Costs

The cost of auto insurance in Florida varies depending on a variety of factors, such as the type of vehicle you own, your driving record, and your age. Generally, the older you are, the less expensive your premiums will be. Additionally, if you have a good driving record, you may be eligible for discounts. Your insurance company can provide more information about how to save on premiums.

Finding an Insurance Provider

When shopping for the right insurance policy, it is important to compare rates between several different providers. You can do this online, or you can contact a local agent for more personalized service. It is also important to read the fine print of each policy to make sure that it meets your needs and that you understand all of the coverage limits.

Conclusion

Florida motor vehicle insurance laws require all drivers to have the minimum coverage in order to legally operate a motor vehicle. Having the proper coverage can provide peace of mind, knowing that you and your passengers are protected in the event of an auto accident. When shopping for the right insurance policy, it is important to compare rates between several different providers and read the fine print of each policy. Following these tips can help you find the right coverage for your needs.

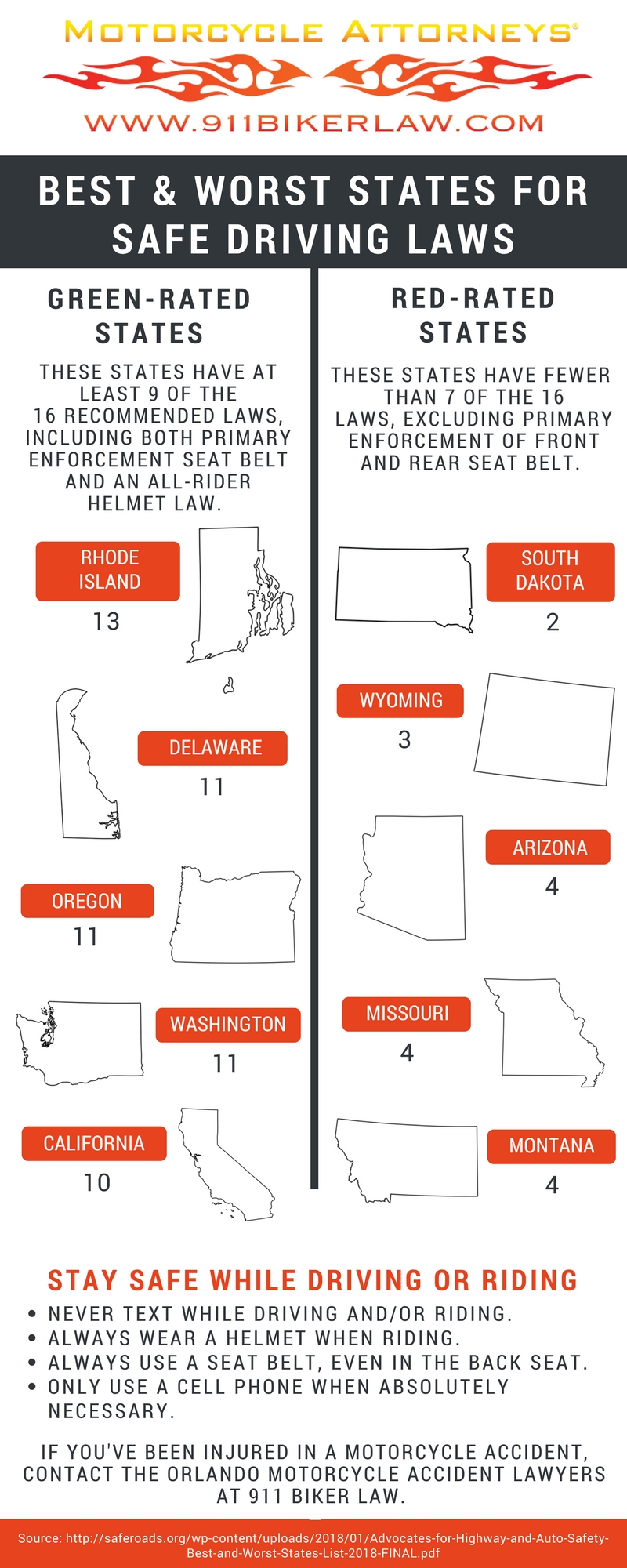

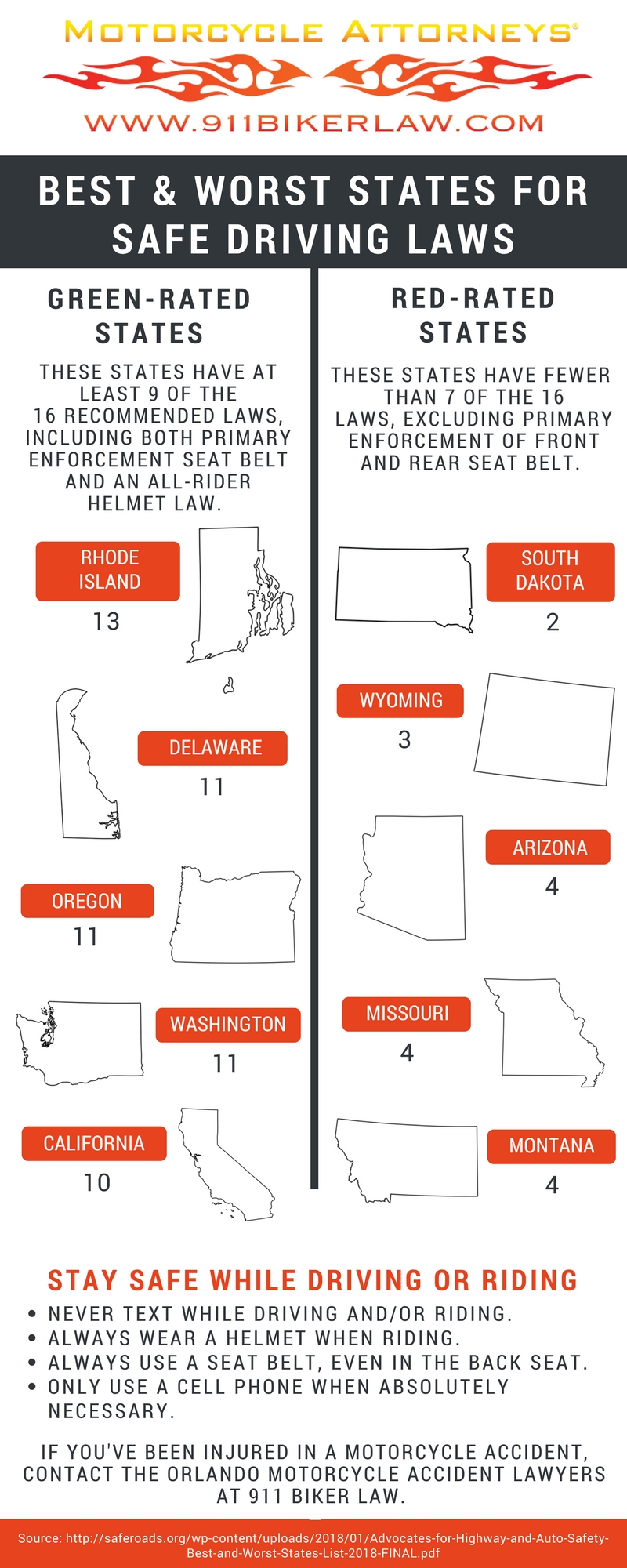

Do Florida Vehicle Laws Keep Drivers Safe?

The Two Motor Vehicle Insurance Laws In Florida Are Financial

Understanding Florida No-Fault Motor Insurance Laws | Goldberg Noone

Why is Florida the worst state to get in a car crash?

The florida lemon law or the florida motor vehicle warranty enforceme…