Do All Drivers Have To Be Insured

Do All Drivers Have To Be Insured?

Insurance Requirements for Drivers Vary by State

Driving without insurance is illegal in every state. But the laws vary from state to state, as do the penalties for driving without insurance. In most states, financial responsibility is required for any driver who has caused an accident or incurred any damage to property or persons. In some states, like Wisconsin, financial responsibility is required for all drivers, regardless of whether they have caused an accident or not. That means that all drivers in Wisconsin must have insurance. But in most states, like California, only drivers who have caused an accident have to have insurance.

The Minimum Amount of Insurance Required by the State

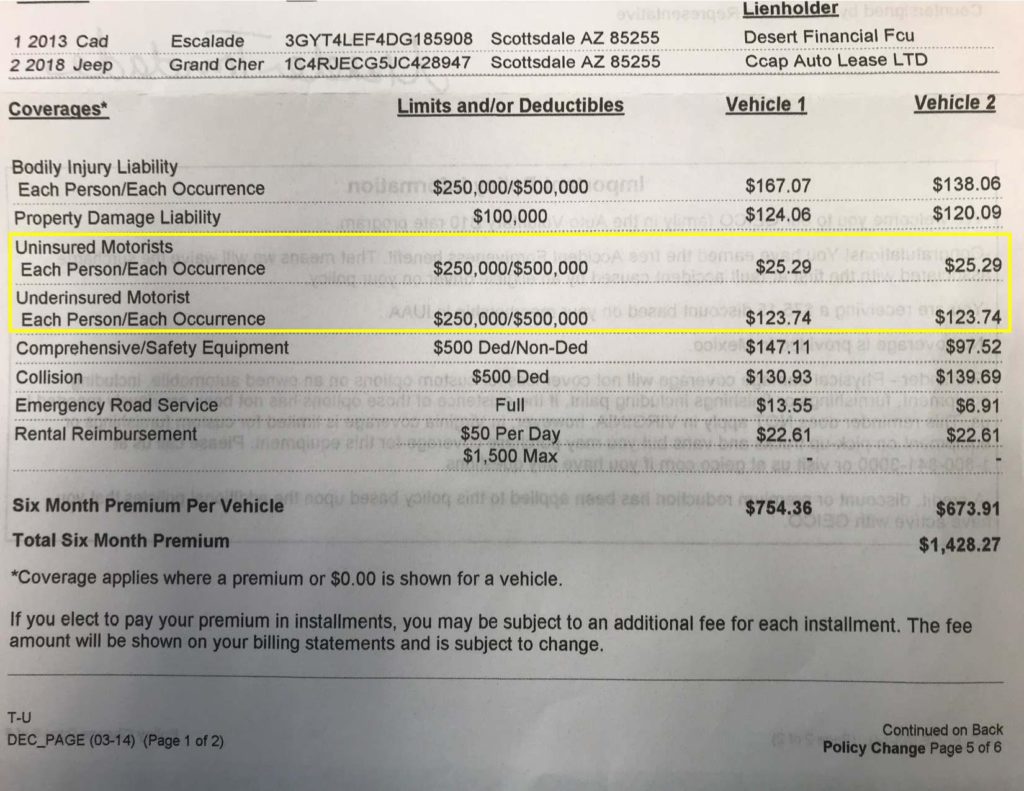

In addition to the laws that require all drivers to have insurance in some states, each state also has laws regarding the minimum amount of insurance that drivers must carry. In most states, drivers are required to carry a minimum amount of liability insurance. Liability insurance covers the costs of any damage or injury that the driver causes to another person or property. The minimum amount of liability insurance required by each state varies, but typically it is around $50,000 per person and $100,000 per accident. Some states also require drivers to carry a minimum amount of uninsured motorist insurance, which covers the costs of any damage or injury caused by an uninsured driver.

The Penalty for Driving Without Insurance

If you are caught driving without insurance, you could face serious penalties. In most states, the first offense is a misdemeanor, which could result in a fine of up to $500 and a driver's license suspension of up to six months. In addition, the state may require you to file a Certificate of Financial Responsibility, which is a statement made to the state that you have enough money to pay for any damage or injury you cause. The second offense for driving without insurance is usually a felony, which could result in a fine of up to $1,000 and a driver's license revocation of up to one year.

How to Get Insurance

Getting insurance is easy and affordable. There are many companies that offer car insurance, and they all have different rates and coverage levels. It is important to shop around and compare rates to make sure you are getting the best deal. You can also get discounts if you take a defensive driving course or if you have a good driving record. Additionally, some states offer discounts for drivers who insure multiple vehicles or who have a clean driving record.

Bottom Line

All drivers in the US are required to have insurance, but the requirements vary from state to state. Depending on the state, drivers may be required to carry a minimum amount of liability insurance, uninsured motorist insurance, or both. If you are caught driving without insurance, you could face serious penalties, including fines and license suspensions. Shopping around for insurance is the best way to make sure you are getting the best deal.

New Study Finds Teens Have Risky Definitions of ’Safe Driving’

How to Instantly Update All Windows 10 Drivers at Once

The Best Ways To Choose The Very Best Car Insurance Coverage | This

How to increase the number of insured drivers on MI roads

What You Should Know About Uninsured and Underinsured Motorist